Stock Market Predictions: I Know First Evaluation Report for S&P 500 Index -July

Executive Summary

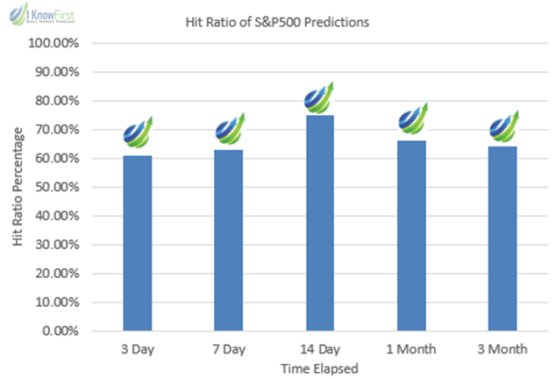

In this forecast evaluation report, we will examine the performance of the forecasts generated by the I Know First AI Algorithm for the S&P 500 Index with time horizons ranging from 3 days to 3 months, which were delivered daily to our clients. Our analysis covers the time period from the 1st January 2019 to 19th 2019. Below, we present our key takeaways for checking hit ratios of our predictions.

Highlights:

- 79% Hit Ratio for 14-day time period of S&P 500 predictions allowing our clients to be able to invest their money with significant less risk

- Predictions consistently above 60% accurate despite very volatile times in the world economy over the last half year

The article was written by

The article was written by  Read The Full Premium Article

Read The Full Premium Article