Stock Market Forecast: Combined Investment Strategy with Weekly Check

This article was written by the I Know First Research Team.

This article was written by the I Know First Research Team.

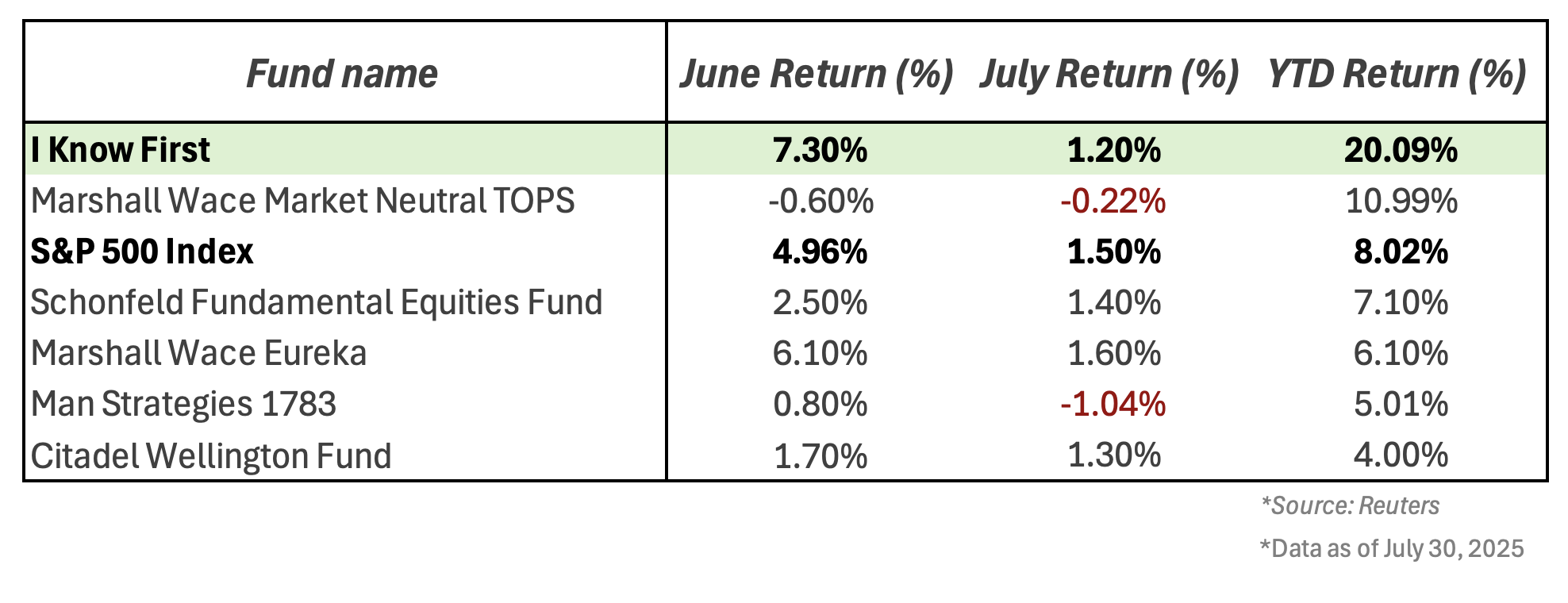

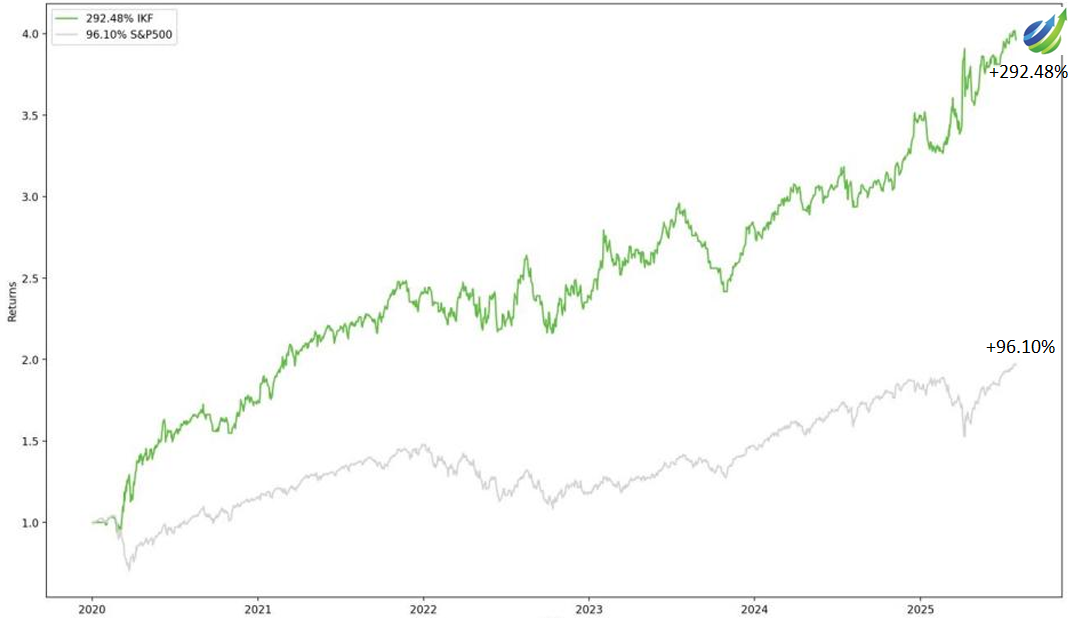

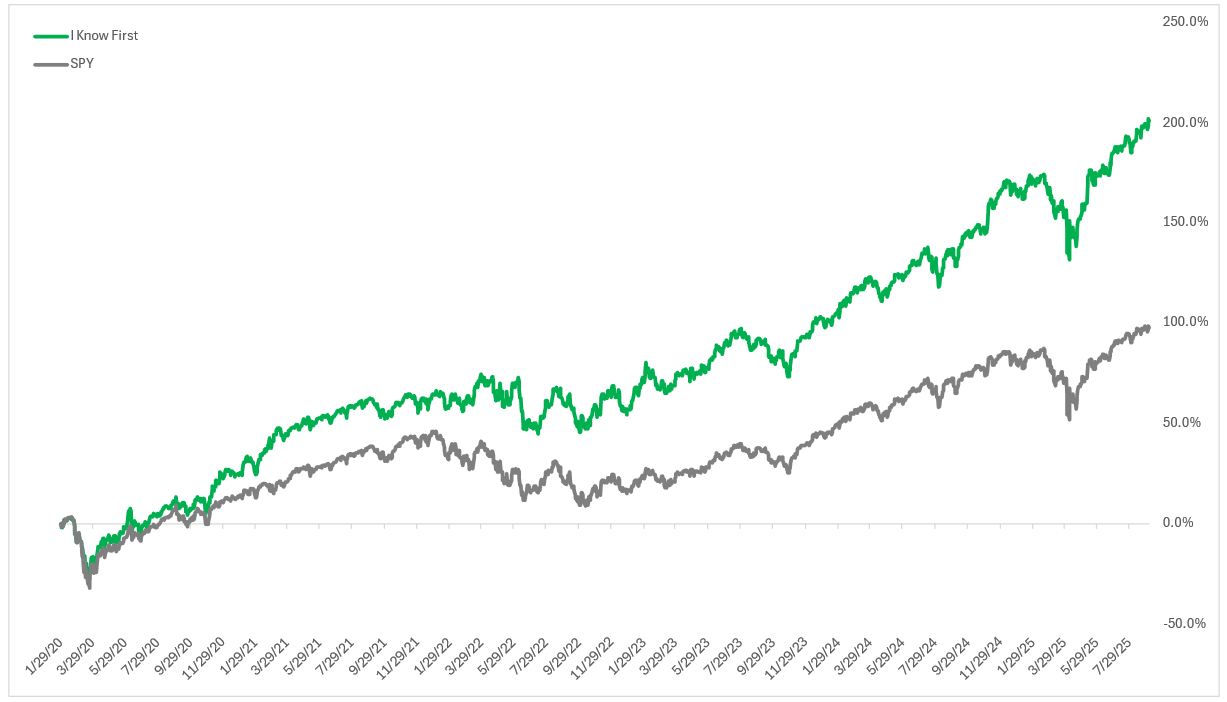

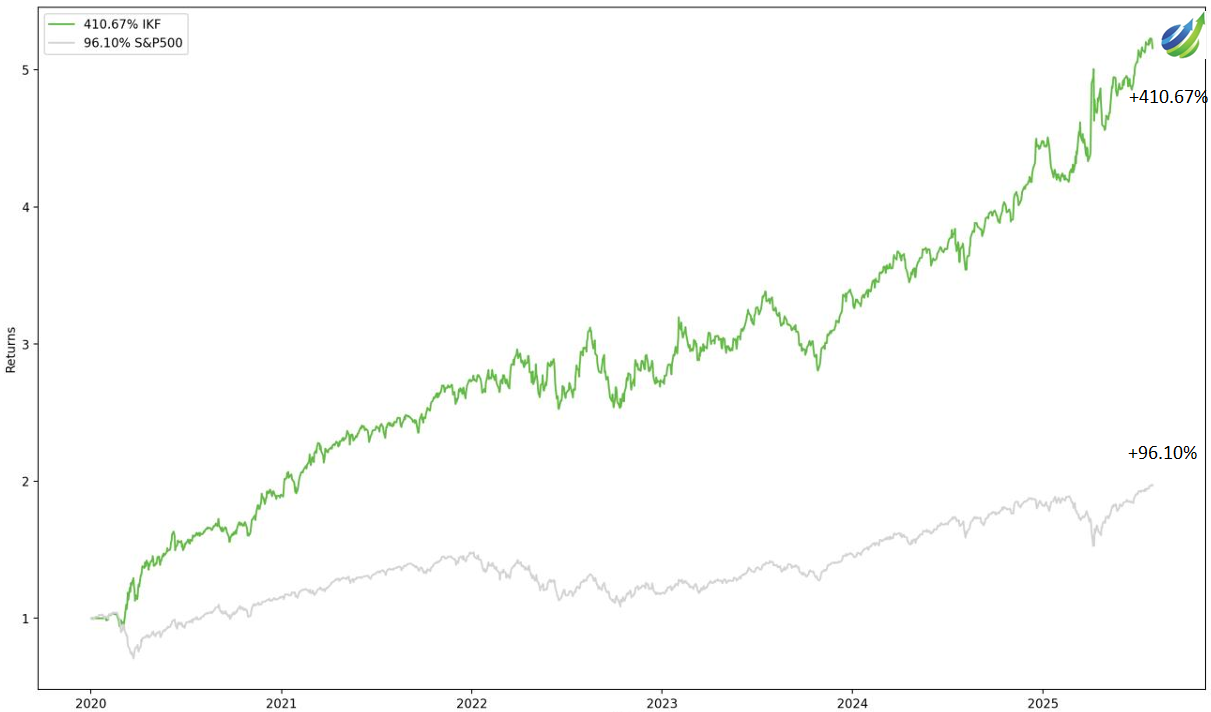

I Know First provides investment solutions for institutional investors with a competitive advantage utilizing our advanced self-learning algorithm. I Know First provides an individual approach for institutional clients to improve their investment process based on their needs and preferences. We have reviewed the performance of the combined investment strategy during the period from January 10th 2020, to July 31st, 2025. Visit our website for more details about I Know First solutions for institutional investors.

Read The Full Premium Article

Read The Full Premium Article

This article was written by Samy Nakach – Investment Analyst at I Know First.

This article was written by Samy Nakach – Investment Analyst at I Know First.