Stock Forecast: AI-Powered Industry L2 ETFs Strategy

Stock Forecast: I Know First provides investment solutions for both individual and institutional investors, utilizing an advanced AI self-learning algorithm to gain a competitive advantage. We offer a personalized approach to our institutional clients, assisting them in their investment process based on their specific needs and preferences. For more details about I Know First solutions for institutional investors, please visit our website.

Stock Forecast: AI-Powered Industry L2 ETFs Strategy

Stock Market Prediction: The following trading strategy was developed using I Know First’s AI Algorithm daily forecasts from January 1st, 2020, to April 12th, 2024, with a focus on S&P 500 stocks selected based on the signal filter. This strategy is available to our institutional clients: hedge funds, banks, and investment houses, as a tier 2 service on top of tier 1 (the daily forecast).

The strategy involves trading GICS level 2 ETFs based on the majority direction. While, the Level 1 Sectors include broad segments of the economy, such as technology, healthcare, finance, and consumer goods to provide a high-level view of the market. Level 2 Industries goes deep into specific industries. For example, within the technology sector (Level 1), you might find industries like semiconductors, software, and hardware. These industries offer a more detailed perspective on the market.

The term “majority direction” refers to our predictions for stocks, upon which we base our position. This decision is guided by a number of long and short stock forecasts. Therefore, if the count of long stock forecasts surpasses the count of short stock forecasts, the majority direction is to go long and we construct a long portfolio. Conversely, if the count of short stock forecasts is higher, we assume a short portfolio.

In this strategy, we open our portfolio based on the majority direction. If it is long, we pick the top three Level 2 ETFs that have more components in our stock universe and are weighted based on how many stocks from those ETFs are in our selection. For example, if in our 50 picks, we have 7 stocks from XHB, 5 stocks from KCE, and 4 stocks from XSD, we buy those 3 ETFs and weight them accordingly. If it’s short, we construct a short portfolio and check weekly to ensure it doesn’t change. If a short majority direction switches to long, we close our portfolio and go long in the SPY until the next rebalancing period.

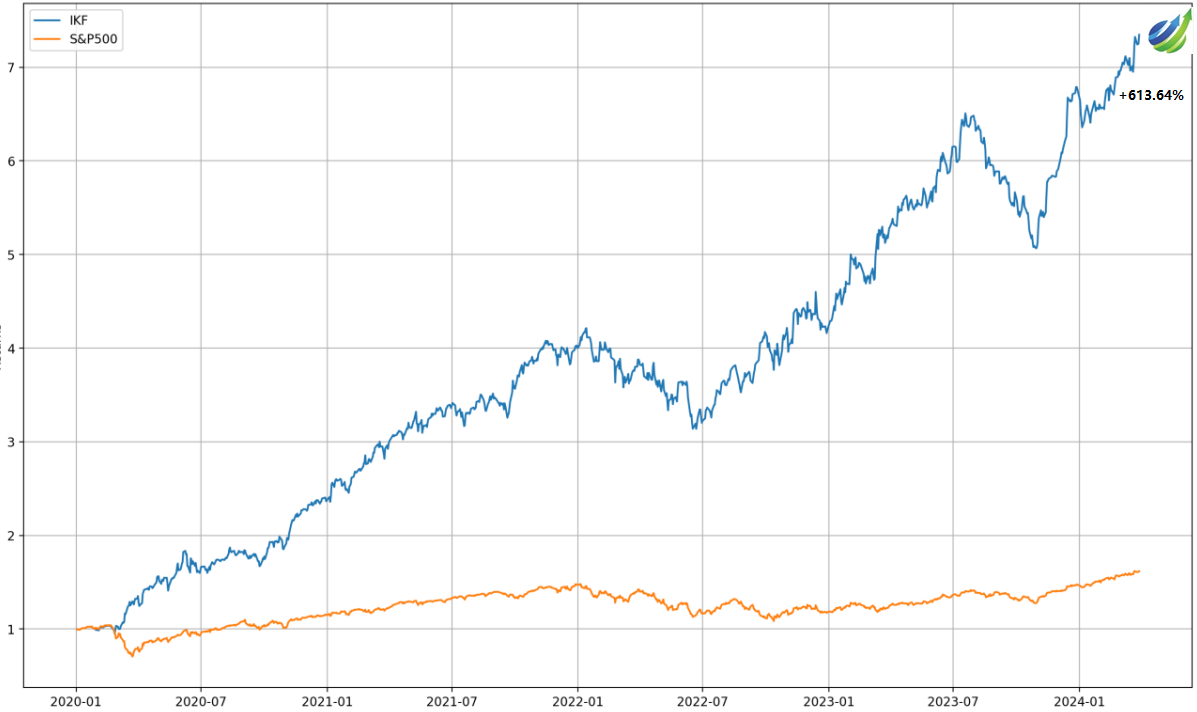

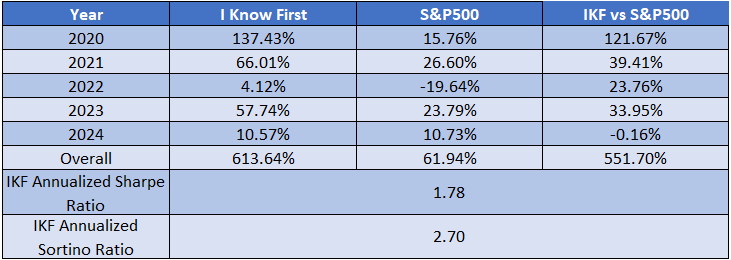

The strategy provides a positive return of 613.64% which exceeded the S&P 500 return by 551.70%. Below we can notice the strategy behavior for each year.

The I Know First strategy has an impressive Sharpe ratio (which compares the return of an investment with its risk) of 1.78 and a Sortino ratio (which compares the return of an investment with its given level of downside risk) of 2.70.

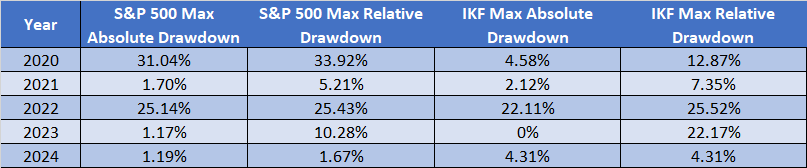

We can observe the strategy alongside the drawdowns of the S&P 500 for the analysis period. Overall, the IKF strategy experienced fewer drawdowns than the S&P 500, making it not only high-return but also less risky compared to the S&P 500.

I Know First Algorithm – Seeking the Key & Generating Stock Market Forecast

The I Know First predictive algorithm is a successful attempt to discover the rules of the market that enable us to make accurate stock market forecasts. Taking advantage of artificial intelligence and machine learning and using insights of chaos theory and self-similarity (the fractals), the algorithmic system is able to predict the behavior of over 13,500 markets. The key principle of the algorithm lies in the fact that a stock’s price is a function of many factors interacting non-linearly. Therefore, it is advantageous to use elements of artificial neural networks and genetic algorithms. How does it work? At first, an analysis of inputs is performed, ranking them according to their significance in predicting the target stock price. Then multiple models are created and tested utilizing 15 years of historical data. Only the best-performing models are kept while the rest are rejected. Models are refined every day, as new data becomes available. As the algorithm is purely empirical and self-learning, there is no human bias in the models and the market forecast system adapts to the new reality every day while still following general historical rules.

Conclusion

I Know First offers investment solutions for institutional investors, leveraging our advanced self-learning algorithm to gain a competitive advantage. We provide a personalized approach for our institutional clients, enhancing their investment process according to their specific needs and preferences. In this context, we have evaluated the performance of the AI-Powered Industry L2 ETFs strategy during the period from January 1st, 2020, to April 12th, 2024.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.