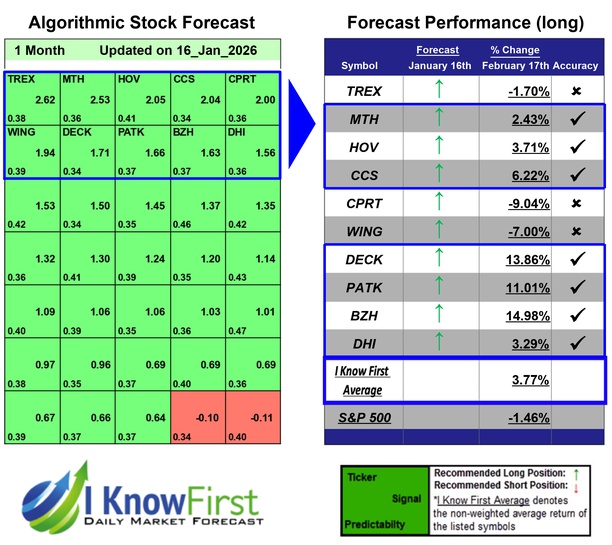

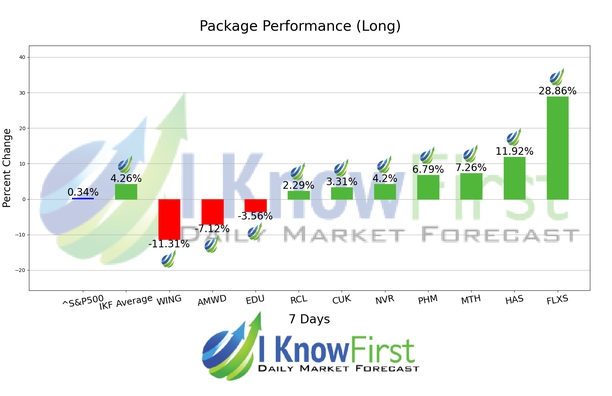

Consumer Staples Stocks Based on Artificial Intelligence: Returns up to 41.96% in 3 Months

Package Name: Consumer Stocks

Recommended Positions: Long

Forecast Length: 3 Months (11/18/25 - 2/18/26)

I Know First Average: 16.98%

Recommended Positions: Long

Forecast Length: 3 Months (11/18/25 - 2/18/26)

I Know First Average: 16.98%

Read The Full Forecast