Algorithmic Trading Strategies For European Stocks: Returns Up to 240%

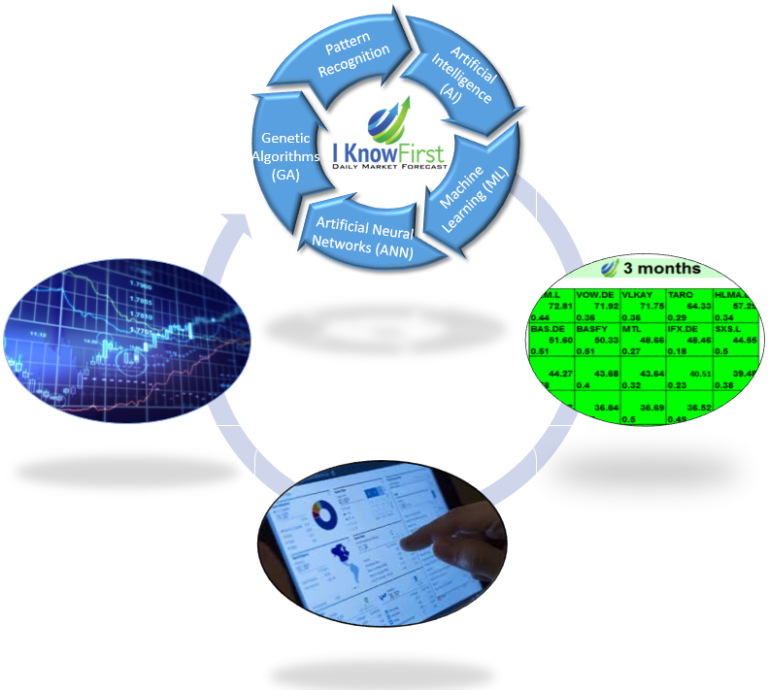

In the following article we present an analysis of a series of trading strategies directly adoptable by I Know First clients which have generated returns up to 240% over the period going from August 2015 to April 2017. The strategies follow the algorithm’s signals and invest daily in the strongest ones from the package “European Stocks” hence resulting in a portfolio continuously in line with the program’s recommendations and with the evolving market.

The graph below shows the evolution in time of 2 strategies with portfolios made up of 5 and 10 stocks based on the I Know First 3-month time horizon signals. These are confronted with the performance of the market (ETF iShares MSCI Europe UCITS ETF Acc in red) from August 2015 to April 2017. The I Know First Portfolios registered returns up to 87.1% and 54%, largely above the benchmark.

Strategy Description

In the first day of the simulation we extract the highest 2, 5, or 10 (depending on the strategy adopted) signals from the forecasts sent to clients for a certain time horizon and open long or short positions (depending on whether the signal is positive or negative) for the respective tickers in the investment portfolio. In these simulations all positions are allocated the same weight (equally weighted).

Every following day the portfolio is rebalanced according to the most recent algorithmic predictions which are sent to clients on a daily basis. Positions for which signals in absolute value are not among the strongest anymore or for which signals changed direction are closed and new positions are opened again in order of the signals’ absolute value untill that the portfolio is again full.

This system translates into a portfolio continuously in line with the algorithm’s recommendations and hence with the market’s evolving dynamics.

Performance

The table below shows the statistics for strategies that use both long (positive) and short (negative) signals with respectively 14-day, 1 month and 3-month time frames which are sent daily to clients for the construction of the portfolios of various dimensions (from 2 to 10 stocks).

These strategies resulted in returns of between 41.7% and 240.6% in the time horizon analyzed (18.08.2015 – 01.04.2017) against the ETF performance of 1.6% (Benchmark Total Return).

Furthermore, the strategies have excellent risk statistics with a Beta (correlation between daily returns of the strategies with the market) of under 0.3 and a Sharpe ratio (risk adjusted return) of above 1.2.

The above analysis shows that simple portfolio rebalancing strategies aligned to the forecasts of the I Know First predictive algorithm results in a daily selection of investments continuously adjusted to the ever-changing market environment and generate considerable returns, significantly outperforming the market.

For any question on the above strategies please contact [email protected]