Aggressive Stocks & Coronavirus Stock-Market Volatility

Executive Summary

The purpose of this report is to present the results of live forecast performance evaluation for I Know First AI Algorithm, specifically for the Aggressive stocks. The following results were observed when signal and predictability filters were applied to pick the best-performing stocks out of the most predictable ones. The period under evaluation is from 17th July 2019 to 6th January 2021. The corresponding returns distribution of stock filters for the Aggressive stocks are shown below:

The Aggressive stocks Package Highlights:

- 14.47 % – the highest average return for an investor in the Top 10 Signals with a period of 3 months

- Predictions reach up to 54% precision regardless of market volatility

- The Top 10 signal group outperformed the S&P 500 by 4 times for the 1 month time horizon

The above results based on forecasts’ evaluation over the specific time period using a consecutive filtering approach. Consecutive filtering includes predictability, then signal, to give an overview of the forecasting capabilities of the algorithm for the specific stock universe.

About the I Know First Algorithm

The I Know First self-learning algorithm analyzes, models, and predicts the stock market. The algorithm is based on Artificial Intelligence (AI) and Machine Learning (ML) and incorporates elements of Artificial Neural Networks and Genetic Algorithms.

The system outputs the predicted trend as a number, positive or negative, along with a wave chart that predicts how the waves will overlap the trend. This helps the trader to decide which direction to trade, at what point to enter the trade, and when to exit. Since the model is 100% empirical, the results are based only on factual data. Thereby results in avoiding any biases or emotions that may accompany human-derived assumptions.

The human factor is only involved in building the mathematical framework. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

Our algorithm provides two independent indicators for each asset – Signal and Predictability.

The Signal is the predicted strength and direction of the movement of the asset. Measured from -inf to +inf.

The predictability indicates our confidence in that result. It is a Pearson correlation coefficient between past algorithmic performance and actual market movement. Measured from -1 to 1.

You can find a detailed description of our heatmap here.

The Stock Picking Method

The method in this evaluation is as follows:

We take the top X most predictable assets and, from them, we pick the top Y highest signals.

By doing so we focus on the most predictable assets on the one hand. On the other hand, capturing the ones with the highest signal.

For example, a top 30 predictability filter with a top 10 signal filter means that on each day we take only the 30 most predictable assets. Then we pick from them the top 10 assets with the highest absolute signals.

We use absolute signals since these strategies are long and short ones. If the signal is positive, then we buy and, if negative, we short.

The Stock Market Forecast Performance Evaluation Method

We perform evaluations on the individual forecast level. It means that we calculate what would be the return of each forecast we have issued for each horizon in the testing period. Then, we take the average of those results by strategy and forecast horizon.

For example, to evaluate the performance of our 1-month forecasts, we calculate the return of each trade by using this formula:

This simulates a client purchasing the asset based on our prediction and selling it exactly 1 month in the future.

We iterate this calculation for all trading days in the analyzed period and average the results.

Note that this evaluation does not take a set portfolio and follow it. This is a different evaluation method at the individual forecast level.

The Hit Ratio Method

The hit ratio helps us to identify the accuracy of our algorithm’s predictions.

Using our Daily Forecast and Global Model asset filtering, we predict the direction of the movement of different assets. Our predictions are then compared against actual movements of these assets within the same time horizon.

The hit ratio is then calculated as follows:

The Benchmarking Method – S&P 500 Index

In order to evaluate our algorithm’s performance in comparison to the US market, we used the S&P 500 as a benchmark.

The S&P 500 measures the stock performance of the largest 500 companies by market cap listed on different stock exchanges in the United States. It is one of the most followed equity indices. It is frequently the best indicator for the overall performance of US public companies, and the US market as a whole. S&P 500 is a capitalization-weighted index. The weight of each company in the index is determined based on its market cap divided by the aggregate market cap of all the S&P 500 companies.

For each time horizon, we compare the S&P 500 performance with the performance of our forecasts after the filtering processes described above. For example: after our Global filtering the model recommended buying a given asset and hold it for three days on five different occasions, the S&P 500 performance we will use as a benchmark will be the average of returns only in these five intervals of three days.

S&P 500 Amid Coronavirus Market in 2020

Understanding what is happening in the market with the S&P 500 stock index is important in predicting aggressive stocks. The S&P 500 was up 28.9% for 2019, its biggest one-year gain since 2013 when it rallied 29.6%. However, in March 2020 S&P 500 index dropped 33.68 % in around one month. The COVID-19 had led to one of the fastest U.S. stock market declines in history. Based on fool.com example the S&P 500 stock index in 2020 can be compared with the 2007-2009 Global Financial crisis. The S&P 500 down 52% from the pre-crash peak it hit in October 2007.

Although the US stock market started to recover in June, the pandemic’s economic impact remains very high. From the figure below we can see the shorter-term moving average curve (10-day) crossed above the longer-term 30-day moving average curve in July. This indicated a change in sentiment from bearish to bullish. The near future S&P 500 forecasting predicts that the stock market will remain increasing.

The S&P 500 is representing 12.7% upside. According to Credit Suisse, S&P 500 aggregate earnings per share will grow by 25% to $175 in 2021, from the $168 seen previously. Stocks are heading even higher in 2021 in the wake of the Georgia Senate runoff races, due to the prospect of a unified Democratic government. In conclusion, as can be seen, the US stock market will recover from the pandemic, and the S&P 500 stock index will rise in the near future. Consequently, the most profitable investment for an investor will be the longest term as predicted by the company.

Stock Universe Under Consideration – the Aggressive stocks Market

In this report, we conduct testing for the Aggressive stocks that I Know First cover by its algorithmic forecast in the “The Aggressive stocks” package. The period for evaluation and testing is from 17th July 2019 to 6th January 2021. During this period, we were providing our clients with daily forecasts for the Aggressive stocks and the time horizons which we evaluate in this report are five periods spanning from 3 days to 3 months.

Evaluating the Signal Indicator for the Aggressive stocks

In this section, we will demonstrate how our stock-picking method can improve if we add the signal indicators.

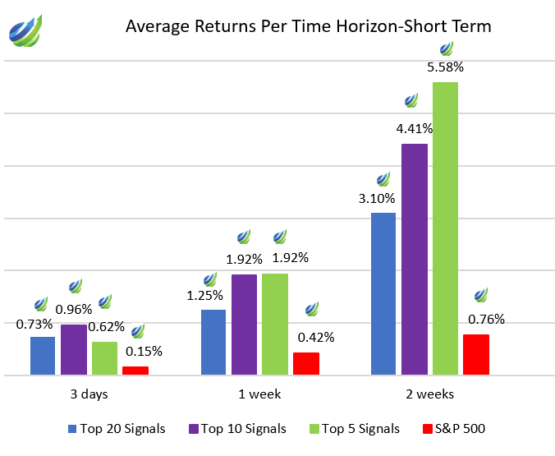

Considering Table 1 and Table 2, we can see that the percentage increases when signal strength is applied by considering the Aggressive stocks. This occurs from 3 days to 3 months. We can also see a significant jump in returns from horizon to horizon. The lowest predictability occurs at the 1 month time horizon for the Top 20 Signals with an average return of 5.64%. Every signal group for every time horizon outperformed the S&P 500. For the 3 months time horizon, the Top 10 Signal group exponentially outperformed the benchmark index. That group had a return of 14.47% in comparison to the S&P 500’s return of 4.65%. Simultaneously, we can observe 4 times outperformance of the Top 10 Signal for 1 month time horizon compared to the S&P 500’s with the 52% predictability. Predictions reach up to 54% precision regardless of market volatility.

Furthermore, 1 week and 2 weeks time horizons, considerably outperforming the S&P 500, all have a hit ratio of 50% and above. Even though those results seem not high enough, the average returns are positive and beating the benchmark. This is significant because, in addition to having tremendous returns on a long horizon, we also have demonstrated consistency for positive gains in short time frames.

Figure1 : Average Returns Per Time Horizon – Short Term

Figure 2: Average Returns Per Time Horizon – Long Term

The longer the time horizon, the higher the average return of the aggressive stock. The highest average return in the longest horizon of time – 3 months. For the Top 20 Signals – 11.30%, for the Top 10 Signals – 14.47%. for the Top 5 Signals – 13.73%. The difference with the benchmark is almost 2 times for the Top 20 Signals, the Top 10 Signals, and the Top 5 Signals. The Top 10 Signals’ average return on the whole-time horizons is higher than the average return for the Top 20 Signals and the Top 5 Signals. It is important to realize that aggressive stocks are highly volatile. For stocks with high volatility, having a long-term investment outlook is ideal because we can see a sizable change in the stock prices, irrespective of short-term downtrends.

Hit Ratio Per Time Horizon Analysis

Figure 3:Hit Ratio Per Time Horizon

From Figure 3, we can conclude that the smallest predictability (less than 50%) for the shortest time horizon – 3 days. The highest predictability falls on the 1 month time horizon. For the Top 20 Signals – 54%, for the Top 10 Signals – 52%, for the Top 5 Signals – 51%. Over the 3 months time horizon, the predictability decreases by 1 percent for all Top Signals.

Any market fluctuations heavily influence high volatility stocks. Regional and national economic factors, such as tax and interest rate policies, can significantly contribute to the directional change of the market and greatly influence volatility. The main reason for the global market volatility in 2020 was COVID-19. One of the sharpest drops into a bear market (indicated by a decline of 20% in major market indexes) due to economic fears around the COVID-19 containment measures, April saw one of the strongest months on record for stocks in the last 45 years. Consequently, such fluctuations in stock prices can lead to losses for some investors pursuing short-term investment goals since the market’s downtrends can last up to a year. Altogether, it can be concluded that the most profitable options for an investor will be the whole top Signals with a period of 3 months.

Conclusion

This evaluation report presented the performance of I Know First’s algorithm for the aggressive stocks from 17th July 2019 to 6th January 2021. The algorithm is outperforming the benchmark index throughout the time periods. The I Know First algorithm has obtained the best performance for the 3-month time horizon. Due to the high volatility of aggressive stocks having a long-term investment outlook is ideal. We can see a sizable change in the stock prices, irrespective of short-term downtrends. All in all, an investor can improve his investments by adding Aggressive stocks to his portfolio when considering the I Know First predictability indicator.