LNG Stock Forecast: Cheniere Tops Energy Sector With 39.10% Stock Increase

LNG Stock Forecast

This article was written by Graham Ellinson, a Financial Analyst at I Know First currently studying Mathematics at Northumbria University Newcastle.

This article was written by Graham Ellinson, a Financial Analyst at I Know First currently studying Mathematics at Northumbria University Newcastle.

“Now, more than ever, it is crucial that the United States use its abundant energy resources to support friends and allies abroad” - Sean Strawbridge, CEO of the Port of Corpus Christi

Summary

- Cheniere Energy, Inc. (Ticker: LNG) shares have been trading -8.94% off its 52 week-peak

- LNG accounts for only a small amount of the global crude oil market it is estimated to amount for 10% of the crude oil market by 2020.

- China imposed a new 10 percent tariff on all U.S. imported LNG, lowed than the original 25% touted.

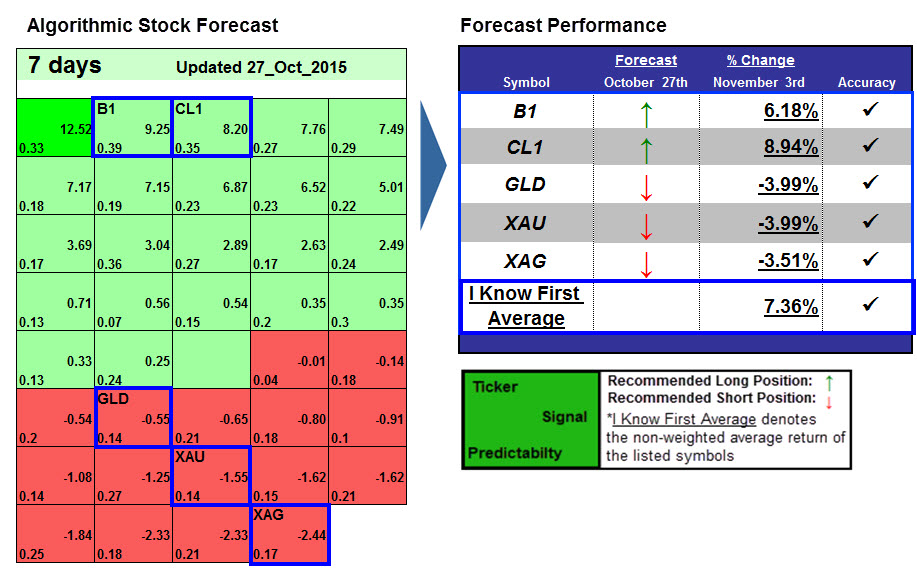

- Current I Know First Forecast remains bullish on Cheniere.

Read The Full Premium Article

Read The Full Premium Article

This article was written by Blair Goldenberg, a Financial Analyst at

This article was written by Blair Goldenberg, a Financial Analyst at