Algorithmic ETF Strategy Based on Daily AI Forecasts

In the following, we analyze the performance of our ETF Package by evaluating an algorithmic ETF strategy which invests on a daily basis in the ETFs selected by our AI system and can easily be recreated by using the daily forecasts provided to clients.

We show that the I Know First algorithm’s signals including the costs of bid-ask spreads and commissions results in a high-performing trading strategy with excellent statistics:

- Returns of up to 58% in a 2-year time period

- Alphas over 20%

- Betas below 0.3

- Sharpe ratios reaching 1.25

Algorithmic ETF Strategy

Our system is a predictive stock forecast algorithm based on Artificial Intelligence and Machine Learning with elements of Artificial Neural Networks and Genetic Algorithms incorporated in it. This means the algorithm is able to create, modify, and delete relationships between different financial assets. Based on the relationships and the latest market data, the algorithm calculates its forecasts and outputs signals which represent each assets’ predicted change in value. Since the algorithm learns from its previous forecasts and is continuously adapting the relationships, it adapts quickly to changing market situations.

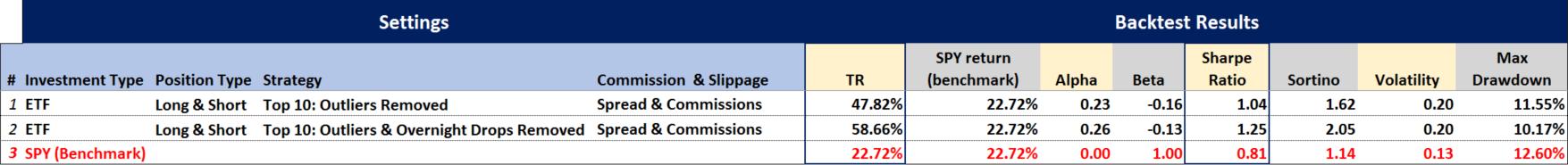

In the following, we use the daily top 10 signals generated by our algorithm for ETFs to trade the respective ETFs long and short. We rebalance the portfolio of ETFs based on the daily algorithmic forecasts, thus maintaining our portfolio in line with the market trends identified by the algorithm. We apply two basic filters to the algorithmic signals. First, (row 1 in table below) we eliminate outliers from the top 10 signals in order to control for signals which are strongly out of line with the remainder of the forecast and second (row 2 in table below), we filter out ETFs which have had overnight moves of over 2% (quite large returns for ETFs) since in this case, the algorithmic predictions are missing significant amounts of return information (our predictions are computed using closing prices, thus overnight moves are not accounted for in the daily AI signals).

Strategy Performance

The results of this ETF strategy for the period 08/18/2015 – 09/01/2017 including the effect of bid-ask spreads and commissions (0.35 cents per share and .06% spread per trade ) are summarized in the following table (click on the table to enlarge). Rows 1 and 2 present the statistics of the I Know First Portfolios while row 3 shows those of the benchmark, the SPDR SPY ETF (market cap weighted S&P 500 stocks ETF).

As can be seen in the table both portfolios significantly outperform the benchmark in terms of total return (47.82% and 58.66% versus 22.72%) with controlled Beta (below 0.3) and solid Alpha (above 20%), while also presenting excellent risk-adjusted returns (Sharpe ratios of 1.04 and 1.25) and significantly lower drawdowns than the SPY (11.55% and 10.17% versus the SPYs 12.60%).

The performance lines for the ETF strategy’s two portfolios are shown in the following graph.

As can be seen above, the ETF strategy exhibits steady and stable growth over the benchmark, avoiding the market downturn in late 2015-early 2016 and presenting steady growth since February 2016.

The consistency of the performance lines is thus well expressed in the high Sharpe ratios which in essence divide the strategy’s return by its volatility, and are thus a risk-adjusted metric of the performance of the portfolio. The high Alphas indicate strategies with consistent gains over the markets while the low Beta values show that the returns are not strongly correlated to the market, and thus will hold in market downturns. Both of these portfolio features are clearly discernable in the above lines, all in all, presenting statistically very solid strategies with very high returns, indicating that these portfolios will perform well in the future as well.

Conclusion

In this article, we presented an analysis of a simple algorithmic ETF strategy based on the daily ETF signals of our AI based forecasting program. The portfolios created are comprised of 10 ETFs and are rebalanced as the algorithmic signals change, thus constantly adjusting the investments to the market trends identified by the algorithm.

We show that trading ETFs using the predictions results in portfolios that have strong returns (over 45% in the last 2 years versus the benchmark’s return of 22.7%), controlled risk (Sharpe ratios above 1 and drawdowns below 12%), excellent Alpha and Beta statistics (Alpha above 20% and Beta below 0.3), exhibiting steady growth over the market in the last 2 years. All these features point to strategies that will continue their excellent performance into the future.

Read More

If you are interested in algorithmic trading strategies, algorithmic predictions of ETFs, or machine learning to predict the stock market read more here:

- Algorithmic Trading Strategies for European Stocks

- ETF Forecasts

- I Know First Stock Forecast Algorithm