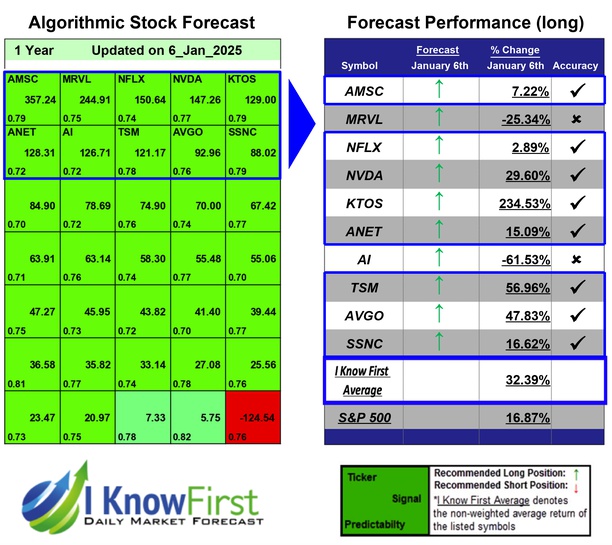

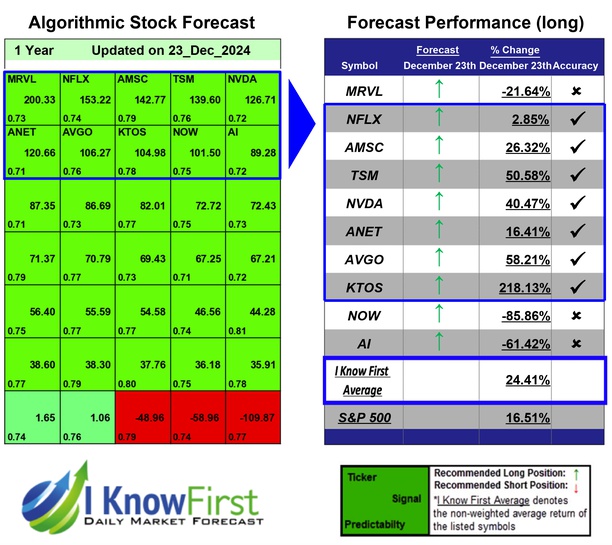

I Know First AI-Powered Portfolio: Beat the Market with AI-Driven Stock Picks

IKF AI Portfolio Performance: +28.25% Return vs. +21.35% Return for the S&P 500

Discover the power of AI in the stock market with the I Know First AI Portfolio — our newly rebranded Institutional Portfolio now available to retail investors. Powered by advanced machine learning and quantitative analysis, this portfolio is designed to consistently identify high-potential stocks and deliver market-beating returns.