Russell 2000 Index: I Know First Index Forecasts Evaluation Report

Russell 2000 Index Predictions Executive Summary

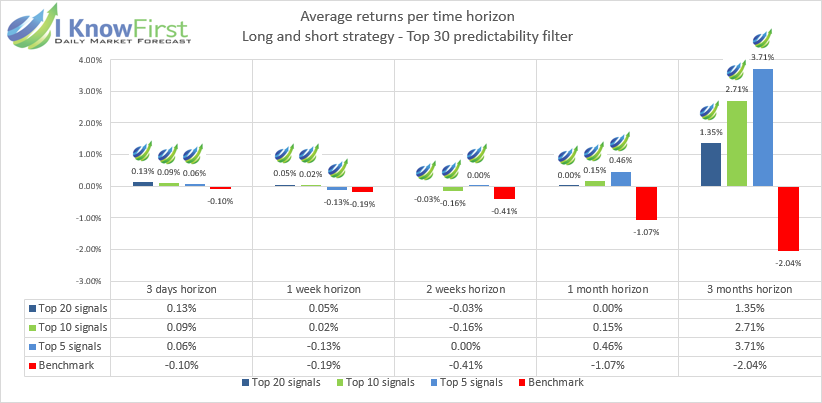

In this forecast evaluation report, we examine the performance of market indices predictions generated by the I Know First AI Algorithm for the Russell 2000 Index with time horizons ranging from 3 days to 3 months, which were delivered daily to our clients. Our analysis covers the time period from 1 January 2019 to 9 August 2019. Below, we present our key takeaways for checking hit ratios of our Russell 2000 predictions in the market.

Highlights:

- 91% Hit Ratio for 3-months time period for Russell 2000 predictions allowing our clients to be able to invest their money with significant less risk

- Predictions consistently hit above 63% accuracy despite volatile market conditions