Aggressive Stocks Amid Coronavirus Market in 2020

Executive Summary

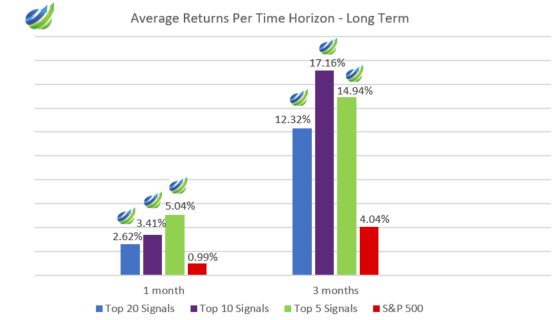

The purpose of this report is to present the results of the live forecast performance evaluation for I Know First AI Algorithm, specifically for the Aggressive stocks. The following results were observed when signal and predictability filters were applied to pick the best-performing stocks out of the most predictable ones. The period under evaluation is from 20th December 2019 to 8th November 2020. The corresponding returns distribution of stock filters for the Aggressive stocks are shown below:

Highlights:

- The highest average return in the longest horizon of time - 3 months: for the Top 20 signals - 12.32%, for the Top 10 signals - 17.16%, for the Top 5 signals - 14.94%.

- S&P 500 price target implying a 12% rally in 2021.

- 17,16 % - the highest average return for an investor is the Top 10 Signals with a period of 3 months.

This Best Chinese Stocks article was written by Erica McGillicuddy, Analyst at

This Best Chinese Stocks article was written by Erica McGillicuddy, Analyst at  This Southwest Airlines (NYSE: LUV) stock forecast article is written by Hao Liu, Financial Analyst at I Know First.

This Southwest Airlines (NYSE: LUV) stock forecast article is written by Hao Liu, Financial Analyst at I Know First. Read The Full Premium Article

Read The Full Premium Article