Best Chinese Stocks: Is China Finally Recovering from COVID-19?

This Best Chinese Stocks article was written by Erica McGillicuddy, Analyst at I Know First.

This Best Chinese Stocks article was written by Erica McGillicuddy, Analyst at I Know First.

Summary

- So far China’s economy has recovered as well as it possibly could have, but its future is dependent on the global economy

- US-China relations are dependent on their phase one trade agreement being upheld

- China’s government plans to bring growth to the economy through investments in high-tech infrastructure

- China’s economy is reliant on its customers’ ability and desire to continue importing from China

2020 has been highly unpredictable, with the COVID-19 pandemic throwing global economies into flux. China, the initial location of the virus, has been very susceptible to the market fluctuations. When the virus started spreading quickly in the first quarter of 2020, China’s GDP saw a sharp decline of 6.8% year-over-year, according to BBC. Most factories and businesses were shut down for a large portion of this quarter as a part of China’s strict quarantine measures to contain the virus. The impact of these closures was seen both in the decrease of GDP and a 4% decrease in household income, as stated by London Business School.

In the second quarter when China adapted and was able to limit the spread of the virus, the GDP increased 3.2% year-over-year. This growth came at a time when most other countries were still suffering losses and reflects China’s ability to grow amid such difficult circumstances. Regarding the pandemic, China has had great success in containing the virus that was once concentrated in China. In the first two weeks of July, China only saw 77 new cases while the US saw 816 221, as stated by Forbes. Moving forward, US-China relations, China’s government’s investments, and Chinese exports are the biggest factors in China’s recovery. Taking these into account, China’s economy will still be largely dependent on the abilities of other economies to recover.

US-China Relations Revitalized

Tensions between the US and China have been building for years. The issues of exports and sharing of information have been at the center of their conflict, and were partially dealt with in their Phase One Trade Deal which was signed on January 15, 2020. This agreement had both countries agree to reduce tariffs on the other country’s products, and China agreed to allow Americans more protection for their technology and trade secrets. Furthermore, China agreed to import $200 billion in goods and services from the US by 2021, and to loosen their agricultural standards that have been put in place to block the purchase of American goods, according to The New York Times.

This trade agreement alleviated some of the tensions, and caused a reduction in tariffs by both countries, however, their relationship is still far from ideal for the two largest economies in the world. China is well below the proportion of US imports it should have met by this point as per the trade deal, which brings concern regarding the longevity of their agreement. Furthermore, the South China Morning Post states that the US Treasury Department sanctioned 11 Hong Kong and mainland officials due to the national security law being put into effect. These sanctions essentially have the ability to prevent the individuals from taking part in the US dollar system. How China’s relationship with the US fairs will impact its ability to recover, as exports are essential to China’s economy.

Investing in Best Chinese Infrastructure Stocks

The Chinese government has recently heavily invested in infrastructure, which is the same strategy it utilized to recover from the Asian financial crisis and the 2008 global financial crisis. In the first two months of 2020 alone, China’s government had already invested RMB 950 million in infrastructure bonds, as stated by ConstructConnect. China is focusing investments in high-tech infrastructure rather than the traditional infrastructure investments that it has made in the past, with the hopes of higher returns. These investments will be focused in the sectors of 5G networks, big data centers, electric vehicles, Internet, and modern transportation, according to Fitch Ratings.

These state investments should benefit businesses in these industries and sectors, but it comes at a cost. China has a history of high debt due to heavy investments by the state, which are not all successful. The Oxford Saïd Review states that more than 50% of the infrastructure investments in China since 1986 have had higher costs than revenues. It appears that more tech industry infrastructure investments have been made in the hopes that they will be more profitable, which may solve this issue of unsuccessful investments.

Some of the best Chinese stocks’ trends reflect these investments. NetEase Inc. and Alibaba Group Holding Ltd from the Hong Kong Stock Exchange are prime examples of companies from high-tech industries that have fared very well throughout the pandemic. BYD Company on the Shenzhen Stock Exchange is in the automobiles and renewables industry, another industry in the high-tech infrastructure category. BYD Company has also done very well in the stock market in 2020.

China’s Exports Power

China is heavily reliant on exports, as the industry sector (which includes manufacturing) typically makes up roughly 40% of China’s GDP. This means that China’s economic recovery from the pandemic is dependent on the recovery of other countries which may be getting hit harder. If the countries that import from China have weak economies they will not have the financial ability to purchase as much as usual.

The initial impact of the pandemic on China was seen in January and February’s numbers, when exports shrank 17.2% from 2019. Since then there have been some ups and downs, with the most recent numbers from July exceeding expectations with exports up 7.2% year-over-year, when experts anticipated a drop of 0.2%, according to Trading Economics. High exports of medical equipment and electronics made the difference; however, these exports will only be temporary as more countries begin to overcome COVID-19.

There is also a possibility that the pandemic will cause countries to rethink their dependence on China for exports. Having to depend on another country to deliver high-quality products in a small time frame in such crucial circumstances may cause China’s top importers to reinvest in their own production of products that are important to society, such as medical products and PPE. While there are no signs of this based on July’s export growth, it is possible that this change will occur once everything settles down and decisions can be properly made.

Chinese Stocks and Market Recovery

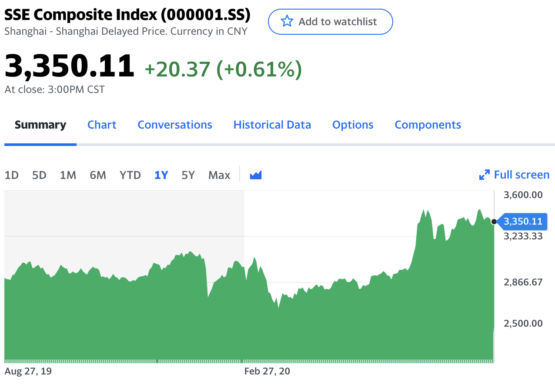

Ever since July, the Chinese stock market has been flourishing. In the first two weeks of July, the Shanghai Composite Index rose an astounding 15%. This is thanks to an increase in investments in the best Chinese stocks from both domestic and international investors. According to The Wall Street Journal, after a $101 billion USD investment into the banking system by the People’s Bank of China, the Shanghai Composite Index rose 2.3%. Soon after on August 18, the index experienced a rise of 0.4% to reach its highest point since February 2018.

In the tension of quarantine when boredom was high, China saw a spike in new trading accounts. In the time from January to June 2020, 7.98 million new trading accounts were opened in China. Since then, the numbers have continued growing. In June, China saw 2.43 million new trading accounts opened, which is the monthly high since July 2015, and contributes to a total of 170.2 million Chinese trading accounts as of July 31. While this adds a lot of funds to the market and is a large factor in why China’s stock market is recovering so well, it does come with drawbacks. Retail traders make up roughly 70% of China’s stock market transactions, which puts a lot of political pressure on the government to avoid stock declines which panic new traders.

Another concern is that although China is home to so many flourishing companies, many of them choose to be listed in the US rather than in China. For example, this year more than 20 China-based companies have went public in the US, despite ongoing tensions between the US and China. Recently, some top China-based companies listed in the US have opted to add secondary listings on the Hong Kong Stock Exchange. JD.com Inc., NetEase Inc., and Alibaba Group Holding Ltd have all taken this path and are seeing great results as some of the best Chinese stocks. The Hang Seng Index is down this year, and more companies adding listings in China could really help it get back on track.

ETFs are another important part of China’s stock market, as they provide access to the stock market to more investors. The top holdings by ETFs on the Hong Kong Stock Exchange are Jiangsu Hengrui Medicine Co. Ltd., Alibaba Group Holding Ltd., and Luxshare Precision Industry Co. Ltd, according to Investopedia. The most popular ETF on the Hong Kong Stock Exchange is the iShares MSCI China ETF. This ETF package has proven to be very successful in the past year with a 1-year trailing total return of 31.6% in comparison to the S&P 500 at 17.2%. This ETF’s holdings closely match the MSCI China Index which is composed of mid and large cap stocks. The major sectors of this index’s top stocks are consumer discretionary, communication services, and financials which demonstrates variation.

Successful I Know First Forecasts for Best Chinese Stocks

Chinese ETF forecasts are a part of I Know First’s extensive forecast package offerings. In the following August 25, 2019 Chinese ETF Forecast, the algorithm accurately predicted 10 out of 10 movements over a 1-year time horizon.

I Know First’s algorithm also has success in predicting the best Chinese stocks. In the May 25, 2020 Shanghai Stock Forecast the algorithm accurately predicted 8 out of 10 movements on the 3-month horizon. The average return of this forecast was 26.66%.

I Know First’s algorithm demonstrates its strong predictive abilities across many Chinese stock exchanges. In this May 25, 2020 3-month Hong Kong Stock Forecast the algorithm correctly predicted 9 out of 10 of the best Chinese stocks on the Hong Kong Stock Exchange. The algorithm gives accurate predictions over many time horizons, stock exchanges, and asset types.

Conclusion

The pandemic has turned the global economy upside down, and although China is one of the first to begin coming out the other side, there is still a long way to go. China needs to maintain a relationship with the US to get exports back up, however this is proving difficult as the pandemic has made it more difficult for the US and China to uphold their phase one trade agreement. China’s government has chosen to invest in high-tech infrastructure to improve economic growth, which will likely mean success for stocks within that industry. Still the government can only do so much. China’s exports are a crucial part of its economy, and are dependent on other countries’ recoveries and whether customers continue importing from China. China’s stock market has been recovering well so far thanks to the government’s strategy, high exports in specific industries, and an influx of new trading accounts. China has had a positive recovery from the pandemic thus far, but the economy is heavily reliant on the global economy and the trajectory of COVID-19.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast