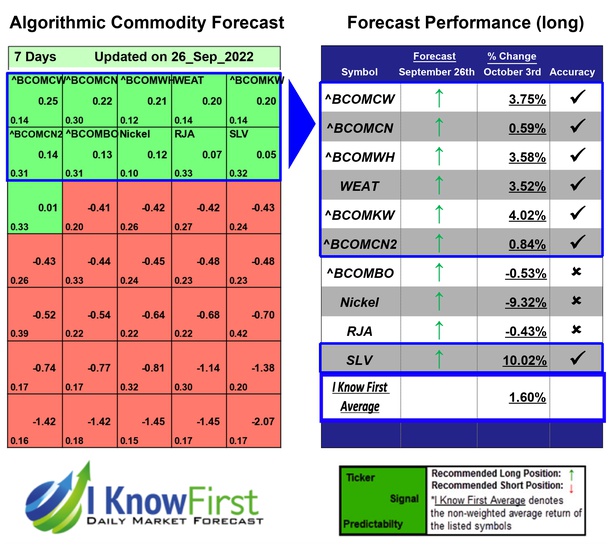

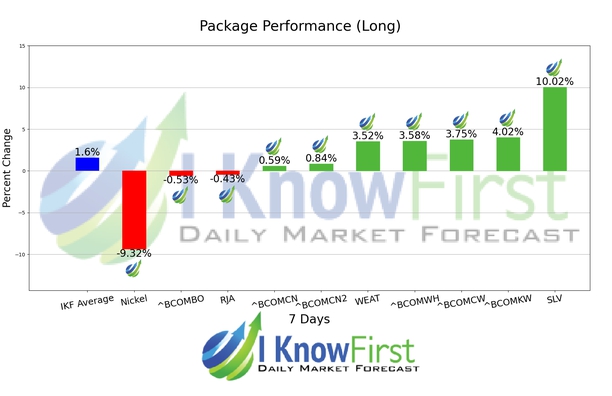

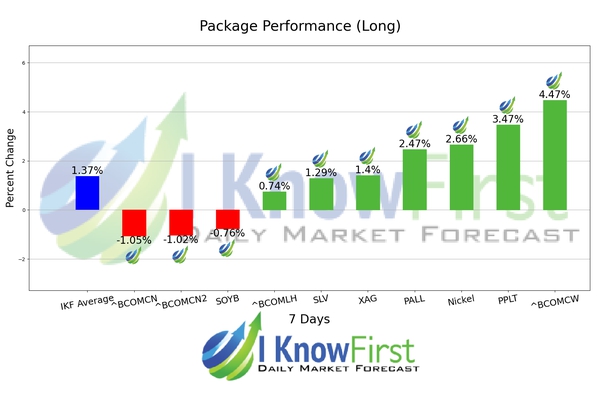

Commodity Outlook Based on Deep-Learning: Returns up to 10.02% in 7 Days

Package Name: Commodities

Recommended Positions: Long

Forecast Length: 7 Days (9/26/22 - 10/3/22)

I Know First Average: 1.6%

Recommended Positions: Long

Forecast Length: 7 Days (9/26/22 - 10/3/22)

I Know First Average: 1.6%

Read The Full Forecast

Read The Full Premium Article

Read The Full Premium Article