MARA Stock Forecast: Marathon Digital Holdings Is A Strong Momentum Buy

The MARA Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The MARA Stock Forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

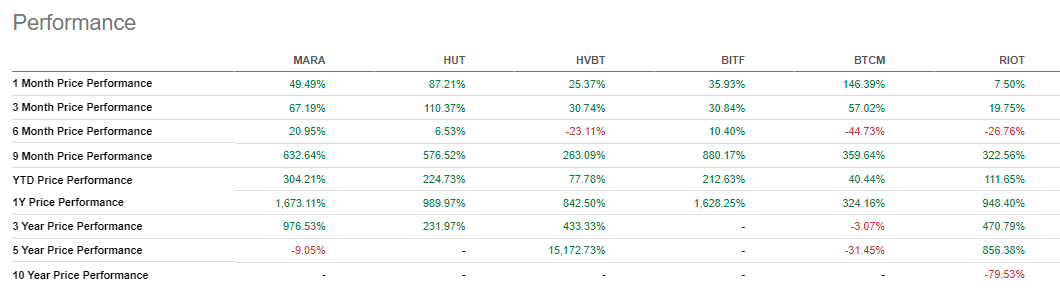

- The stock of Marathon Digital Holdings has a YTD price performance of +304.21%.

- The AI algorithm is still extremely super bullish for MARA. MARA is a super-strong momentum stock you should bet on.

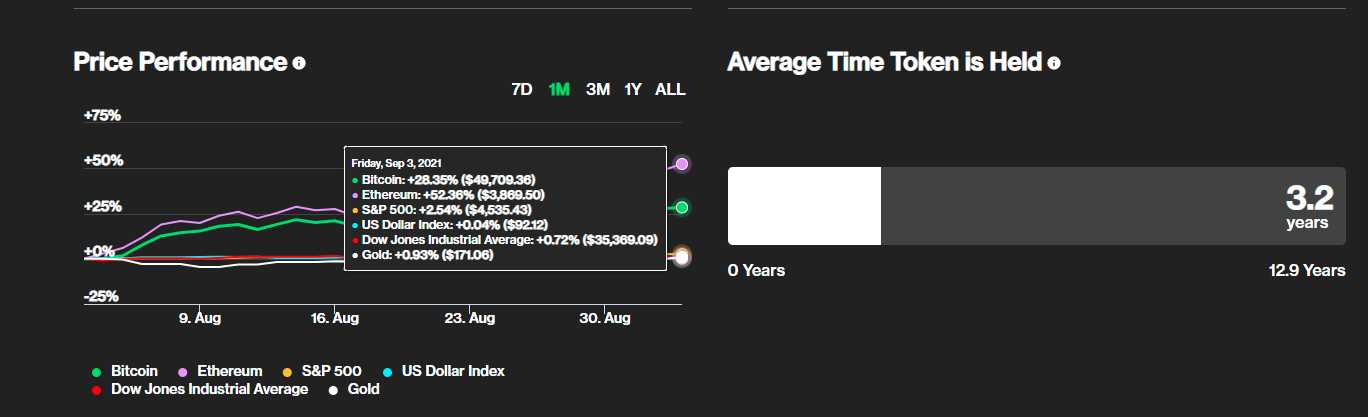

- Bitcoin’s price has a 1-month performance of +28.35%. MARA’s 1-month return is +49.49%.

- Marathon’s Bitcoin hash rate mining capability will get higher because it recently acquired more than 21,500 ASIC Miners from Bitmain.

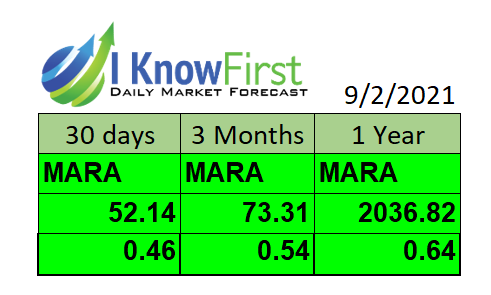

The stock of Marathon Digital Holdings (MARA) has increased more than +44% since the buy recommendation of I Know First analyst Yutong Li. The 1-month price return of MARA is +49.49%. The big surge for the past 30 days has helped MARA achieved a YTD gain of +304.21%. The strong momentum of MARA is why the AI Algorithm of I Know First is extremely bullish. I Know First gives MARA a 1-year forecast score of 2,036.82 with a predictability rating of 0.64. A particular stock only needs to get a forecast score of 100 and above to get a buy signal from I Know First.

Compare the chart above to the August 8 version below. The over 2,000 1-year forecast score attribute is why you should still go long (or average up) on MARA. The 30-day and 90-day forecast scores of MARA are also positive numbers. I Know First is confident that MARA has no downside probabilities within the next month or 12 months.

Going forward, MARA is apparently sustaining its strong ascendent momentum. You should not miss this upward ride of MARA. The big +49.49% 1-month return has made MARA an expensive stock to own. On the other hand, the +28.35% 1-month increase in Bitcoin price justifies the recent substantial increase in the valuation ratios of MARA. The market cap of Bitcoin is now more than $941 billion. Marathon’s core business is mining Bitcoin.

If Bitcoin price keeps on increasing and reaches $60k, we can assume that MARA will wrap 2021 with annual revenue of more than $250 million and an EPS of $0.98. These projections are feasible. The ongoing problem with more infectious variants of COVID-19 will compel more people to invest in Bitcoin and other cryptocurrencies. Cryptocurrency hoarding is the best hedge against the global economic recession/depression caused by COVID-19.

Why I Know First Is Extremely Bullish

The principles of momentum investing explain why I Know First has an extremely bullish one-year forecast score for MARA. Seeking Alpha’s Quantitative AI algorithm gives MARA a momentum grade of A+ – the highest possible rating. Performance-wise, MARA is outperforming the stock returns of some of its Bitcoin-centric peers. MARA actually has the best 6-month price return of +20.95%. On a 1-year basis, MARA’s +1,673.11% performance is significantly higher than the 1-year returns of its Bitcoin-centric peers.

My favorite momentum indicator is Exponential Moving Average or EMA. My EMA rule is a surging stock remains a buy if it does not dip below its 20-day EMA. Based on the chart below, EMA is a strong buy. Its 5-day EMA is $41.58 is higher than its 13-day EMA of $38.82. The 13-day EMA is higher than the 20-day EMA of $37.03. The 20-day EMA is higher than the 50-day EMA of $33.19.

The other reason why I Know First gave a very high 1-year forecast score for MARA is that the stock still trades notably lower than its 52-week high of $57.75. Going forward, MARA could rebound back near its 52-week high if Bitcoin prices rebound back to $63k or higher. Going forward, MARA’s stock price will always get influenced by Bitcoin’s price movements.

Why MARA Has Strong Momentum

Growth potential is still the number one factor when I make my investment quality analysis. The strong upward momentum of MARA is because investors like its super-high forward revenue CAGR of 739.34%. Only Riot Blockchain (RIOT) has a triple-digit forward revenue CAGR estimate. Take note that the 3-year revenue CAGR of MARA is 247.34%. It is the best among its Bitcoin peers when it comes to growth performance.

The future growth performance is also correlated with how good MARA is when it comes to mining Bitcoin. As per the latest report of Marathon’s management, the company is produced 469.6 new Bitcoins last August. This production was worth $23.615 million. MARA currently has 22,412 active miners that produce 2.3 EH/s. The Hash rate will improve soon because Marathon recently acquired 21,584 top ASIC miners from Bitmain. Another 5,916 ASIC miners are for delivery to Marathon. If the price of Bitcoin stays at $50k and all the new ASIC miners get used this month, MARA’s September could result in more than 750 Bitcoin mined (worth $37.72 million).

The new ASIC miners from Bitmain could really boost the Bitcoin mining production of MARA.

Potential Risks

MARA has an obvious headwind because its stock price will always be tied to the Bitcoin price index. MARA’s headache is that Bitcoin, like oil and gold, is vulnerable to supply and demand rules. If there are not enough Bitcoin buyers, higher monthly Bitcoin mining is useless when nobody is buying Bitcoin at higher prices. There is also the scary 18.55% short interest on MARA. Any stock that has more than 8% short interest is risky to own.

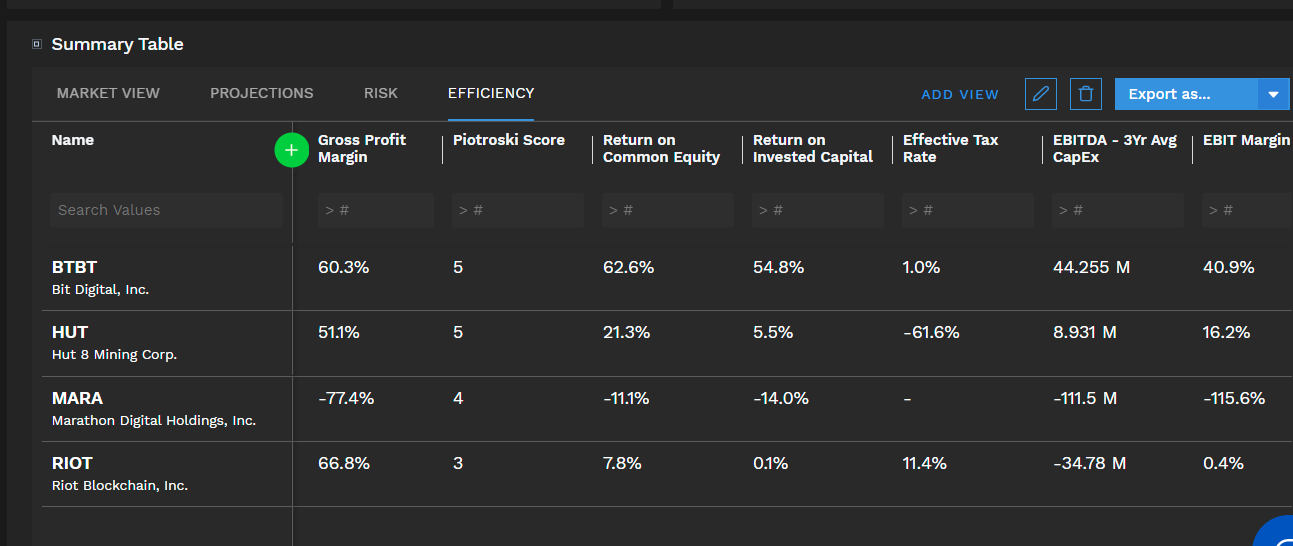

The Piotroski score of MARA is 4. It is therefore a decent value stock. The thesis of this article is that MARA is a strong momentum stock.

MARA Stock Forecast: Conclusion

MARA is a strong momentum stock you should buy. The massive +304.21% YTD gain in MARA’s price is explained by the chart above. MARA only mined 50.4 Bitcoins in January but then it went up by more than 900% to 469.6 by August. This massive monthly revenue increase is why the AI algorithm of I Know First gave MARA a 1-year score of 2,036.82. I Know First understood that MARA has solid upside potential. The receipt of more than 21,500 new ASIC miners could help MARA achieve a 7 EH/s monthly Bitcoin hash rate by October 2021.

I Know First has a very strong buy recommendation for MARA. MARA is a good momentum investment if you don’t like mining Bitcoin yourself.

Past Success With MARA Stock Forecast

I Know First has been bullish on the MARA stock forecast in the past. On August 1st, 2021 the I Know First algorithm issued a forecast for MARA stock price and recommended MARA as one of the best option stocks to buy. The AI-driven MARA stock prediction was successful on a 1-month time horizon resulting in more than 52.73%.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as forex forecasts, as well as gold predictions, while also providing the latest Apple stock news. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.