MARA Stock Forecast: an Early Mover in the Cryptocurrency Field with Growing Mining Power

This MARA stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This MARA stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlight:

- MARA stock has grown by 211.08% since January 2021

- Marathon Digital Holdings Inc. has raised $212 million of cash, up by 50.0% quarterly

- The company has competitive financial ratios with a net margin of 572.60% and a current ratio of 219.27, outperforming 97% and 96% of companies in the capital markets industry

- With Marathon’s improvement in its mining power and a solid financial position, the target price for MARA will hit $40 for the upcoming year

Overview of Marathon Digital Holdings Inc.

Marathon Digital Holdings Inc., formerly Marathon Patent Group, is a digital asset technology company that mines cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets in the United States. Marathon Digital Holdings Inc. operates a Data Center in Hardin, Montana, the United States with a power capacity of approximately 105 megawatts. It also owns approximately 2,060 Application-Specific Integrated Circuits (ASIC) Bitcoin Miners at a co-hosted facility in North Dakota, United States. The company was founded in 2010 and is headquartered in Las Vegas, Nevada. Since last August, Marathon Digital Holdings (NASDAQ: MARA) has rocketed 681.96% over this 1-year time horizon.

Marathon’s Exceptional Mining Power Growth

Marathon Digital Holdings Inc. is one of the largest bitcoin miners in North America. Throughout the first half of the year, Marathon’s total bitcoin holdings have increased to approximately 5,784 BTC, as the company produced 265.6 BTC in June – a 17% rise compared to May.

The company has been striving to grow its bitcoin mining power and increase its hash rate. According to this article, Marathon plans to expand machine deployments and to have a more advanced mining computational power over the next several months. It anticipates delivering 75,000 miners by the end of this year, with another 15,200 arriving in January 2022. The company also expects to have a total of 103,120 miners by the first quarter of 2022 and produce 5560 Bitcoin per day.

On August 2nd, 2021, Marathon announced that it has entered into a contract with Bitmain to purchase 30,000 Antminer S19j Pro (100 TH/s) miners for $120.7 million to increase the computing power for bitcoin mining. “Increasing our percentage of the total network’s hash rate increases our probability of earning bitcoin, given the uniquely favorable conditions in the current mining environment, we believe it is an opportune time to add new miners to our operations,” said Fred Thiel, Marathon’s CEO. As Marathon continues to fully deploy more powerful miners and enhance its hash rate, we can expect the company to grow to be one of the largest miners, not just in North America, but also in the world.

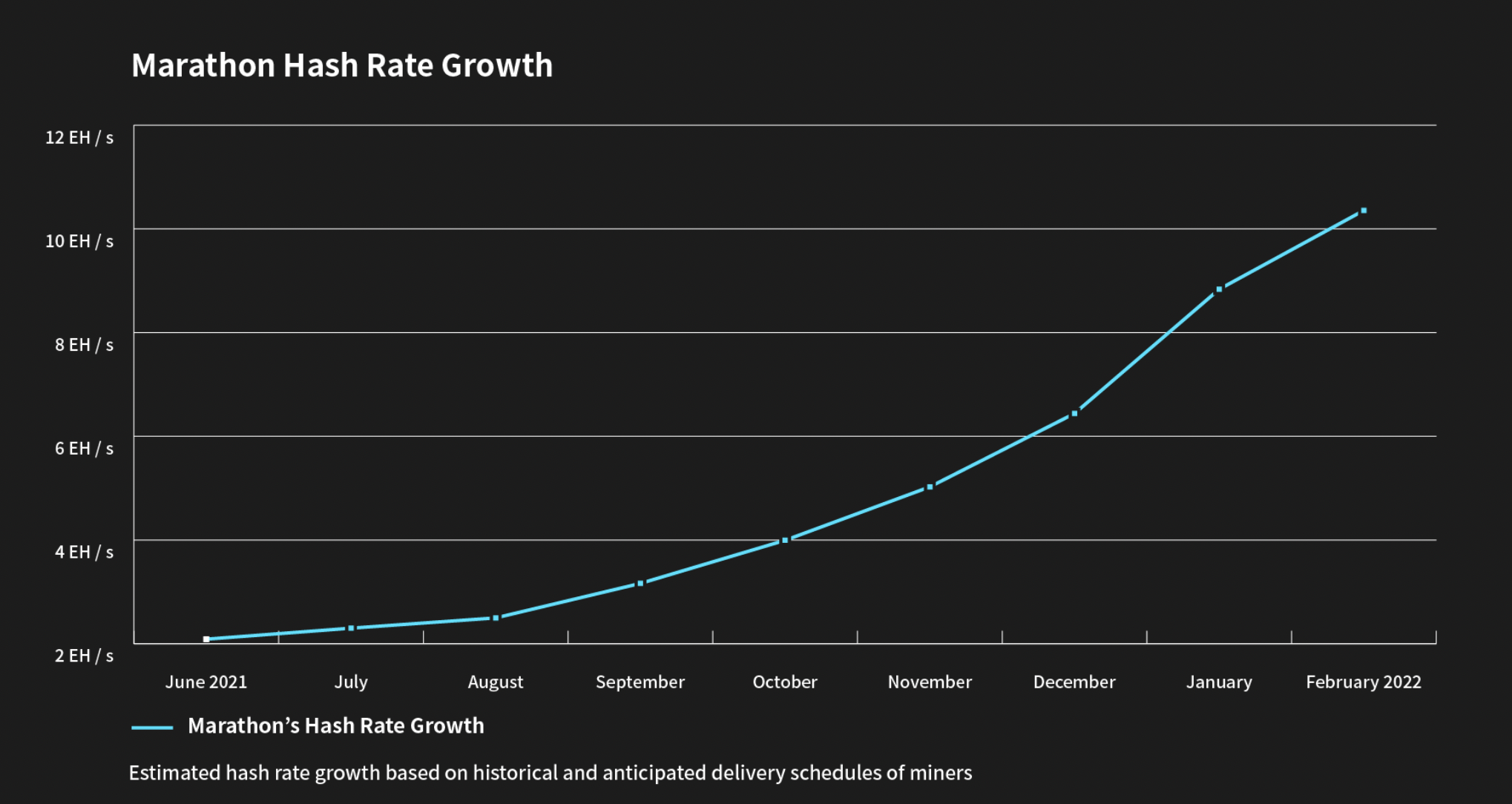

According to the graph below, Marathon’s hash rate is projected to increase fleetingly, and the company intends to have it over 10 EH/s by the first quarter of 2022. This is so far the largest hash rate capacity that publicly traded miners have announced. Thus, there is a promising outlook for Marathon as this hash rate can potentially increase the efficiency of Marathon’s bitcoin earnings and generate more revenues. Marathon’s persistent efforts in bitcoin production will also make it stand out among other cryptocurrency mining companies.

Marathon: Positioned for A Strong Financial Competitiveness

According to Marathon’s 10-Q form of Q1 2021, it had a cash balance of $212 million, which was up by 50.0% quarterly and took up about 33.3% of its total asset. This impressive jump in the cash balance can demonstrate that the company has enough cash holding to expand and upgrade its cryptocurrency mining machines. This cash balance can also contribute to the company’s assets value and can lead to a higher valuation of the stock. Additionally, Marathon generated a revenue of $9.2 million in the first quarter, which was 14.4 times larger compared to Q1 2020. This substantial increase in revenue can again exhibit Marathon’s revenue generation ability as its hash rate enhances.

Next, let’s select several comparable companies of Marathon Digital Holdings and the capital markets industry benchmark to evaluate its financial performance. These companies are Morgan Group Holding Co (USD, MGHL), China Finance Online Co. (USD, JRJC), CreditRiskMonitor.Com, Inc. (USD, CRMZ), Cohen & Company Inc. (USD, COHN), Mentor Capital Inc (USD, MNTR).

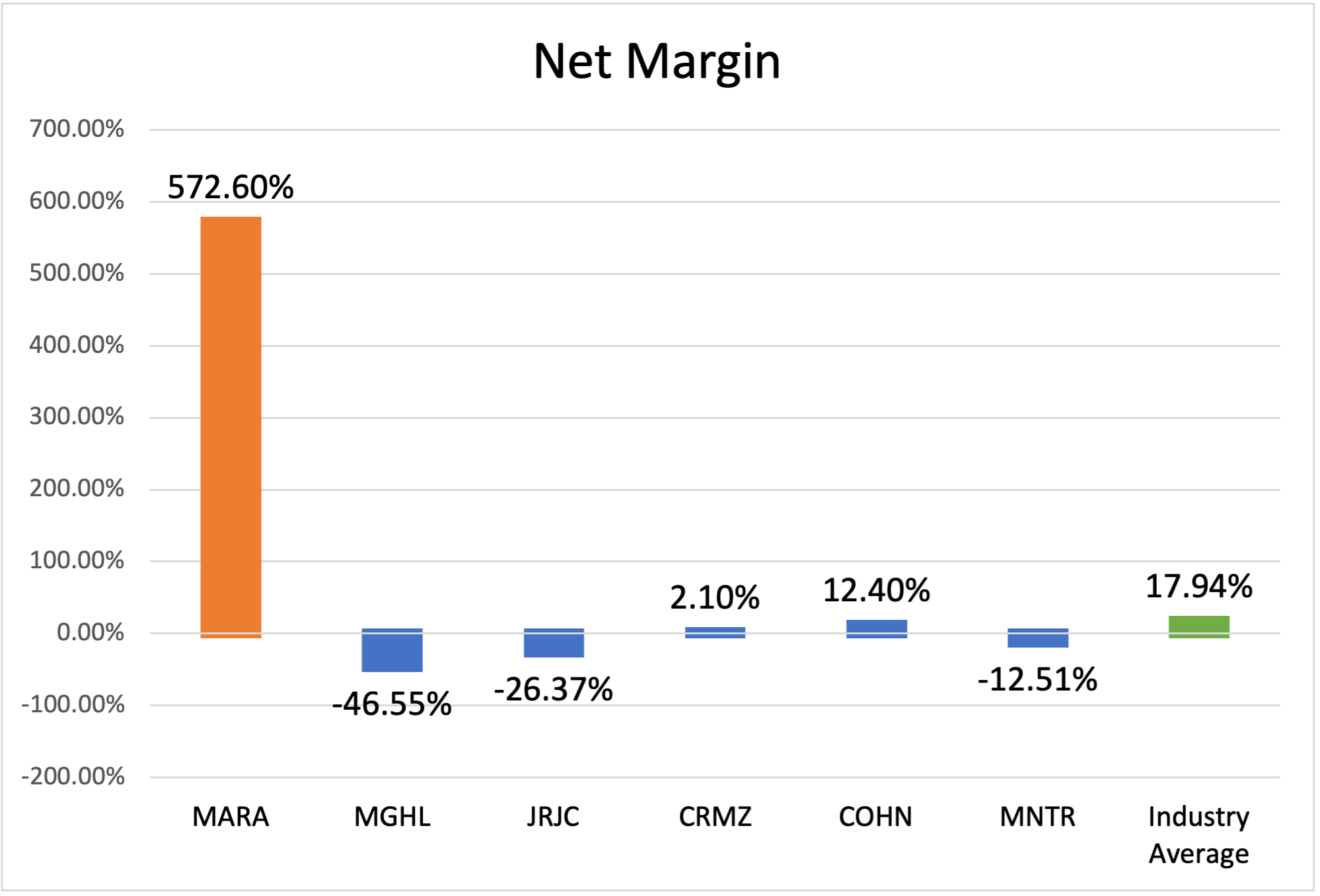

According to GuruFocus, Marathon’s Net Margin of 572.60% is exceptionally higher than all its peers we selected and the industrial average. This number is also outstripping 97% of companies in the capital markets industry. This can demonstrate that the company is effectively controlling its costs and generating enough net income from its revenue.

(Figure 1: Net Margin)

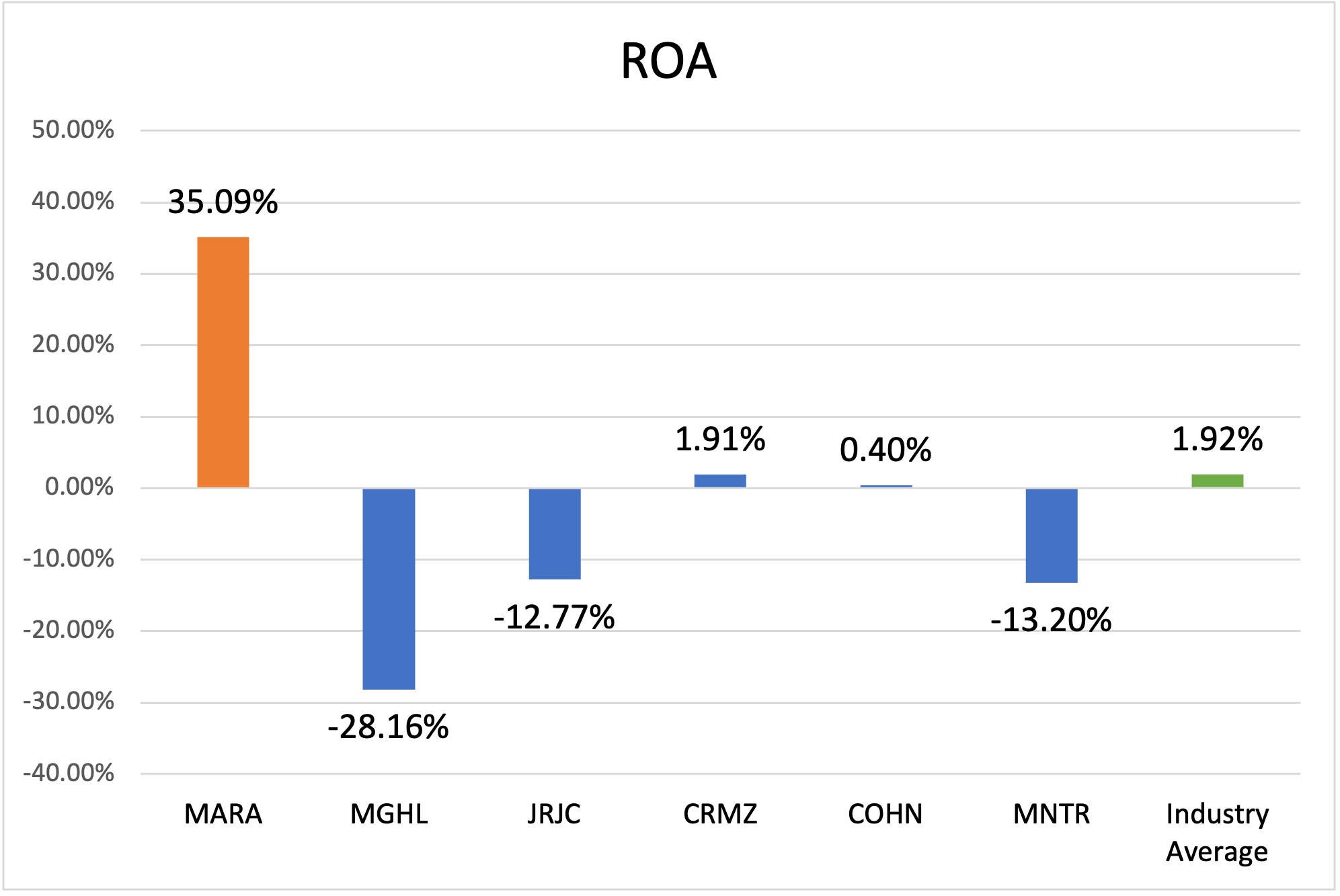

In addition, MARA has a striking current ratio of 219.27, being the highest one among other companies we picked and the industry benchmark. This ratio is also ranking higher than 96% of companies in the industry, indicating Marathon’s excellent liquidity and operational efficiency. Besides, from Figure 3, MARA has a notable ROA of 35.09%, surpassing the industry benchmark and outperforming 96% of companies in the capital markets industry. This can demonstrate the company’s excellent profit generation ability from its assets.

(Figure 2: Current Ratio)

(Figure 3: ROA)

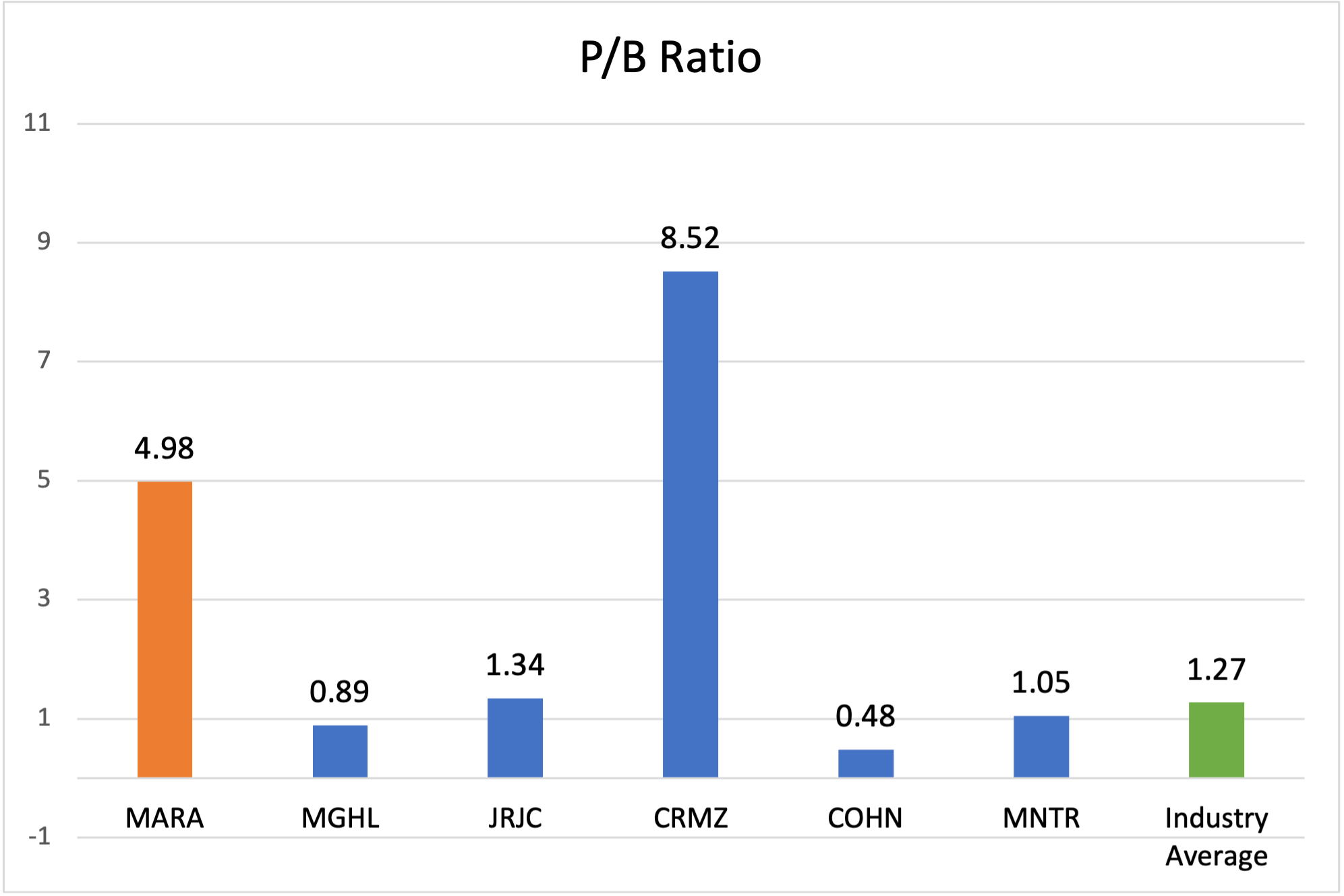

Furthermore, MARA’s current P/B ratio of 4.98 and P/E ratio of 55.6 suggest that the stock is overvalued. Nevertheless, Marathon’s large cash holding can be one driving factor for this high stock valuation. We can also notice that most comparable companies do not even have positive profits. Plus, given Marathon’s leading mining power and exceeding financial position, the high value of the P/E ratio can also be seen as a sign of its potential growth. Therefore, MARA should still be considered a worthy investment.

(Figure 4: P/B And P/E Ratios of Comparable Companies)

MARA Stock Forecast: Targeted Price Hit $40 in 2022

From the above stock price chart, MARA’s current stock price is above all its three moving averages (the purple line is MA-50, the orange line is MA-100, and the blue line is MA-200). Plus, MARA’s recent stock price tends to bounce in the wide range between its support and resistance levels of $19.5 and $31.5, which connects with the uncertainty in the cryptocurrency market. We can also notice that the last closed MARA price has just surpassed its resistance level, which can also be a rising signal for its stock growth.

From a long-term perspective, MARA stock has an overall increasing price level and is also generally above its MA-200 line in this 1-year period. Even though this stock price displays a lot of volatility as the price of Bitcoin fluctuates, MARA is still positioned for massive growth and great returns as a strong-buy investment in the long run from our earlier discussion. Therefore, my MARA stock forecast is that its target price in 2022 will hit $40 with a return of 16.79%. It also has a great potential to go above this target price depending on Marathon’s mining power growth and the price of Bitcoin, etc. Moreover, investors should also recognize a higher degree of risk going along with this substantial returns Marathon can bring and pay attention to the overall cryptocurrency market situation to make wise investment decisions.

Conclusion

In a nutshell, as one of the largest bitcoin miners in North America, Marathon has been dedicated to improving its mining power by investing in more advanced miners and enhancing its hash rate. This expansion in the company’s mining capacity and its solid financial position in the industry has also translated into its cash and revenue growth, boosting the MARA stock. Therefore, despite the high volatility in its stock price, MARA still appears to be attractive in the long run.

From I Know First’s forecast above, MARA has high signals for all long-term time horizons from 1 month to 1 year, which proves Marathon’s potential growth. Additionally, we can see an extremely strong signal of 2997.51 with a predictability of 0.63 for the 1-year forecast, which again indicates the encouraging long-term outlook of MARA stock.

Past Success with MARA Stock Forecast by I Know First

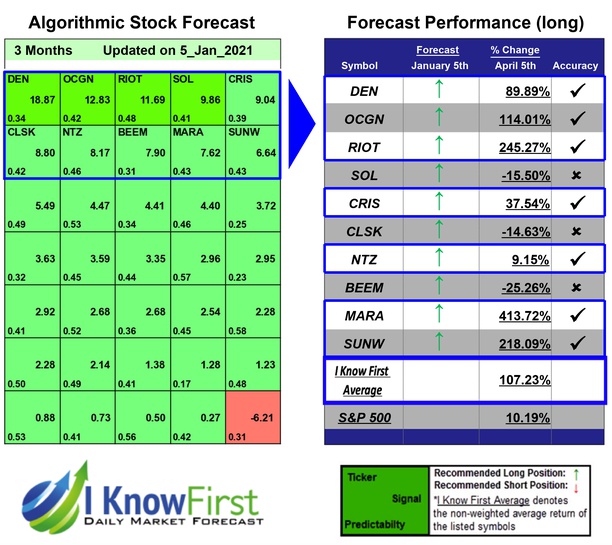

On April 5th, 2021, I Know First’s Aggressive Stocks Forecast package had accurately predicted 7 out of 10 stock movements on a 3-month time horizon and saw great returns. This package was screened by I Know First’s algorithm for higher volatility stocks that present greater opportunities but are also risker. MARA stock forecast was one among the recommended long-position aggressive stocks that saw an exceedingly high return of 413.72%, surpassing the S&P 500 benchmark (10.19%) with a market premium of 403.53%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.