AMZN Forecast: The Everything Stock

![]() This AMZN Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This AMZN Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

Highlights:

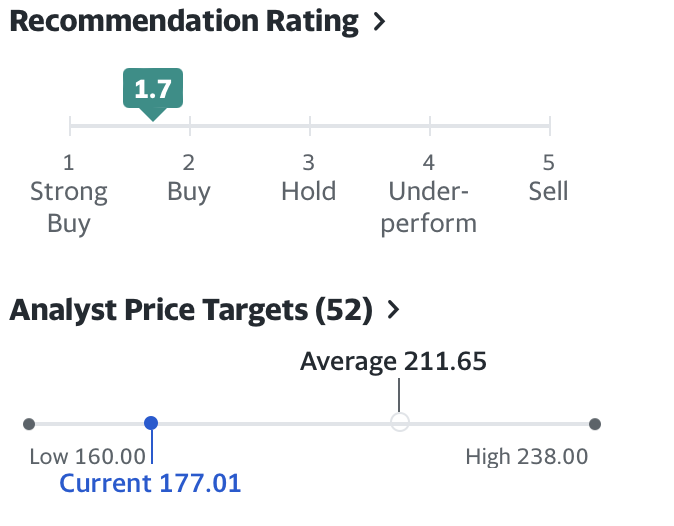

- Technical indicators suggest a Buy opportunity for Amazon’s stock.

- Analysts place the target price at $211.65.

- Staunch cost-cutting has significantly increased earnings.

AMZN Forecast: Introduction

Amazon was founded on July 5, 1994, by Jeff Bezos in Bellevue, Washington. The company started as an online book marketplace but gradually expanded its offerings to include various product categories. This diversification led to it being called”The Everything Store”.

High growth expectations backed by investments in AI have made AMZN a top performer this year. With a $1.9 trillion market capitalisation, it is the 5th largest company in the world. The AMZN stock is up 18.10% Year to Date.

The firm has experienced spectacular growth in 2020 due to increased demand for e-shopping during the pandemic. The rapid expansion caused them to over-hire and implement short-term “patches” to meet demand. This racked up costs, decreased profitability, and decreased consumer spending in 2022. The stock plummeted throughout 2022, causing management to implement swift changes. This granted a reversal of the trend with rapid growth through 2023 and increases in profitability, making it one of the best-performing stocks.

AMZN Forecast: Revenue Analysis

The company strategically divides revenue by geographical factor in its financial reports, reflecting the robust international expansion strategy. This approach also ensures that losses in some segments can be offset by gains in others, instilling confidence in the investors. It also sets AWS as a separate sector, making the split as “North America Sales,” “International Sales,” and “AWS Sales.” This division emphasises the importance of AWS for the firm and underscores management’s belief in it as the most significant potential expansion driver. This strategic focus on AWS is a testament to Amazon’s forward-thinking approach and ability to adapt to changing market dynamics, which should inspire confidence in the company’s future among investors.

AMZN Forecast: Primitives as the building blocks of success

In its latest annual report, the CEO attributes the company’s successes to the focus on “primitives,” a concept originally from software development that Amazon has appropriated for its core business. The company defines this as focusing on the core processes, deeply analysing those processes, and developing algorithms for optimal execution. This reduces the deviation of efficiency metrics between operations in different regions or departments within the same firm. Once the algorithms, whether in software or a set of guidelines, have been “polished” by Amazon, it advertises it to partners and clients, receiving extra revenue. It is cheaper for partners or clients to use Amazon’s proprietary software or services that are tried and tested rather than dedicating resources to develop their own.

This increases Amazon’s influence among competitors and partners and provides a competitive advantage. It has provided the most fruitful gains in their e-shop division, where “third-party sales revenue” became a meaningful part of their income by clients outsourcing their logistical needs for a fee to Amazon.

AWS

No discussion of Amazon’s earning projections has been without mentioning AWS. Despite constituting around 16% of the firm’s revenues, it has had the most significant growth prospects. It used to incur losses for consecutive years due to large R&D expenditures and a ruthless fight for talent. However, once the volume increased and marginal costs plummeted, the profits have rapidly increased. With more firms becoming aware of the benefits of the cloud, the demand is ever-increasing. Despite intense competition from the sector, especially from Microsoft, Amazon has managed to maintain and expand its market share. This positive outlook for the AWS division and Amazon’s ability to adapt and innovate should make business analysts feel optimistic about the company’s financial performance. Research shows that 70% of businesses in the US still use in-house IT solutions. This gives Amazon unique opportunities to expand soon and ensures that growth will persist. Currently, AWS is more suited for more prominent firms with higher computing intensity needs. Although attempts have been made to make the pricing more flexible, it is still rigid. This has allowed Microsoft Azure to grab higher market share as their plans are more customisable.

Cost-cutting

The rapid demand surge for deliveries and online entertainment during the pandemic was troublesome for Amazon. Despite obvious financial benefits, it exerted unprecedented pressure on the firm’s supply chain. Aiming to maximise customer satisfaction, Amazon ended up overspending in the short term and was left with subpar logistic systems in place after, albeit with a sizably expanded market share.

This forced management to take severe cost-cutting measures in the last two years and reshuffle logistics and procurement structures. The changes have resulted in lower costs and significantly improved profitability margins.

However, in his last statement, the CEO insisted that the cost-cutting measures are far from over. FY 2024 will again focus on optimising the value chain with more cost-cutting initiatives. Mr. Jassy is expected to focus most closely on streamlining the fulfilment and logistics division while conducting a deep dive into the other divisions. This is a positive notion for investors and is reflected in high earnings projections for the coming year.

Online Retail

Online retail is the core of Amazon’s business and remains the most significant revenue generator. Besides cost-cutting initiatives, the firm aims to increase revenue by expanding its grocery delivery service. In the US, it does so through partnerships with grocery retailers and its proprietary brand, Amazon Fresh. They have recently rolled out a new subscription service, like “Prime”, for grocery deliveries, where customers can get unlimited free express deliveries on grocery orders.

They are also trying to capture the demographic of customers receiving government-subsidised groceries through an EBT card by discounting the membership. Partnering with independent retailers expands its potential customer base, grabbing different price points.

This is a promising trajectory as the grocery delivery market has increased recently and is projected to retain the trend, only accelerating.

Entertainment Division

Amazon’s latest report hinted at the ambition to increase its market share in the entertainment streaming market by offering a “one-stop shop” for all entertainment needs. Through strategic acquisitions and investment in the entertainment division, Amazon benefits from the ability to fulfil many entertainment needs and wants. “We are what we believe is the premiere entertainment hub from an application perspective,” Andrew Bennett, VP and head of global video partnerships for Prime Video, MGM+ and Freevee, said in an interview with StreamTV Insider.

Amazon doesn’t publicly disclose Prime Video membership figures, but recent estimates point to around 200 million users. On Nielsen’s The Gauge monthly snapshot, Prime Vide accounted for 2.8% of TV time in the U.S. in January, ranking third behind leaders YouTube (8.6% share) and Netflix (7.9% share).

The expansion of the entertainment division brings higher advertising revenues, growing 24% YoY from $38B in 2022 to $47B in 2023, primarily driven by sponsored ads. Recently, Amazon has increased its advertising reach by introducing ads into Prime Video shows and movies.

Just Walk Out

In 2018, news outlets ran headlines about Amazon’s “Just Walk Out” technology, which they dubbed the future of retail experience. The combination of cameras and sensors inside Amazon’s grocery stores allowed a cashier-less experience. The customer would walk in, scan a QR code, sign into their Amazon account with a linked credit card, place groceries in the basket, and leave without checkout. This seemed like a logical next step after the spread of self-checkout desks at supermarkets worldwide. Amazon invested significant resources in training the software, hoping they could sell it to our retail outlets and revolutionise the shopping experience.

But that did not happen. The consumers felt uncomfortable with the shopping experience and would opt for traditional stores instead. Whether it was the rapid implementation or the technology was too futuristic for the “average Joe”, Amazon was forced to accept defeat and close some of the larger stores in the US in 2024. However, the company has undoubtedly gathered vast data on how people shop in-store, which is bound to be an asset. Until customers are ready for a fully automated shopping experience, Amazon will likely sell the gathered data to other physical outlets. Additionally, in-store retail constitutes only about 3% of the firm’s revenues, so the decision to close stores is unlikely to materialise in meaningful losses.

AMZN Forecast: Analysts’ Consensus.

As the Q1 2024 earnings report approaches, analysts are optimistic. According to NASDAQ, Q1 2024 results are expected to be around $0.82 per share, up from $0.31 reported last year. Notably, in FY 2023, Amazon has outperformed all earnings estimates. It posted impressive results in Q4 2023, beating estimates by 25%. High earnings in Q4 are expected due to the high seasonality of the business, yet it is still an outstanding result.

Analysts are bullish on the stock, predicting upside potential with an average target price of $211.65.

AMZN Forecast: Technical Indicators.

Technical analysis supports the buy recommendation. The stock price has been in a continuous, stable uptrend since November 2023 and shows no signs of reversal. There has been an uptick in volatility and slight downward pressure in anticipation of the earnings call. This pushed the stock price towards the lower Bollinger band, which indicates a potential Buy opportunity. The widening of the bands signals that the volatility has currently increased. However, the mean-reverting nature of it also signals that it is bound to decrease, so there is no cause for worry. The patterns presented by the Moving Averages for periods of 50,100, and 200 also indicate a stable uptrend.

The Relative strength indicator was close to the upper bound for a while, indicating the stock was potentially overbought. Still, it is rapidly approaching the lower bound, again suggesting a potential buy opportunity. The Average True Range indicator has increased, signalling higher volatility. However, it is still within reasonable bounds, especially for tech stocks, which makes Amazon an attractive investment even for more risk-conscious investors.

AMZN Forecast: Conclusion

All in all, AMZN is an attractive stock for a well-diversified portfolio. It provides solid upside potential without excessive risk. The wide range of segments makes it a unique stock for gaining exposure to multiple industries, making for a well-rounded portfolio. With a dedication to increasing profitability and a focus on robust innovation, forecasts fruitful returns. Therefore, I take a Buy-side recommendation.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the AMZN stock forecast.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.