Even though Yahoo (

YHOO) Chief Executive Officer Marissa Mayer slipped up and "overslept," making her late to a meeting with advertisers last week, YHOO as an investment is still currently a buy. This is driven by the company's proactive approach to revitalize itself as well as the upcoming Alibaba.com (BABA) IPO, which currently outweighs the risks associated with the stock. Our advanced

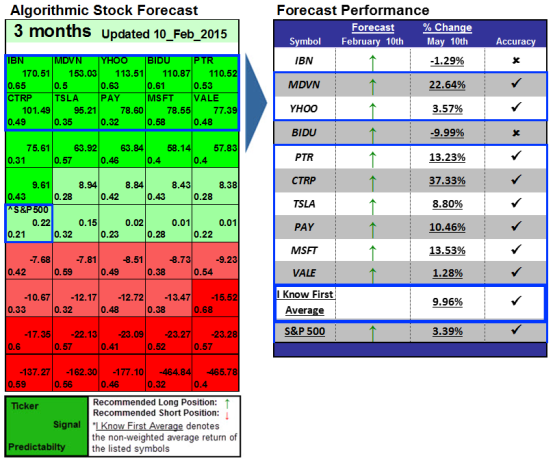

algorithmic prediction system also has a bullish forecast for YHOO shares in the 1-month and 3-month time horizons.

Over the past year the stock returned approximately 32%, outperforming the broader market over the same time frame. While this

rise during the last year has made the stock more expensive compared to its peers, the company is able to justify this evaluation and has potential to expand value.

This article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

This article was written by Blair Goldenberg, a Financial Analyst at I Know First, and enrolled in a Masters of Finance at Colorado State University.

Read The Full Premium Article

Read The Full Premium Article