Yahoo Stock Prediction: Sum of Parts Valuation Reveals Yahoo Is Still Undervalued

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Yahoo Stock Prediction

Summary:

- Even with its current market valuation of $40.6 billion, I still see Yahoo as undervalued.

- Sum of parts calculation told me that Yahoo is worth more than $45 billion.

- It is time to go long on YHOO while it still trades below $44.

- Yahoo still owns 15.4% of Alibaba and 35.5% of Yahoo Japan.

- YHOO has strong buy signals from its positive algorithmic forecasts.

Yahoo (YHOO) is now great value play after it sold its core internet business to Verizon (VZ) for $4.8 billion. Yahoo will soon be free from being the whipping boy of Alphabet (GOOG) and Facebook (FB). Marissa Mayer failed to make Yahoo a competitive platform for digital advertising.

However, now is the right time to go long on YHOO. A sum-of-parts analysis clearly reveals Yahoo’s current market cap of $40.58 billion is inadequate. The bargain status of YHOO right now is not going to last long. The stock market will eventually realize that Yahoo is a lot more than $40.58 billion.

Estimating the true worth of Yahoo is easy. Let us start with the $4.8 billion that Yahoo will receive from Verizon. We then add the value of Yahoo’s 15.4% stake in Alibaba (BABA). Alibaba’s market cap right now is $236.29 billion.

236.29 x 0.154 = 36.39 billion

$4.8 billion + $36.39 billion = $41.19 billion

The $41.19 billion estimate is near the current valuation of Yahoo. However, it is a mistake that the stock market is only valuing Yahoo based on its Alibaba stake/Verizon windfall. Investors are too focused on the Alibaba stake of Yahoo that they are forgetting the other crown jewel, Yahoo Japan.

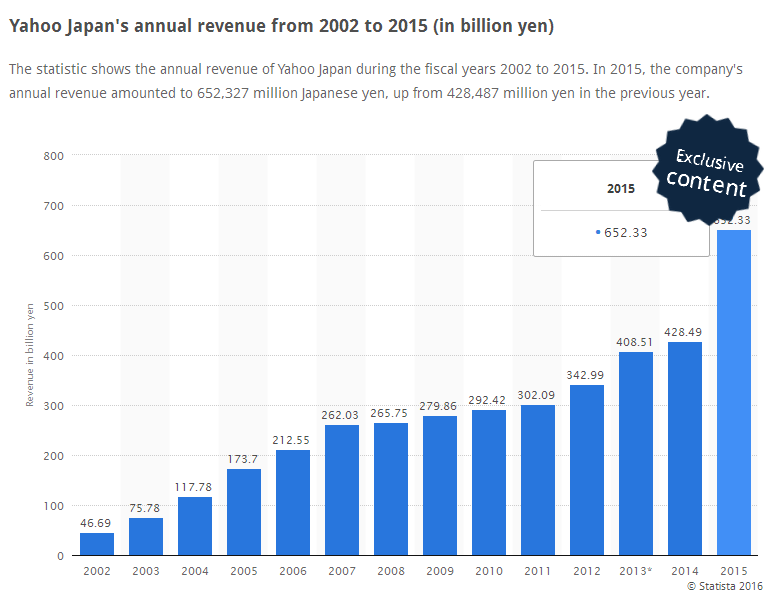

Yahoo also owns 35.5% of Yahoo Japan and it is worth around $8.5 billion. Unlike its American sister company, Yahoo Japan has managed to build a strong internet empire in Japan. Yahoo Japan managed to keep out Google (GOOG) in the land of the Rising Sun.

The rightful sum-of-parts valuation of Yahoo is therefore $49.69 billion. This is 20% higher than how much the market perceives Yahoo is worth right now.

Yahoo Japan Pays Yahoo 3% of Its Annual Gross Revenue Forever

Due to potential U.S. tax issues, Yahoo is unlikely to unload its stake in Yahoo Japan soon. However, there is the strong possibility that Yahoo Japan, SoftBank (SFTBY) or Alibaba will buy the 35.5% stake of its American sister firm. Selling the Yahoo Japan stake outside America will likely prevent Yahoo from getting a huge U.S. capital gains tax bill.

Yahoo still benefits from Yahoo Japan’s success whether or not it keeps its 35.5%. A deal struck in 1996 requires Yahoo Japan to pay 3% of its annual gross profit to Yahoo. This royalty fee payment runs in perpetuity. Yahoo is getting around $90 million from Yahoo Japan as its 3% share.

In spite of the global dominance of Google, Yahoo Japan consistently grow its annual revenue. Yahoo Japan is also posting positive growth in its operating income.

My point is that even though Yahoo will unload its internet business to Verizon, it still has $90/million year from Yahoo Japan’s internet gross profits. This perpetual royalty payment from Yahoo Japan should be worth more than $2 billion. My valuation of Yahoo is now therefore $51.69 billion.

Consequently, my six-month price target for YHOO is now $51.

Conclusion

My $51 price target for Yahoo is due to its little-discussed stake and perpetual royalty money from Yahoo Japan. However, the recent surge in Alibaba’s stock price (+38.9% in six months) might still have some steam behind it. BABA hitting above $100 is another tailwind for Yahoo.

TipRanks analysts have an average $109 price target for BABA. Alibaba’s surging revenue might help that Yahoo co-owned company reach $109 within six months. A bullish run on BABA is always a good thing for Yahoo. Furthermore, as per TipRanks data, hedge fund managers are increasingly more confident and are buying more YHOO shares.

Small retail investors should always heed what the big boys of investing are doing. Right now, they are amassing YHOO shares.

My Buy rating for Yahoo is also in line with its stock’s highly favorable algorithmic forecasts. As per the machine learning computers of I Know First, Yahoo is a great stock to bet on right now. YHOO’s one-year algorithmic forecast has a very high predictability score of 0.63.

Analysts of Yahoo’s technical indicators and moving averages are also endorsing a Strong Buy recommendation.

Past I Know First Forecast Successes with YHOO

I Know First has been bullish on YHOO in the past, as shown below. In past forecasts, such as the one dated on July 14, 2014, the I Know First algorithm correctly predicted an increase for YHOO in a 1 year time period. The return on YHOO during the course of 1 year had been 9.40%, providing an investors a 2.69% premium over the SP500’s return of 6.71%, during the same period. YHOO had a signal strength of 73.31, and a predictability indicator of 0.45. This forecast was apart of the Tech Stocks package, and the algorithm had predicted 9 out 10 stocks correctly, with an average return of 26.96%.

The forecast is color-coded, where green indicates a bullish signal while red indicates a bearish signal. Brighter greens signify that the algorithm is very bullish as it does at the top of this forecast. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset, while the predictability is the historical correlation between the prediction and the actual market movements. Thus, the signal represents the forecasted strength of the prediction, while the predictability represents the level of confidence.

This forecast for YHOO was sent to current I Know First subscribers on July 14, 2014.