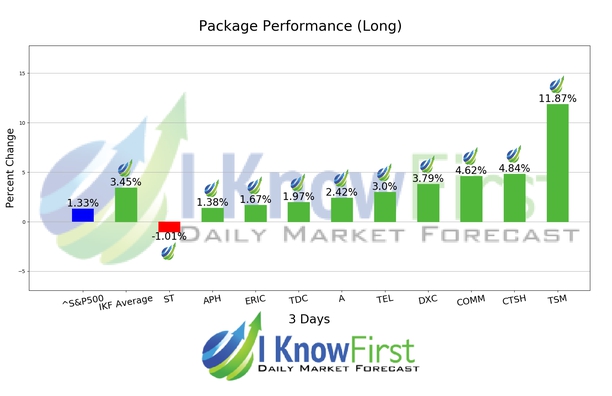

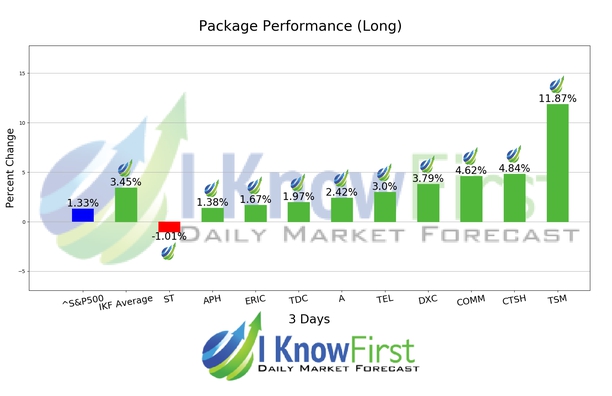

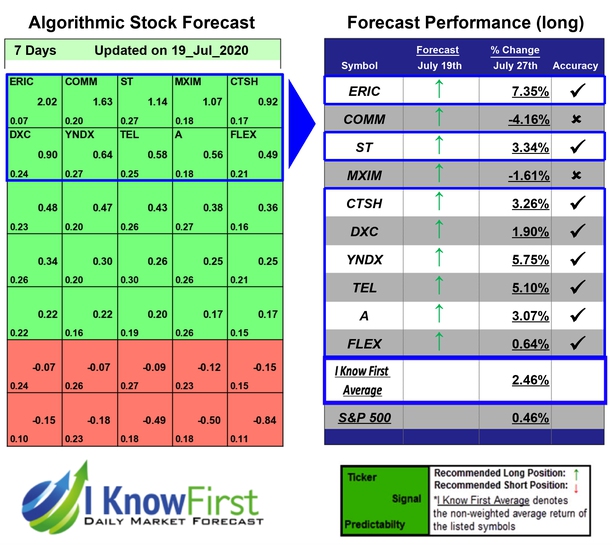

Top Technology Stocks Based on Big Data: Returns up to 11.87% in 3 Days

Package Name: Tech Giants Stocks Forecast

Package Name: Tech Giants Stocks ForecastRecommended Positions: Long

Forecast Length: 3 Days (7/26/2020 - 7/29/2020)

I Know First Average: 3.45%

Read The Full Forecast

Package Name: Tech Giants Stocks Forecast

Package Name: Tech Giants Stocks Forecast

Package Name: Tech Giants Stocks Forecast

Package Name: Tech Giants Stocks Forecast

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First. Read The Full Premium Article

Read The Full Premium Article

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First. Read The Full Premium Article

Read The Full Premium ArticleDisclaimer:

I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor.