Ericsson Stock Assessment: Why LM Ericsson’s Stock Deserves A Price Target of $13.80

The Ericsson stock assessment was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The Ericsson stock assessment was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- Ericsson’s stock has risen more than 25% since my June 8, 2020 buy recommendation. I’m still endorsing it as a buy. This stock has enough momentum energy to fly higher.

- The worsening political saber rattling between China and the U.S. is just near-term drama. Ericsson will continue to prosper as the new top dog in 5G infrastructure deployment.

- The company will also still prosper just in case China decides to ban it as a retaliation against the gathering anti-Huawei sentiment of America and Europe.

- Ericsson does not really need the low-margin 5G deployment business in China. It can just concentrate on international markets.

- The bottom line is that with Huawei ostracized outside of China, Ericsson enjoy a less competitive international market for 5G contracts.

My June 8 buy recommendation for Ericsson (ERIC) is a big winner. The stock has risen from $9.48 to $11.39. It went as high as $11.93. Unfortunately, the worsening political drama between the U.S. and China made some investors nervous. Do not worry, Trump is just using his anti-China posturing to improve his chances of winning his re-election come November. The political propaganda of Trump does not diminish the investment quality of Ericsson. Ericsson is not an American company. Ericsson is Swedish and is therefore not vulnerable to China’s possible retaliation against Trump’s anti-Huawei crusade.

Ericsson’s Healthy Financials

Investors should realize that there’s no real headwind that would prevent ERIC from hitting my 1-year price target of $13.80. The quantitative analysis AI of Seeking Alpha is still very bullish on Ericsson’s stock. ERIC now only has a grade score of B for Value but Seeking Alpha’s AI still rates ERIC as an A- minus under Growth and Momentum factors. Yes, a capital gains of 25% is already a strong excuse to take your profits on Ericsson. However, there’s a strong probability that you can make more net profit if you ride the momentum of ERIC. The chart below clearly states that Ericsson’s stock is a momentum traders’ bet right now.

As per value, ERIC remains very affordable. Compared to Chinese backlash-vulnerable American firms JNPR and ANET, Ericsson’s stock still has lower valuation ratios. ERIC’s forward GAAP P/E of 23.47 is also lower than Nokia’s 53.09. We all know that Ericsson is the stronger bet when it comes to global 5G deployment. As of July this year, Ericsson has won 99 5G contracts while Nokia landed only 79 contracts.

The balance sheet position and cash flow numbers of Ericsson are also more decent than that of Nokia, Arista, and Juniper. We should always prioritize investing on companies with the better balance sheet and stronger cash flow.

Why Political Grandstanding Should Not Intimidate Investors

Trump could not do anything to fix America’s deteriorating COVID-19 pandemic problem. He is antagonizing China on a bet that it could help him win another year four-year term. The xenophobic (or Sinophobia theatrics) machinations of Trump helped him win in 2016. He is again hoping that his anti-China stand will win back his core supporters in America. Political headwinds are impermanent and should not influence our long-term investing decisions.

I repeat, Ericsson is not an American company. China will be stupid if it also starts issuing sanctions against a European company like Ericsson. America’s punitive anti-Huawei moves could only provoke Chinese retaliation against American companies. Communist Chinese politicians would be making a big mistake if it starts banning Ericsson from doing business inside China.

China is already having a hard time dealing with a Trump-led United States. It cannot afford to also antagonize the European Union. Huawei’s ostracization should not lead to China being ostracized by allied countries of the United States and the EU. Most of the world are seething against China’s poor handling of the COVID-19 outbreak. Any further Chinese provocation against countries that stops using Huawei as a 5G supplier could create a highly-infectious pandemic of hatred against China. Instead of Huawei just suffering, China would be risking a catastrophic hit against its entire economy. The economic fortune of China is very reliant on its foreign customers.

Conclusion

I reiterate that the anti-Huawei movement around the world remains a giant tailwind for Ericsson. This tailwind is boosting not only the 5G products of Ericsson but also its data center-related services/hardware. Huawei’s global ostracization will help Ericsson achieve a forward 5-year revenue CARG of 7-15%. The ongoing COVID-19 headwind will eventually evaporate and Ericsson will be reaping the benefits of the 5G revolution and cloud computing trend. Ericsson’s data center business is already benefiting from the pandemic-induced increasing adoption of cloud computing.

My intrepid forecast is that Ericsson will likely end 2020 with annual sales of $27.3 billion, and EPS of $0.6. Using a forward GAAP P/E valuation of 23.5, we can come up with a future stock valuation of $14.1 for Ericsson. This figure is already higher than my 1-year price target of $13.80.

My fearless buy recommendation for ERIC is also thanks to its bullish one-year trend forecast score from I Know First. When the quantitative AI algorithm of Seeking Alpha and the predictive AI of I Know First are both bullish on a stock, every body should go long on it immediately.

I Know First’s Past Success with Ericsson Stock

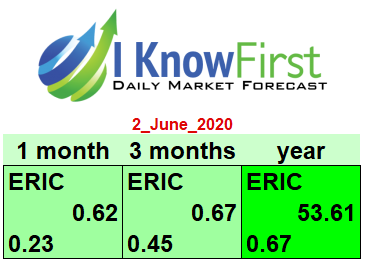

I Know First has been successful with Ericsson stock predictions in the past. On June 8, 2020, the I Know First algorithm issued a 1-month and 3-months bullish Ericsson stock prediction and the algorithm successfully forecasted the movement of the ERIC stock on 1 month and is doing great going forward. So far, ERIC shares rose by 26.11% in line with the I Know First algorithm’s forecast. See chart below.

Here at I Know First, our AI stock forecast technology has modeled and predicted more than 10500 asset price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. We provide stock picking strategies for institutional clients, as well as private investors to identify the best investment opportunities in the market. We have various packages, such as momentum trading, top technology stocks, exchange rate predictions, and AAPL stock forecast. Today, we also provide gold future predictions and commodities prices predictions.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast