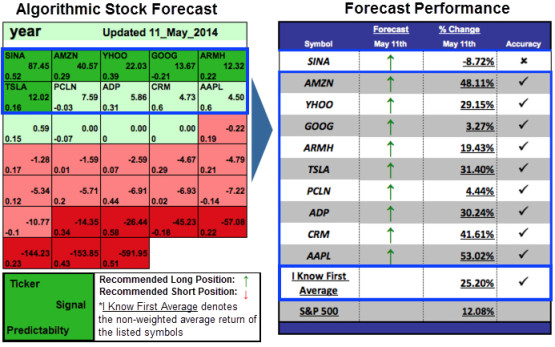

Best Stocks To Invest In: Up To 53.02% Return In 1 Year

Read The Full Forecast

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Stock Market Forecast: This forecast is part of the "Risk-Conscious" package, as one of I Know First's quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

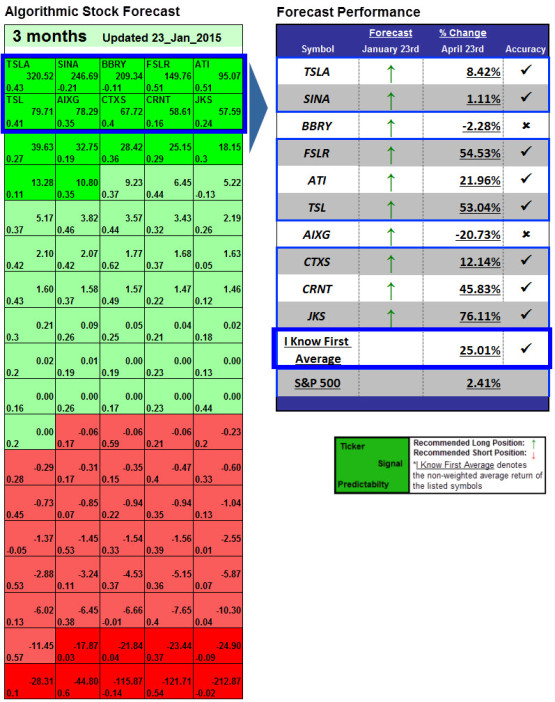

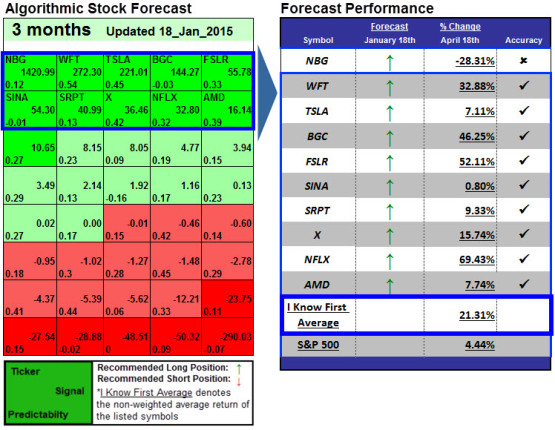

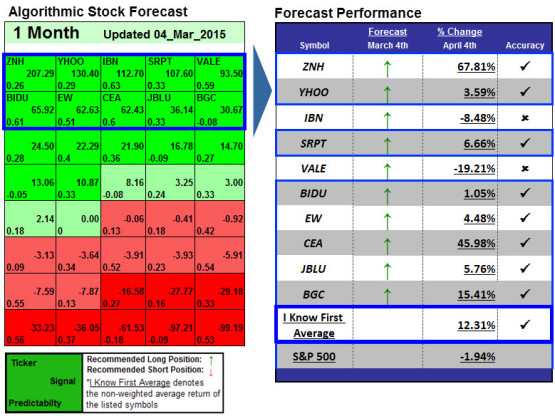

Forecast Length: 1 Month (3/4/2015 - 4/4/2015)

Forecast Length: 1 Month (3/4/2015 - 4/4/2015)

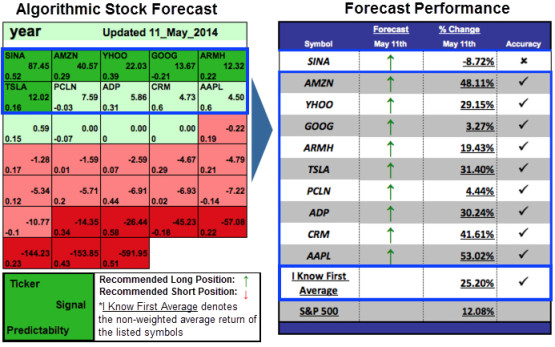

Forecast Length: 3 Month (1/6/2015 - 4/6/2015)

Forecast Length: 3 Month (1/6/2015 - 4/6/2015)

fiscal quarter ending December 27th, 2014, and it blew the doors off of analysts’ expectation. The company sold 74.5 million iPhones during the holiday quarter, which is astonishing when you consider this means it sold 34,000 iPhones every hour over that time. Record revenue from iPhone and Mac sales, as well as a record performance from the Apple App Store, led to the company’s highest ever revenue of close to $75 billion. Even more impressive, the company posted net profits of $18 billion, a record for any publicly traded company. Shares rose about 5% in after hour trading after the positive financial news.

Now that the financial results have been released and pored over by analysts, there is a divergence of opinion on how the stock will perform during the rest of 2015. Nearly a dozen research firms raised their price targets on Apple after the company’s impressive report. But some analysts believe that Apple will face significant challenges in the coming year, citing such arguments as the stock is now too expensive or that slowing smartphone growth, which Apple is overly reliant on, will harm the company’s margins. However, Apple is well positioned for continued growth in 2015 because of its diverse ecosystem of product offerings and its success in China. Furthermore, the company is still currently undervalued, even with its stock price having climbed over 60% since the same time last year.

fiscal quarter ending December 27th, 2014, and it blew the doors off of analysts’ expectation. The company sold 74.5 million iPhones during the holiday quarter, which is astonishing when you consider this means it sold 34,000 iPhones every hour over that time. Record revenue from iPhone and Mac sales, as well as a record performance from the Apple App Store, led to the company’s highest ever revenue of close to $75 billion. Even more impressive, the company posted net profits of $18 billion, a record for any publicly traded company. Shares rose about 5% in after hour trading after the positive financial news.

Now that the financial results have been released and pored over by analysts, there is a divergence of opinion on how the stock will perform during the rest of 2015. Nearly a dozen research firms raised their price targets on Apple after the company’s impressive report. But some analysts believe that Apple will face significant challenges in the coming year, citing such arguments as the stock is now too expensive or that slowing smartphone growth, which Apple is overly reliant on, will harm the company’s margins. However, Apple is well positioned for continued growth in 2015 because of its diverse ecosystem of product offerings and its success in China. Furthermore, the company is still currently undervalued, even with its stock price having climbed over 60% since the same time last year.Disclaimer:

I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor.