KKR Forecast: Leading the Charge on Private Credit

![]() This KKR Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This KKR Stock Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

Highlights

- KKR’s fee-driven model now supports more than $550 billion in fee-paying AUM, enhancing earnings stability

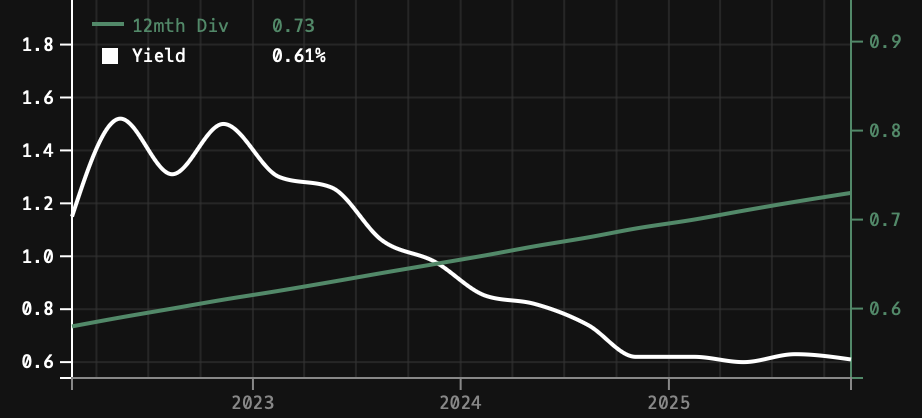

- The 12-month dividend has grown steadily, while yield compression reflects a meaningful increase in the share price

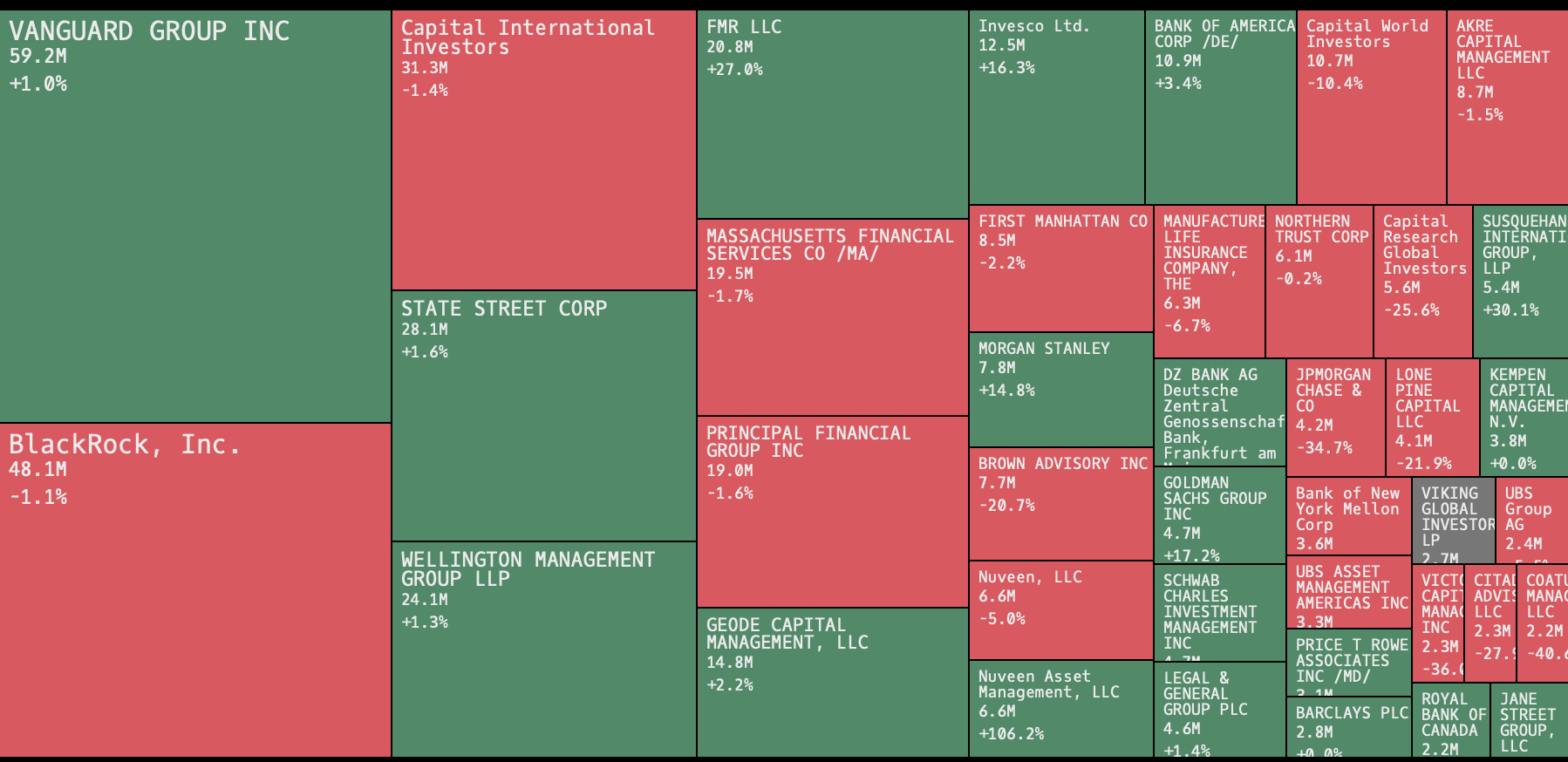

- Institutional investors hold a significant portion of shares, with major asset managers representing a double-digit ownership stake

Company Overview

Founded in 1976 by cousins Henry Kravis and George Roberts, along with their mentor Jerome Kohlberg, KKR emerged as a pioneer of the modern leveraged buyout and gained early prominence through landmark deals such as the takeover of RJR Nabisco. Over time, the firm expanded well beyond its buyout roots, building a global platform spanning private equity, credit, real assets, and infrastructure. Following its merger with listed affiliate Kohlberg Kravis Roberts Financial Holdings LLC, KKR accelerated its growth and shifted toward a more diversified, fee-driven model, becoming one of the most influential players in the alternative investment industry.

Business Segments

KKR’s private equity business remains its most well-known segment, investing across buyouts, growth strategies, and sector-focused opportunities worldwide. This division focuses on transforming and expanding portfolio companies through operational improvements and strategic oversight.

Its credit segment has grown into one of the firm’s largest platforms, encompassing private, leveraged, and liquid credit strategies. These strategies provide financing solutions to companies while generating steady, recurring fee income for KKR.

KKR’s real assets division includes infrastructure and real estate, targeting essential services and income-producing properties across global markets. These long-duration investments offer diversification and resilience through varying economic cycles.

Supporting all major strategies is KKR’s capital markets business, which arranges financing and provides advisory services for both KKR portfolio companies and external clients. This segment enhances the firm’s deal execution capabilities and adds a source of revenue.

Leadership and Management

KKR’s leadership is defined by continuity and long-term alignment, led by co-CEOs Joseph Bae and Scott Nuttall, who have been instrumental in expanding the firm beyond its private-equity roots into a diversified global investment platform. Founders Henry Kravis and George Roberts remain active as executive co-chairmen, providing strategic oversight while allowing the next generation to drive operational growth. The firm’s partnership-driven structure, supported by experienced regional and asset-class leaders, reinforces a culture focused on disciplined investing and sustained expansion. This stable, well-aligned management team has played a central role in KKR’s ability to scale its fee-based businesses, strengthen its global presence, and consistently execute on long-term strategic goals.

KKR Forecast: AUM and Fundraising Trends

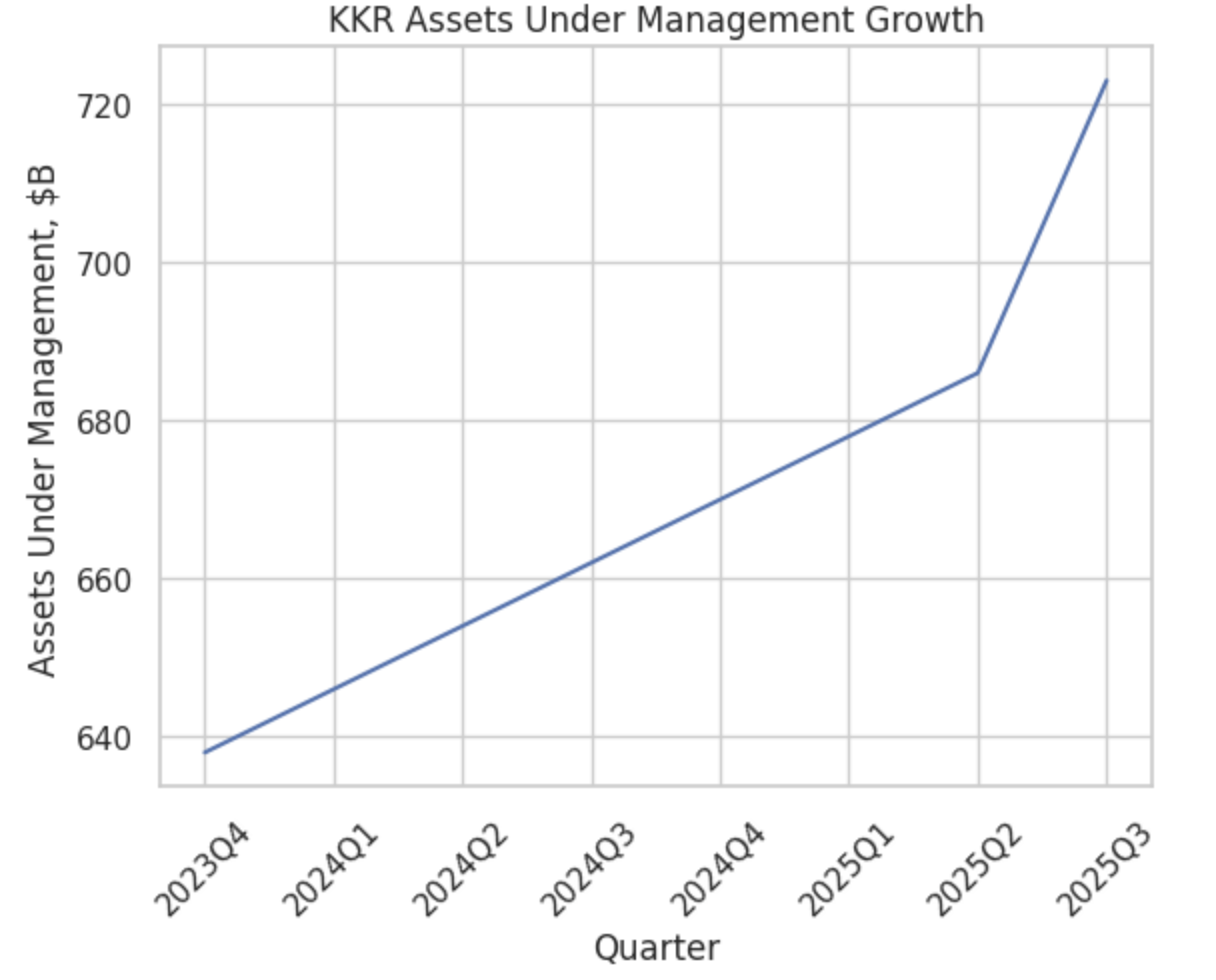

KKR’s steep AUM climb this year reflects a combination of strong fundraising cycles, the rapid expansion of its private-credit platform, and continued investor rotation toward alternative assets in a high-rate environment. Institutions have been directing more capital toward private credit as banks pull back from corporate lending, allowing KKR to capture a particularly large share due to its scale, track record, and growing suite of evergreen and insurance-related products. At the same time, its infrastructure and real-estate strategies have benefited from global demand for long-duration, yield-oriented assets, while the firm’s perpetual-capital vehicles have continued to attract inflows that provide stable, compounding AUM. The combination of these trends has driven KKR’s notable AUM acceleration over the past year.

KKR Forecast: Revenue Breakdown

KKR’s revenue is built on three primary sources, beginning with management fees, which form the most consistent and predictable part of its income. These fees are tied to fee-paying AUM across private equity, credit, and real assets, and they rise as the firm launches new funds, scales existing strategies, and expands its perpetual-capital vehicles.

Performance income, often referred to as carried interest, is the second major component. This revenue is earned when KKR successfully exits investments at gains above predetermined return hurdles. Because it depends on market conditions and the timing of realisations, performance income can fluctuate meaningfully from year to year.

A third pillar is investment income, which comes from KKR deploying its own balance-sheet capital alongside clients. This includes equity gains, interest, dividends, and other returns from the firm’s proprietary holdings.

Fee-related Earnings Growth

Fee-related income at KKR has shown a clear upward trajectory in recent years, driven by strong growth in fee-paying AUM and the firm’s strategic shift toward more durable, recurring revenue sources. As credit, infrastructure, and real estate platforms expand—and as perpetual-capital and insurance-related vehicles grow—KKR is generating a larger share of its earnings from long-term fee streams rather than from cyclical performance income. This trend has been reinforced by robust fundraising, particularly in private credit, where investor demand for yield has surged. As a result, fee-related income has become a steadily increasing portion of total earnings, reducing volatility in the firm’s financial results and providing a more predictable foundation for future growth.

KKR Forecast: EPS Growth

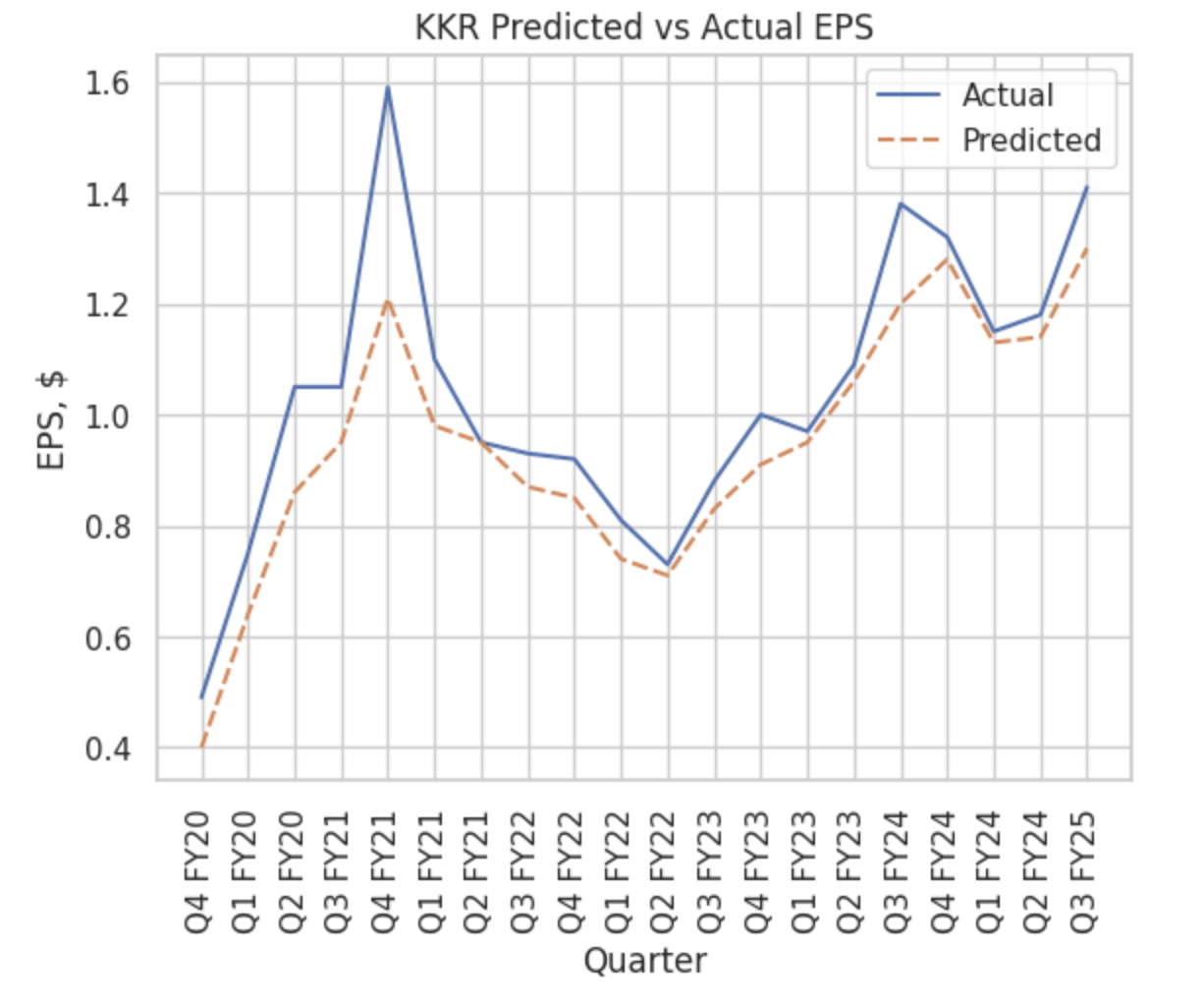

KKR’s earnings per share have shown a clear upward trajectory across recent reporting periods, reflecting both the strength of its underlying fee-related earnings and favourable performance income in key quarters. The company has consistently exceeded analyst estimates, with actual EPS coming in above predictions in nearly every period shown, including notable beats such as Q4 FY21 and Q3 FY24. This pattern highlights improving profitability driven by expanding fee-paying AUM, strong fundraising in private credit and infrastructure, and effective capital deployment. Even in quarters with more modest gains, EPS has generally trended higher year over year, underscoring a business model that is becoming more resilient, more diversified, and increasingly capable of generating steady earnings growth across different market cycles.

Dividend and Capital Allocation

KKR’s dividend pattern illustrates a steadily rising payout over the past few years, supported by the firm’s expanding base of fee-related earnings and the growing stability of its cash flows. Even as the 12-month dividend has climbed, the yield has moved lower, reflecting a share price that has appreciated more quickly than the dividend itself.

This dynamic suggests that investors are assigning a higher valuation to the company’s long-term growth prospects, effectively compressing the yield despite increasing distributions. The trend aligns with KKR’s broader capital-allocation strategy, which prioritises reinvesting in high-return areas such as private credit, infrastructure, and insurance while still delivering measured dividend growth. By balancing rising payouts with disciplined reinvestment, KKR continues to strengthen its financial position and enhance shareholder value without compromising future expansion.

KKR Forecast: Institutional Investors

KKR’s shareholder base is dominated by large institutional investors, reflecting its role as a major global asset manager and a core holding in both index and actively managed portfolios. The largest stakeholders include Vanguard Group and BlackRock, which together own a meaningful portion of the outstanding shares through their index and ETF products. Other significant holders such as State Street, Wellington Management, and Capital International Investors contribute to a broad, diversified base of long-term capital.

Some active managers, including FMR (Fidelity) and Invesco, have notably increased their positions, signalling growing institutional conviction in KKR’s growth outlook. Meanwhile, firms such as Morgan Stanley, Goldman Sachs, Nuveen and others show more dynamic changes in their holdings, highlighting ongoing repositioning among professional investors. Overall, the combination of stable index ownership and selectively expanding active positions points to strong institutional support and reinforces KKR’s status as a widely held, high-quality financial stock.

Macroeconomic Outlook

KKR’s macro outlook is shaped by a mix of supportive long-term trends and near-term uncertainties that influence deal activity, fundraising, and portfolio performance. A gradual easing of interest rates would be broadly positive, lowering financing costs and improving valuations for private equity, real estate, and infrastructure assets. At the same time, the continued pullback of traditional banks from corporate lending is fueling strong demand for private credit, an area where KKR has been aggressively expanding. Structural themes such as global infrastructure investment, reshoring, energy transition, and digitalisation also create long-duration opportunities that align well with the firm’s strategy.

However, slower economic growth, geopolitical tensions, and uneven capital-market conditions may constrain exit activity in certain segments, moderating performance income even as fee-related earnings continue to grow. Overall, the macro environment presents challenges but also significant openings for well-capitalised alternative managers, positioning KKR to benefit from secular shifts toward private markets and long-term investment solutions.

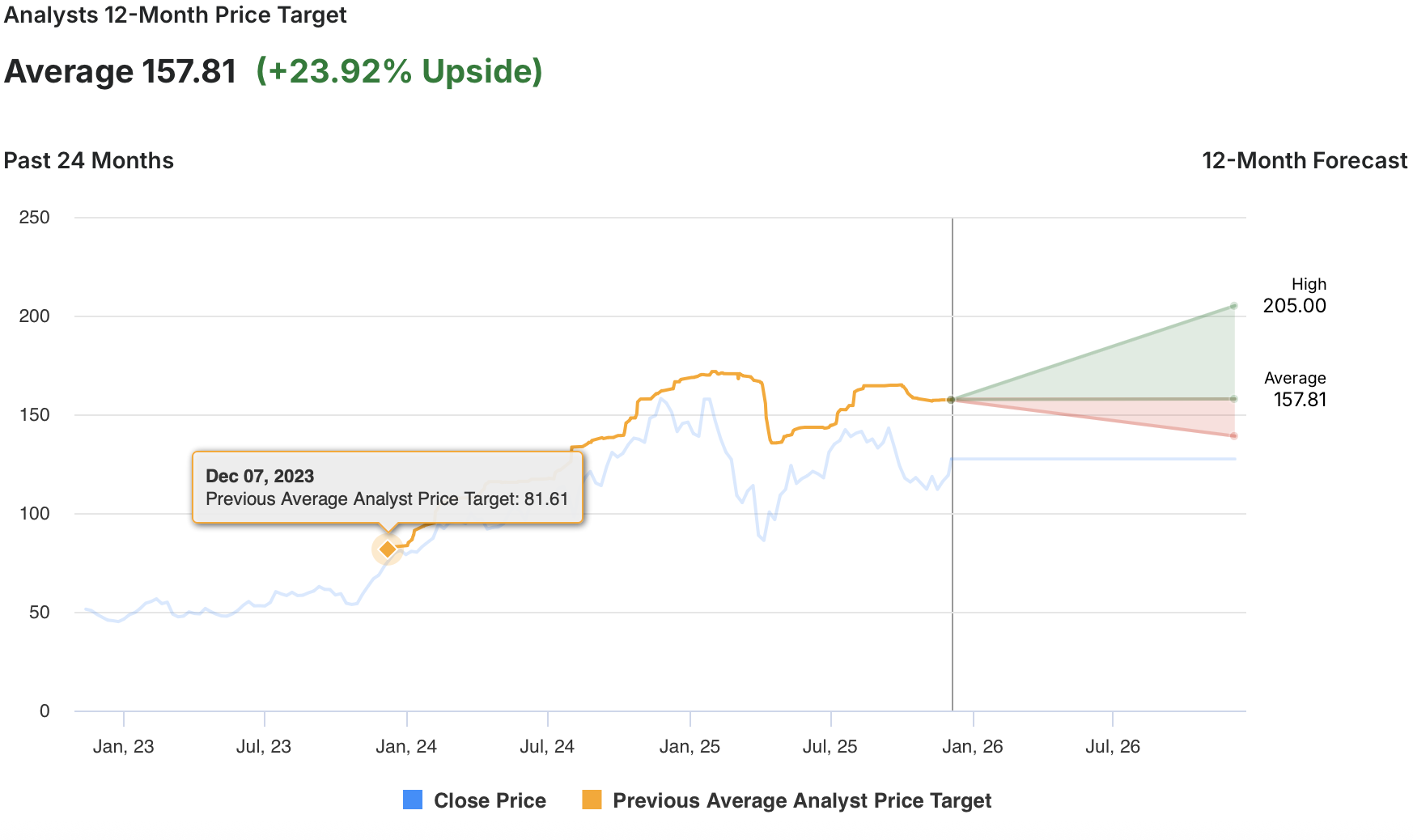

KKR Forecast: Analyst Outlook

Analyst sentiment toward KKR remains strongly positive, with the majority of research firms assigning overweight, outperform, or buy ratings across recent updates. Major institutions such as Barclays, Morgan Stanley, Wells Fargo, and Oppenheimer repeatedly reaffirm optimistic stances, often citing the firm’s expanding fee-related earnings base, strong AUM growth, and exposure to high-demand areas like private credit and infrastructure. Several analysts have also raised their price targets during the year, reflecting both improving fundamentals and confidence in KKR’s long-term growth trajectory.

While a few firms implemented downward revisions or maintained more neutral views, these remain the minority and often focus on valuation stretches after periods of rapid share appreciation. Target prices broadly cluster in a higher range, with many updates showing incremental increases over time. Overall, the analyst community appears aligned in its view that KKR is well-positioned to continue compounding earnings and delivering shareholder value, and this is reflected in the consistently favourable ratings issued throughout the year.

KKR Forecast: Conclusion

A valuation analysis of KKR shows a company that continues to trade at a premium to traditional asset managers but at a discount to some of its closest peers in the alternative-asset space, reflecting both its strong growth profile and the market’s expectations for continued expansion. One key factor influencing KKR’s valuation is the growing share of fee-related earnings, which investors view as more predictable and deserving of a higher multiple than performance income. The firm is also exceptionally positioned to reap the benefits of the rise of private credit, which has been reflected in rapid AUM growth in 2025.

Strong growth predicted for EPS, coupled with steadily growing dividends, makes a stellar investment case for KKR. Hence, I give it a “Buy” rating. A valuation analysis of KKR shows a company that continues to trade at a premium to traditional asset managers but at a discount to some of its closest peers in the alternative-asset space, reflecting both its strong growth profile and the market’s expectations for continued expansion. One key factor influencing KKR’s valuation is the growing share of fee-related earnings, which investors view as more predictable and deserving of a higher multiple than performance income. The firm is also exceptionally positioned to reap the benefits of the rise of private credit, which has been reflected in rapid AUM growth in 2025.

Strong growth predicted for EPS, coupled with steadily growing dividends, makes a stellar investment case for KKR. Hence, I give it a “Buy” rating.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for all forecast horizones.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.