NOW Stock Forecast: AI-Driven Workflow Leadership Supports Sustained Growth

This NOW Stock Forecast article was written by Milana Ledova – Financial Analyst at I Know First.

Highlights

- ServiceNow exhibits sustained growth in its key financial indicators.

- Management has raised its outlook for 2025.

- The Board of Directors approved a 5-for-1 stock split to improve liquidity and accessibility.

Overview

ServiceNow, Inc. is a global cloud software company headquartered in Santa Clara, California. It enables organizations to automate and optimize digital workflows across IT, employee, customer, and creator processes. Founded in 2004, ServiceNow has evolved from an IT service management (ITSM) tool to a comprehensive platform for business transformation. Its “Now Platform” integrates AI, automation, and large-scale workflow orchestration, delivering measurable productivity gains and digital resilience to its customers.

Financial Results

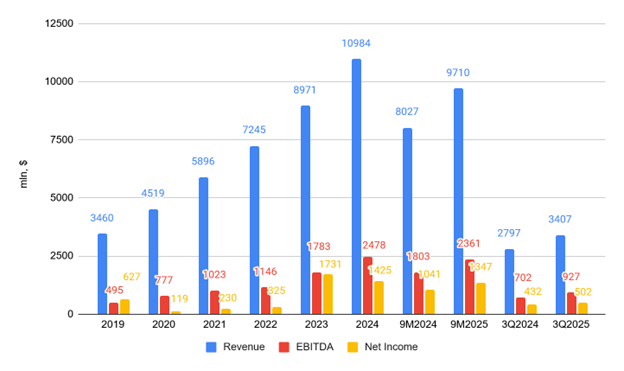

ServiceNow exhibits sustained growth in its key financial indicators. From 2019 to 2024, revenue, EBITDA, and net income all grew consistently, achieving compound annual growth rates (CAGR) of 26%, 38%, and 18%, respectively. Through the first nine months of 2025, this trend continued, with revenue rising by 21%, EBITDA growing by 31%, and net income increasing by 29%.

In the third quarter of 2025 (3Q2025), Revenue, EBITDA, and Net Income increased by 22%, 32%, and 16%, respectively. ServiceNow executed 103 transactions exceeding $1 million in net new Annual Contract Value (ACV) during Q32025. At the end of the quarter, the company boasted 553 customers each contributing over $5 million in ACV, reflecting an 18% year-over-year increase. During the third quarter, ServiceNow launched its new artificial intelligence user interface called AI Experience. This context-aware, multimodal environment consolidates individuals, data, and processes, complemented by robust governance and security mechanisms. Reimagining traditional interfaces, AI Experience serves as an intelligent portal enabling employees to access information, delegate tasks, and collaborate effectively with AI. In September’s Zurich platform update, ServiceNow brought groundbreaking advancements aimed at speeding up multi-agent system development and introducing secure, scalable AI solutions into real-world operations. Among these enhancements were newly developed tools facilitating secure code generation using natural language, reducing barriers to app creation, integrated features like ServiceNow Vault Console and Machine Identity Console ensuring protection of sensitive data and oversight over integrations, and automated workflows driven by agentic playbooks blending AI and human inputs whenever necessary for enhanced control and efficiency.Global Growth and Sector Development.

ServiceNow established a new AI Innovation Hub in Florida, anticipated to generate over 850 jobs and contribute $1.8 billion to the local economy over five years. They partnered with SENAI-SP to introduce an AI training program in Brazil and became the official workflow partner for the Bundesliga, improving both operational efficiency and fan engagement. Their partnerships encompass collaborating with GSA for governmental AI-first modernization efforts, broadening cooperation with NVIDIA through the Apriel 2.0 AI model, integration with NVIDIA AI Factory, teamwork with FedEx Dataworks on AI-driven supply chains, investments in Zaelab for CRM and AI-supported solutions, and acquisition of a stake in Genesys.

ServiceNow was recognized as a Leader across multiple Gartner® Magic Quadrant™ reports, including in the inaugural 2025 Gartner Magic Quadrant for Business Orchestration and Automation Technologies, the 2025 Gartner Magic Quadrant for AI Applications in IT Service Management, the 2025 Gartner Magic Quadrant for the CRM Customer Engagement Center and a six‑time Leader in the 2025 Gartner Magic Quadrant for Enterprise Low‑Code Application platforms.

NOW Stock Forecast: Guidence Outlook

Company management has revised upward its outlook for fiscal year 2025. Management now anticipates that total revenues will range between $12.835 billion and $12.845 billion, representing a 20.5% year-over-year increase, or 20% on a constant-currency basis. Additionally, management has adjusted the following targets:

- Full-year operating margin goal has been raised by 50 basis points, from 30.5% to 31%, thanks to ongoing operational efficiencies driven by AI technologies.

- Full-year free cash flow margin projection has been increased by 200 basis points, reaching a range of 32%-34%.

- Continues to project a subscription gross margin of 83.5% and expects GAAP-diluted weighted average outstanding shares to remain steady at 210 million.

ServiceNow’s Board of Directors approved a five‑for‑one split of the Company’s common stock. The stock split is subject to shareholder approval, which the Company will seek at a Special Meeting of Shareholders scheduled to take place on December 5, 2025.

NOW Stock Forecast: How NOW Stacks Up Against Peers

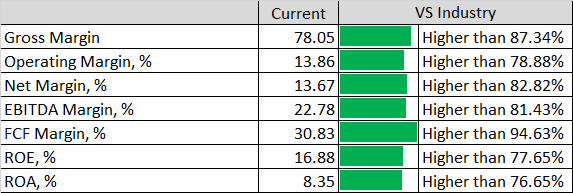

According to GuruFocus, NOW demonstrates good performance in the Software industry. The company demonstrates strong performance with a EBITDA margin of 22.78%, FCF margin of 56.7% and a Return on Equity (ROE) of 16.88%, exceeding the performance of 81.43%, 94.63% and 77.65% of companies in the industry, respectively. NOW’s profitability margins also look impressive across the industry.

(Figure 2: NOW vs Software in TTM on November 6th, 2025)

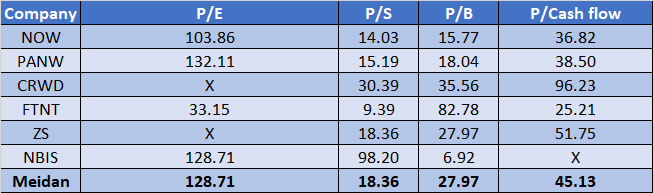

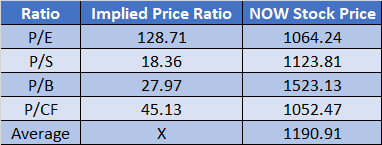

Let’s examine the next comparable companies: PANW, CRWD, FTNT, ZS, and NBIS. The price-to-earning (P/E), price-to-sales (P/S), price-to-book (P/B), and the price-to-cash flow (P/CF) ratios of 103.86, 14.03, 15.77 and 36.82 are lower than the median and average figures as of November 6, 2025.

Based on the information above, NOW’s target price is $1190.91. Currently, NOW stock trades at $858.77 on 6 November, 2025, that generates upside of 39%.

NOW Stock Forecast: Viewpoints from Analyst Community

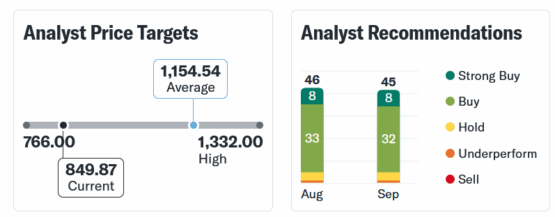

Based on data sourced from Yahoo Finance, the overwhelming majority of analysts rated the stock as Buy and the average price target is $1154.54.

NOW Stock Forecast: Conclusion

ServiceNow is at the forefront of AI-based enterprise workflow automation. Its third quarter 2025 results show strong revenue growth, increased margins, and solid visibility into its order backlog. The company continues to evolve from a simple ITSM platform to a comprehensive AI-based operating system for business transformation. Although the stock’s valuation remains demanding, the combination of recurring revenue, margin scalability, and technological leadership offers an attractive long-term investment thesis. For investors with a 12- to 18-month horizon and a tolerance for growth volatility, ServiceNow offers compelling risk-adjusted upside potential.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the NOW stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.