Can Fidelity Trading Find Use From Genetic Algorithms?

This trading platform analysis article was written by Michael Shpits, a Financial Analyst at I Know First.

Summary:

- Fidelity trading platforms like Active Trader Pro are the largest and arguably the best trading platforms in the United States.

- The I Know First predictive algorithm can provide empirically driven forecasts to Fidelity traders to better augment their trading ability.

- Algorithmic forecasts have a proven track record of accuracy and can help Fidelity even in into the speculative future.

Company Overview

Established in Boston in 1946 as a mutual fund company, Fidelity Investments is a privately-owned investment management company that offers a wide range of financial services from fund distribution and wealth management to investment advice, retirement services, life insurance, and securities transaction (execution and clearance). Fidelity employs more than 40,000 associates across 12 regional offices and 190 investor centers in the United States. With over 32 million individual investors, over $7.3 trillion in total customer assets, and over $2.4 trillion in global assets under management, Fidelity is a financial behemoth. It comes as no surprise that Fidelity trading platforms are a cut above the rest in functionality and execution.

Rated the best online broker by Investopedia, Fidelity offers a trading solution to the majority of individual investors. The average stock trader is provided with a plethora of tools, resources, and analytical research instruments on their platform for no extra cost. In fact, the platform sports no account minimum and no commission fees for trading stock or ETFs, with only a competitive $0.65 fee per option contract.

Active Trader Pro

For more active traders, Fidelity offers their intuitive program, Active Trader Pro. This downloadable platform provided real-time data streaming and a fully customizable interface to suit each investor’s individual preferences and trading strategy. Despite not offering commodities or futures options, the platform is known for its immediate trade executions and flexible news feed options. In fact, their refined trade execution algorithm has made it so that 96% of orders on Fidelity are executed at a price that is better than the national best bid or offer.

With an increase in stock trading as a result of the recent pandemic, platforms like eToro have seen a surge in user count. It is safe to assume that Fidelity is no exception, being the main stock broker for U.S. investors. These fresh entrants to the field could be easily overwhelmed with the myriad of resources at their disposal, one of which is missing is a purely empirical algorithmic prediction of assets without any human judgment involved. The I Know First algorithm can bridge this gap and provide both rookie and senior traders with a powerful tool to augment their own research with and execute trades more efficiently.

How Does the I Know First Algorithm Work?

Built on elements of artificial neural networks and genetic algorithms, the I Know First predictive forecast system incorporates artificial intelligence and machine learning in its analysis of stock markets.

Outputting a predicted trend whether positive or negative, the algorithmic forecast is derived from purely empirical data, avoiding any pitfalls which may arise due to human error. Human input is present only in the initial mathematical framework and input of parameters. Otherwise, the algorithm is continuously updating through a process of bootstrapping, learning from its errors and validating its successes with each successive model application. This process allows for the algorithm to predict the stock market, which by itself is a combination of a complex chaotic system and a random component.

In the end, users receive a forecast based on the best asset choices derived from positive or negative signals predicting price movement, and a predictability value to gauge historical accuracy.

Source: I Know First Article

Can the Algorithm Consistently Help Fidelity Traders?

Sometimes the best way to prove something’s effectiveness is to give direct example of its ability. Being a general-purpose broker, Fidelity offers advanced trading tools and ability on everything from domestic U.S. stocks to international stocks and currency exchange. Let’s use these sectors as benchmarks by which to gauge the algorithm’s predictive effectiveness.

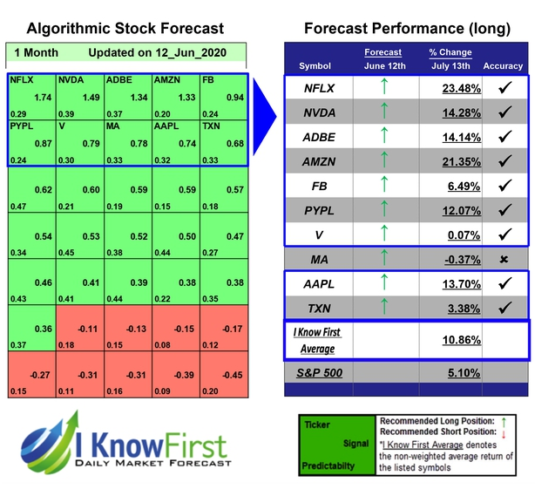

Looking at domestic U.S. stocks, we can look at the recent algorithmic performance based on the S&P 100 stock package which tracks the S&P 100, a subset of the usually more establish and prominent firms of the S&P 500.

Based on this July 12 forecast, we can see that 9 out of 10 assets were correctly predicted by the algorithm in a single month time frame. With Netflix (NFLX) top performing at a 23.48% return, the forecast average was 10.86%, outperforming the S&P 500 benchmark index by a matter of two times.

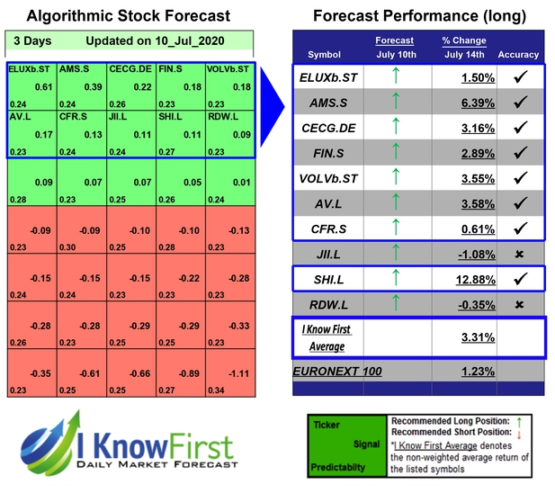

Looking at international stocks, we can look at the recent algorithmic performance based on the European stock package, which tracks a variety of the top European stock choices.

Based on this July 10 forecast, we can see that 8 out of 10 assets were correctly predicted by the algorithm in a three-day time frame. With SHI.L top performing at a 12.88% return, the forecast average was 3.31%, outperforming the EURONEXT 100 benchmark index by nearly three times.

Lastly, we can look at the recent algorithmic performance based on the currency forecast package, which tracks a variety of currency pairs.

Based on this July 12 forecast, we can see that the total hit ratio for the algorithm was 71.15%, with the algorithm correctly forecasting most of the currency pairs during a single month time frame.

Given these three examples out of many similar forecasts for specific asset packages, it can be concluded that the algorithm provides a consistent and insightful analysis of asset markets. With such an intuitive trading platform as that of Fidelity, known for its research and advanced tools, it would be a retreat from their analytical tradition and a mistake to avoid I Know First algorithmic forecasts. By providing another layer of analysis to an already strong analytical platform, the algorithm can help traders more accurately assess their own research and refine their asset choices with precision.

Can the Algorithm Provide for Fidelity’s Future?

Publishing a report in June on institutional investment in both the Bitcoin and larger cryptocurrency industry, Fidelity has in recent times acquired 10.6% of Hut 8’s outstanding shares. Hut 8 is a Bitcoin mining company, whose Fidelity investment raises interest in the asset management giant’s push for institutional adopting of cryptocurrency utility. According to a study by Fidelity Digital Assets, Fidelity Investments’ digital asset firm, there are positive trends which point to further institutional adoption of crypto-related industries. So what if out of pure speculation, Fidelity begins offering cryptocurrency trading in the near future? Well, the I Know First algorithm has that covered also.

According to this March 29 forecast, the price direction of Bitcoin and its U.S. Dollar and Euro pairs was correctly predicted by the algorithm in a three-month time frame. This ability to predict any asset class with consistent accuracy is why the I Know First algorithm can provide great value to not only Fidelity, but its user base as well.

Here at I Know First, our algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing not only Bitcoin forecasts, but also daily predictions for more than 10,500 assets, including forex forecast, gold price forecast, world indices, and individual stocks. Additionally, we provide special coverage for the latest Apple stock news. Our forecasts generated by our algorithmic trading tool are used by institutional clients, as well as private investors and traders to identify the top stocks to buy in the market and exercise the trade faster than the other market players.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.