Stock Picking by AI Empowers Better Investments for eToro Users

This AI stock picking article is written by Hao Liu, Financial Analyst at I Know First.

This AI stock picking article is written by Hao Liu, Financial Analyst at I Know First.

Summary

- eToro benefits from the rise in online trading as a consequence of COVID-19.

- I Know First AI Algorithm has successfully forecast the most highly traded assets in eToro.

- AI forecasts helps alleviate copytrading risks and provides second opinion on stock picking to eToro investors.

- I Know First provides different solutions to different clients, including more customized forecasts to ace eToro traders and clients with their own assets selection.

Company Overview

Founded in 2007, eToro is a social trading and multi-asset brokerage platform that provide financial services with a focus on copy trading. With registered offices in Cyprus, Israel, the United Kingdom, the United States, and Australia, eToro provides global services that offers a wide variety of asset classes to trade via CFDs (Contracts For Difference), including stock indices, company shares, commodities, forex, ETFs, currency pairs and cryptocurrencies. As CFD is forbidden in the US, eToro’s US services are focusing on cryptocurrency trading.

The vision of the eToro is to open up the global markets so that everyone can invest in a simple and transparent way. Since the establishment of the company until now, eToro has been making constant efforts to realize this vision. Over the years, eToro has launched many features, amongst which “CopyPortfolio” is the most iconic. This feature enables investors to copy investment portfolios from the best-performing traders automatically. Investors can invest in two main types of CopyPortfolios: Top Trader Portfolios which comprise the best performing and most sustainable traders on eToro, Market Portfolios that bundle together CFD stocks, commodities, or ETFs under one chosen market strategy.

Especially after COVID-19 boosts online trading this year, eToro also benefits greatly with a 427% user surgein the first four months of 2020. As eToro investors profit from copying the moves of trading veterans, they are also exposed to great risks of copytrading (discussed later in the article). I Know First can help eToro investors alleviate the risks by providing AI forecast. With abundant past success in market predictions, I Know First can help eToro investors make more informed investment decisions in stock picking to achieve better returns.

How I Know First Stock Forecast System Works in Stock Picking

The picture above illustrates how I Know First Stock Forecast Algorithm works. Based on the daily stocks data including relationships between different financial assets and the latest market information, the algorithm uses AI and Machine Learning to generate stock predictions for different time horizons. The database used is 100% historical data free from human derived assumptions, and the prediction generation process is constantly evolving with newly added data. The I Know First System models the future money flow between markets by learning from its previous forecasts and is continuously adapting to changing market situations. This self-learning feature makes it particularly valuable for an unpredictable time like COVID-19. To sum up, by using this system, I Know First predictions are neutral, up-to-date, and are particularly useful during uncertain times.

Why eToro Investors Should Consider Using I Know First AI Predictions for Stock Picking

Generally speaking, I Know First predictions help alleviate the risk of copytrading and provide stock picking solutions to eToro users. Different solutions can be provided to different users. Stocks/assets/packages forecast by AI is a basic service that offers second opinion to users. For more experienced investors/traders, more customized services are also provided for them to create better portfolios and improve their performance. Entirely customized forecast is also available as required by clients based on their stocks/assets selection. More details will be explained below.

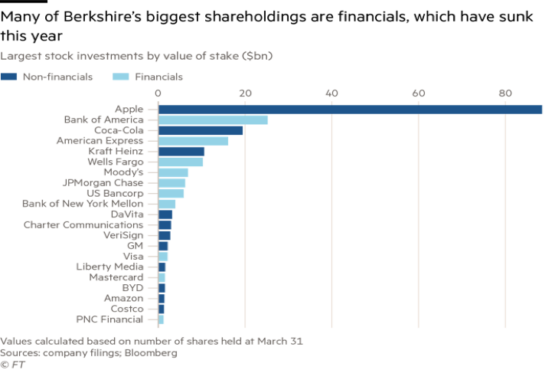

Firstly, copytrading has its risks. On the one hand, the copied stock portfolio itself may not perform well. The Berkshire Hathaway’s stock promoted on eToro’s front page has actually been underperforming the market for over a decade. Particularly in this pandemic, the high on financials and light on tech feature of Berkshire’s portfolio (see chart below) just made the situation worse.

On the other hand, blindly copying the portfolio without doing your own research can easily lead to losses. This is true especially for inexperienced retail investors, which are a large constituent of the eToro users. There are multiple reasons why blindly copying ace investor’s portfolio is risky: you and the ace have different risk-taking ability; there is time lag as investor’s holdings are disclosed months after the trading happens; the aces trading information may not be fully disclosed; there could be bias resulting from fake news; you and those ace traders are likely to have different investment motives, and so on.

Without understanding these differences, eToro’s copytrading can be very risky as eToro only collects the investment amount and preferred trading strategy to generate a copyportfolio (as shown in the screenshot above).

Secondly, I assume many investors who choose to copy portfolio may already be aware of the risk of copytrading discussed above, but copytrading at eToro platform has some further risks. On the one hand, as stated in eToro’s disclaimer, eToro may not replicate the exact composition or performance of the benchmark portfolio, which is subject to the instrument availability on eToro platform. On the other hand, as is also stated in the disclaimer, rebalancing of the portfolio composition is done by eToro based on publicly available data and may be delayed. By the time the portfolio file is disclosed, the copied portfolio is unlikely to trade at a similar price as the copied investor, and new balancing may have already been done. Let alone some investors such as Warren Buffett have SEC’s permission to not fully disclose some holdings in their portfolios before completed. I Know First AI provides real time forecast to seize the best market opportunities before all information become public.

Thirdly, I Know First forecasts on a variety of assets, including those traded on eToro. But instead of simply collecting your investment amount and preferred trading strategy, I Know First gives you more choices to customize your portfolio based on your capital size (I Know First offers small cap and mega cap stocks package) and risk preference (I Know First has both aggressive and conservative stock forecast package). I Know First also provides forecast on indices and ETFs, which are traded on eToro as well. Apart from this, I Know First can offer custom forecasts to the ace traders who create portfolios based on their portfolio composition, so that they can improve their holdings and allocations with an alternative opinion from AI. Additionally, I Know First can even provide totally customized forecast based on clients’ selection of stocks/assets, which is a service more suitable for advanced and mature investors/active traders.

Last but not the least, instead of automatically copying the trading moves of more experienced investors, I Know First premium articles keep you informed about the fundamentals of the companies you invested in and help you understand why it’s a good investment as well as embedded risks.

I Know First Past Forecast Success in eToro’s Popular Assets

While eToro uses machine learning to realize automatic copy-trading for its investors, I Know First uses AI to forecast on the market, including the most highly traded assets in eToro.

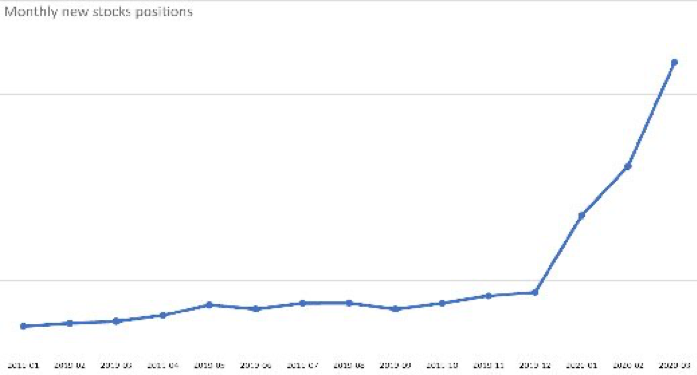

Stock market

After eToro’s announced its ownership of underlying assets and zero-commission trading, investors have begun putting more emphasis on stock investments on eToro. The number of stock trades on eToro grew six-fold throughout 2019 and 2020 Q1. As of 2020 Q1, stocks account for nearly a third of all trades carried out on eToro, which have interestingly grown from previous quarters despite the effect of COVID-19 (see chart above).

The chart above shows the top 10 popular stocks since these offerings started. Leading the list is the well-known electric carmaker Tesla (NASDAQ: TSLA), which between 2019-2020 became the most valuable automotive company in US history. The main reason Tesla stock is so popular on eToro is its high volatility over recent years. The controversial while renowned leader of this company, Elon Musk, has contributed a lot to the volatility of TSLA stock. Another reason is the positioning of this company – it is in the traditional auto industry but at the same time in the innovative high-tech industry. This makes TSLA an extremely attractive stock in today’s market.

Likewise, TSLA is also an attractive stock in I Know First investors portfolio. Over recent years, I Know First has made several successful forecasts on the stock, despite its high volatility. For example, on 21 Apr, 2020, I Know First made a 30-day forecast on TSLA stock with a 2.07 bullish signal and 0.19 predictability. One month later, TSLA rose by 10.88% in line with the forecast (see charts below).

However, TSLA is not the only tech stock on this popular list. Just as FAANG stocks become increasingly popular amongst inventors ever since the pandemic, the situation on eToro is not vastly different. As is no surprise, the tech giants AAPL, AMZN, GOOGL, MSFT, FB, as well as NFLX, are on the list.

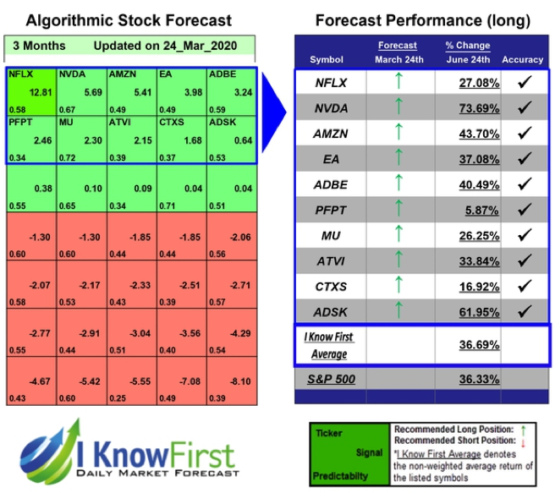

All along I Know First has had a Tech Stock Forecast Package together with a Best AI Stocks Package observing the whole tech industry. As the tech giants dominate the industry over recent years, I Know First has created a particular package particularly looking at the tech giants. As can be seen from the forecast results table below, all top recommended stocks in the package are accurately forecasted. In this March 24th forecast, NFLX and AMZN are also in line with the popular tech stocks on eToro.

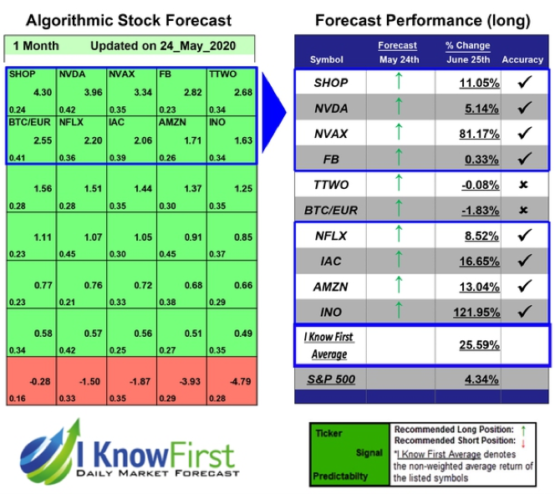

Since the pandemic, I Know First also put forward a Coronavirus Stock Market Forecast Package for investors to seize the opportunities in the volatile market during this strange time. In our most recent forecast on 24 May, 2020 (see chart below), I Know First successfully predicted returns up to 121.95% in one month. Additionally, FB, NFLX and AMZN in the top forecast also appear on eToro’s highly traded stock list.

Crypto market

However, the stock market is not the only place that drew investors’ attention this year. Since the beginning of this year, the price of Bitcoin has been recovering (see chart above), which signals the end of “crypto winter”. With a 31% price surge in January, Bitcoin showed a strong momentum for further price growth. This momentum successfully aroused investors interest back to the crypto market again.

This momentum of Bitcoin actually retains into the following quarter, marking Bitcoin one of the top performing assets in 2020 (see chart above). Deutsche Bank also expressed its optimistic attitude towards the crypto market in a report published this year, “Cryptocurrencies have numerous advantages compared to traditional assets, which could lead more and more people to use them”.

In this environment, eToro reveals in its most recent quarterly report (2020 Q1) that crypto trading is gaining more popularity on its platform than ever. As shown in the chart above from eToro’s report, the volatility of Bitcoin skyrocketed on March 12 to about three times that of S&P 500.

During the recovery of crypto market, I Know First has been keeping up with the volatile performance as well. I Know First provides a Bitcoin package designed for investors and analysts who need Bitcoin forecast predictions of the best cryptocurrencies to buy. The package includes 2 predictions on BTC/EUR and USD/BTC with bullish and bearish signals in the given time horizon for the cryptocurrencies. For instance, in a recent 3-month forecast on 17 March, 2020, I Know First achieved 100% hit ratio by successfully predicted BTC/EUR with a return of 90.2%, and USD/BTC of 47.67% (see chart below).

Conclusion

As online trading become increasingly popular since the pandemic, social investing company such as eToro has gained much more users. eToro’s users can create a portfolio based on their investment amount and trading strategy, and then use eToro’s iconic “copytrading” feature to automatically copy the trading moves of more experienced traders. This feature is intelligent and convenient, but it also exposes retail investors to great risks. I Know First has achieved great success in forecasting on the markets eToro investors trade on, including stock indices, commodities, gold, forex, ETFs, cryptocurrencies, etc. By referring to I Know First AI forecast, eToro investors can alleviate risks of copytrading and take alternative stock picking opinions. For ace investors/traders on eToro, they can benefit from customized I Know First AI forecasts to improve their stock picking process and total returns. Completely customized forecasts are also provided based on client’s own selection of stocks/assets.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.