ATVI Stock Prediction: Why Activision Blizzard Has So Much Potential In Mobile Games

This ATVI stock prediction article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This ATVI stock prediction article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

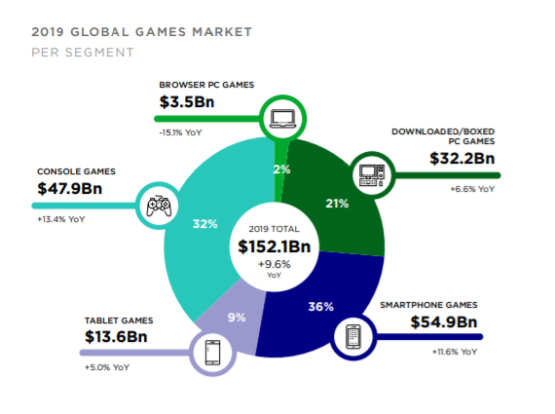

- The success of Call of Duty: Mobile on Android and iOS convinced me that Activision Blizzard will remain of the biggest beneficiaries of the $152 billion/year video games industry.

- Tablet and smartphone games now account for more than 44% of the annual sales from video games. The smartphone is now the key growth driver for video games.

- Activision Blizzard will launch the Switch version of its hit PC game Overwatch on October 15. I expect Overwatch to also launch on Android/iOS by next year.

- A stronger focus on the mobile platform can significantly boost Activision’s annual revenue and net income.

Activision Blizzard’s recent rally is attributed to the big debut of Call of Duty: Mobile. Launched only five days ago, Call of Duty: Mobile, has achieved more than 35 million downloads. This mobile game also earned an estimated $2 million after it breached 20 million downloads three days ago. My own forecast is that Call of Duty: Mobile will post 100 million downloads within one month of its release. I guesstimate that it can also achieve $30 million sales from in-app purchases during its first month.

Call of Duty is developed and published by Tencent (TCEHY) and its subsidiaries. Going forward, I still expect this new mobile game to contribute $10 to $20 million per month to Activision’s topline (via revenue sharing with Tencent). As the intellectual property owner of the Call of Duty brand, Activision likely extracted the best revenue sharing deal it could get from Tencent.

Why It Matters

Expert reviews called Call of Duty: Mobile a true contender to Tencent’s PUBG Mobile. Inclusive of the Chinese version, Game for Peace, PUBG Mobile is the world’s top-grossing mobile game, with monthly sales of $160 million. I think the iconic brand of Call of Duty will help the mobile version reach sales of $60 million/month. Tencent also gave Call of Duty: Mobile a 100-player Battle Royale mode. This makes its similar to the Battle Royale design of PUBG Mobile and Fortnite Mobile.

A 50-50 revenue sharing deal with Tencent can give Activision Blizzard $30 million/month in new revenue. This translates to a probable $360 million/year for Activision. Activision Blizzard’s 2018 revenue was only $7.5 billion. Activision did not spend a dime developing/marketing Call of Duty: Mobile. My $360 million guesstimate could reasonably be computed as pure net income.

Activision’s 2018 annual net income was $1.813 billion. Call of Duty: Mobile therefore has the potential to add 20% more to Activision’s annual net profit. A 20% rise in annual net income could likely translate to 10% to 15% higher price for ATVI. My 90-day price target for ATVI therefore is $62. This price target is higher than the average 12-month price target of $59.13 from TipRanks.

You should invest on ATVI and hold it for a long time. My fearless assessment is that Activision Blizzard will remain one of the biggest beneficiaries of the $152.1 billion/year video games industry. If you think ATVI has high valuation ratios now, wait until 2022. My prediction is that the instant success of Call of Duty: Mobile will compel Activision to release or license mobile versions of its deep library of PC/console games.

Mobile gaming devices like the Switch, tablets, and smartphones are the future of video games. Activision’s profitability could vastly improve now it is expanding more to Android/iOS devices. Inclusive of portable console gaming devices like the Nintendo (NTDOY) Switch, I expect mobile games to hit $71 billion in global sales this year.

Activision’s bottom line can improve now that it is getting more serious on mobile games. Most mobile games are free-to-play. They rely on in-app purchases to monetize. Unlike PC and console games, free-to-play Android/iOS games are immune to piracy.

Activision Blizzard will release the Nintendo Switch version of Overwatch on October 15. It makes perfect sense to assume that the Android/iOS versions will also get released pretty soon. My takeaway is that hit mobile games can help ATVI regain the lost value it suffered since a year ago. ATVI’s stock price is still -31% down from its price a year ago.

Why I’m Super Bullish On Activision Blizzard

My high optimism over ATVI is mainly due to its growth potential on mobile games. Activision already owns King Digital, the developer/publisher of the multi-billion-dollar Candy Crush mobile games franchise. Activision developing or licensing its library of PC/console games for Android/iOS devices can lead to $4 billion in annual revenue from mobile gamers.

King Digital is now contributing $2.08 billion to Activision’s annual sales. My fearless forecast is that the immediate success of Call of Duty: Mobile will inspire Activision to release Android/iOS versions of its legendary PC game franchises like Diablo, World of Warcraft, Overwatch, and StarCraft. I expect NetEase to release the Android/iOS versions of Diablo Immortal in China before 2019 ends.

Conclusion

A big push on mobile games can help Activision Blizzard reverse its recent negative annual revenue growth performance. Smartphones and tablets keep getting more powerful processors, graphics accelerators, and RAM. These mobile gadgets are therefore the obvious king of video games. ATVI is a buy because Activision is now being pro-active and willing to port mobile versions of its hit PC/console games.

I reiterate my $4 billion/year revenue from mobile games for Activision going forward. Activision is no longer solely relying on King’s Candy Crush Saga gold mine to enrich itself on mobile games. Overwatch and Call of Duty: Mobile are only the first salvo of Activision’s campaign on the mobile platform.

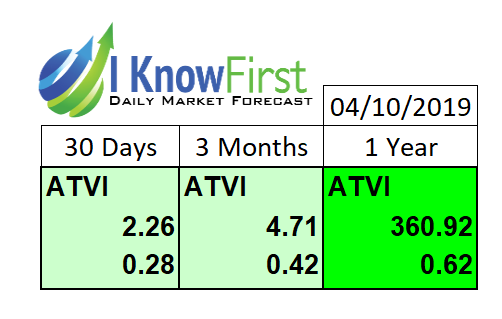

My buy recommendation is supported by ATVI’s super-bullish one-year algorithmic market trend forecast score. I Know First’s stock-picking Artificial Intelligence algorithm gave ATVI a score of 360.92. The bullish signal threshold score is only 100. Like me, I Know First is also super bullish on ATVI.

How to interpret this diagram.

Past Success With ATVI Stock Prediction

I Know First has been bullish on ATVI’s shares in past forecasts. On February 26, 2019, the I Know First algorithm issued a bullish prediction for ATVI stock. The algorithm successfully forecasted the movement of the Activision’s shares. Until today, ATVI’s shares have risen by 32.13% in line with the I Know First algorithm’s forecast. See chart below.

This bullish ATVI stock prediction was sent to the current I Know First subscribers on February 26, 2019.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.