URI Stock Forecast: Set Up for $360 in 2022 with Opportunities in the Rental Industry

This URI stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This URI stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlights:

- United Rentals Inc. is equipped with growing opportunities, going along with the overall promising outlook of the Equipment Rental Industry

- URI’s ratios show a solid financial performance comparing with its rivals

- Despite price volatility, URI is still considered as a “Strong Buy” stock in the long run, and my target price for URI in 2022 is $360

Overview of United Rentals

United Rentals Inc. is the world’s largest industrial equipment rental company in the world, operating in two main segments: General Rentals, and Trench, Power, and Fluid Solutions. It has highly diversified rental services including general construction, specialty construction, and industrial equipment solutions to industrial companies, manufacturers, utilities, municipalities, homeowners, and government entities. Founded in 1997, United Rentals has grown rapidly with a store network of 1,165 rental locations, including 1,081 locations in the United States, 136 stores in Canada, and 11 in Europe. And by 2020, it claims to have, on average, three times the size of other providers in the industry.

Growth and Opportunity Equipped

Above all, with the increasing demand for construction products and services, we could be optimistic about the continuous opportunities URI is equipped with. By looking at the United States Rental Revenue graph below, we can see that the pandemic is impacting the whole Rental Industry in 2020, as some construction projects were paused or delayed and the whole market is affected as well. However, it is encouraging to see the trend start to adjust and increase from the beginning of 2021. With the appropriate approach to deal with the COVID-19, we can expect a long-term good outlook for the Rental Industry, due to the fact that contractors are renting more equipment and the constant development of technology is evolving the industry.

Many potential opportunities for the Equipment Rental Industry are especially interesting in the coming years. Nowadays, contractors are trusting more rental companies because of market volatility and growing their fleet needs for the equipment. According to the American Rental Association (ARA)’s forecast of the whole rental industry in 2021, it projects a 1.5% of industry revenue growth which reaches $50.2 billion. Therefore, the advanced improvement in technology and rising demand for industrial equipment could ensure the sustained growth of the Equipment Rental Industry. And as a leading company in the industry, we could also expect more chances and potentials that URI possesses.

Furthermore, the specialty service sector provides URI with even more opportunities. By looking at the revenue growth of the specialty services, we could see that this sector has an improved return of 27.6%. In 2020, specialty represented 24.5% of revenue, and $2.09 billion of revenue, which is approximately 7 times more than its specialty revenue in 2012.

With all the opportunities mentioned above, I believe that URI still has a lot of potential to grow in 2022, and it now looks like a very great long-position investment.

United Rentals Inc and Its Competition

It is crucial to look at URI’s data in comparison to the industry’s indicators, thus we are going to analyze its financial performance in comparison with its rivals and the overall Industrials Equipment Rental industry average. More specifically, we will mainly focus on United Rentals’ top competitors including Ashtead Group plc (ASHTY, USD), GATX Corp (GATX, USD), and Herc Holdings Inc (HRI, USD).

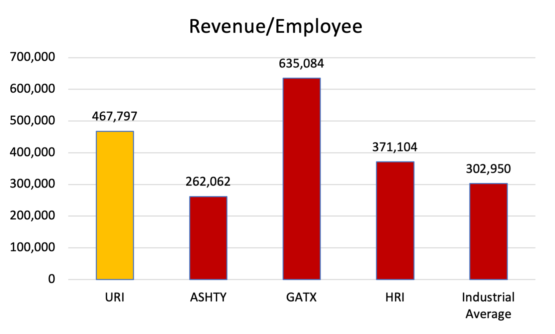

According to WSJ, URI has an annual Gross Margin of 33.20%, higher than Ashtead Group plc (ASHTY), Herc Holdings Inc (HRI), and the industry average by nearly 10%, but lower than GATX Corp (GATX) by 7.67%. A relatively high operating margin implies URI makes more money from its ongoing operations to pay for costs. Plus, URI also has a higher Revenue/Employee ratio compared to Ashtead Group plc (ASHTY), Herc Holdings Inc (HRI), and the industry average, but lower than GATX Corp (GATX) for about $167,287 per employee. Based on these two measurements, we can find out that URI is profitable, efficient, and productive against its competitors – Ashtead Group plc (ASHTY) and Herc Holdings Inc (HRI, USD) and the industry average. However, GATX Corp (GATX) is doing better at these two ratios, so URI still needs to make good strategies in order to improve its profitability and efficiency.

Now, if we look at the company’s Debt to Total Ratio, we see that URI has a value of 57%, equal to the industry average, higher than Ashtead Group plc (ASHTY) and Herc Holdings Inc (HRI), and only lower than the GATX Corp (GATX)’s Debt Ratio. This means that URI has a relatively high amount of debt and leverage relative to its assets. It is one of URI’s encouraging strategies to leverage more cash flow to deliver more returns, and also URI is growing its EBIT, but it is still critical for it to pay attention to the risk of this high leverage.

Lastly, the valuation ratios including P/E, P/S, and P/B ratios are visualized in the bar chart below. URI’s P/E ratio is a little higher but a closely good value compared with the industry ratio. And its P/S ratio and P/B ratio could be considered as overvalued from this chart.

With all the values presented, even though GATX Corp (GATX) is one big competitor to URI in terms of profitability and productivity, URI still has superiority against the rest of the competition. Overall, URI had a solid earnings and valuation performance in the industry, and we could remain positive on its financial growth and position.

URI Targeted Stock Price Forecast

From the above graph, the URI stock has an overall additive increasing trend, no seasonality, and some random fluctuations around its trend over the past year. It is important to note that United Rentals’ activity and growth this year is continuously picking up from the pandemic, and its operating performance has also surpassed most other operators during the pandemic. With United Rentals’ outstanding performance and its potential opportunities, I believe that it will continue to make benefits and rise in the long term.

In early June, we could notice that the stock price started to drop and went under its 50-day and 20-day moving average. When this occurs, my suggestion for this stock is to use an “averaging down” strategy, i.e., adding to its current position and waiting for the price to go back up again. This reason for this strategy comes from our analysis of the promising growth and development of United Rentals, the whole Equipment Rental Industry, and the fact that its stock price is constantly above its 200-day long-term moving average. All our analysis results are evidence for distinguishing this drop as a temporary movement and a signal for a potential increase. My URI stock forecast is that it will experience an adjustment of the price and moderately go back up to its increasing price level. So my target price for URI in 2022 will hit above $360 and may go higher depending on URI’s own development and technology break-through, or the control of the pandemic in the market. Therefore, despite the price drop, URI seems to have a great value for investing at this time, and it should still be considered as a “Strong Buy” in the long run.

Conclusion

In a nutshell, United Rentals Inc. is a leading equipment rental company worldwide and it has gained rapid development and a rising global presence since its foundation in 1997. By conjuring ratio analysis, we see a solid financial performance URI has in comparison with its rival and the industry average. Moreover, with more opportunities in the Rental industry and rapid technological improvements, URI is considered as a strong long-position investment in the long run. Despite the price drop in June, our analysis suggests an averaging down strategy and investors could wait for a further booming cycle of the price. We could trust URI’s potential growth and opportunities in 2022, and thereby my 6-month predicted target price for URI in 2022 will be above $360. Based on I Know First’s forecast above, it has a positive signal and high predictability for both 1-month and 3-month forecasts, which is a sign of its returning price increase in the following months. URI also has a 1-year signal of 344.16 and a predictability of 0.67, which again proves its strong buy position as a long-term investment.

Past Success with URI Stock Forecast by I Know First

On May 14th, 2021, I Know First’s Top S&P 500 Stocks package had correctly predicted 10 out of 10 stock movements on a 1-year time horizon. URI stock forecast was one among the top 10 recommended long-position stocks that reached a high return of 214.23%, and this prediction outperformed the S&P 500 benchmark (48.01%) by 166.22%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.