Silver Market Forecast: Fundamental Basis or One-Time Surge

![]() This Silver Market Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

This Silver Market Forecast article was written by Milana Papadopoulou – Financial Analyst at I Know First.

Highlights

- Lower real rates and inflation concerns are boosting silver’s appeal as a monetary hedge

- Tight COMEX and LBMA stocks and strong PSLV demand

- Institutional moves from paper to physical delivery have exposed scarcity and driven the rally

Investment Rationale

Silver sits at the intersection of monetary metal and industrial commodity, with demand coming from both investors and sectors such as solar energy, electronics, and electric vehicles. As a result, its price reflects a mix of macroeconomic forces.

Against a backdrop of geopolitical uncertainty, changing monetary policy, and tightening physical supply, silver has again moved into focus as a strategic asset. Conditions in the futures market and the behaviour of physically backed vehicles, such as the Sprott Physical Silver Trust (PSLV), highlight the growing significance of physical trading relative to the paper markets.

Silver: Price Performance

Rolling Standard Deviation(below)

Source: Godel

Over the past twelve months, silver has been in a clear and accelerating uptrend. Prices rose steadily through the first half of the year and then entered a much steeper phase, breaking out to new cycle highs near the $90 per ounce. The pattern of higher highs and higher lows, combined with shallow pullbacks, points to a structural re-rating rather than a short-lived rally.

Volatility has increased significantly over the same period. The rolling standard deviation was relatively low earlier in the year but expanded sharply as prices accelerated and moved to new highs, indicating wider daily swings and stronger participation. This combination of rising prices and increasing volatility is typical of silver during a bull market.

Price Drivers

Financial and Macroeconomic Drivers

Silver is benefiting from a macro environment that is increasingly supportive of real assets. Expectations of lower real interest rates and eventual monetary easing have reduced the opportunity cost of holding non-yielding metals, while persistent concerns about inflation, sovereign debt, and currency debasement continue to support demand for stores of value. In this context, silver’s higher beta to gold has attracted investors seeking leveraged exposure to the precious-metals cycle, amplifying price moves during periods of rising risk aversion and declining confidence in fiat currencies.

Physical Supply and Industrial Demand Drivers

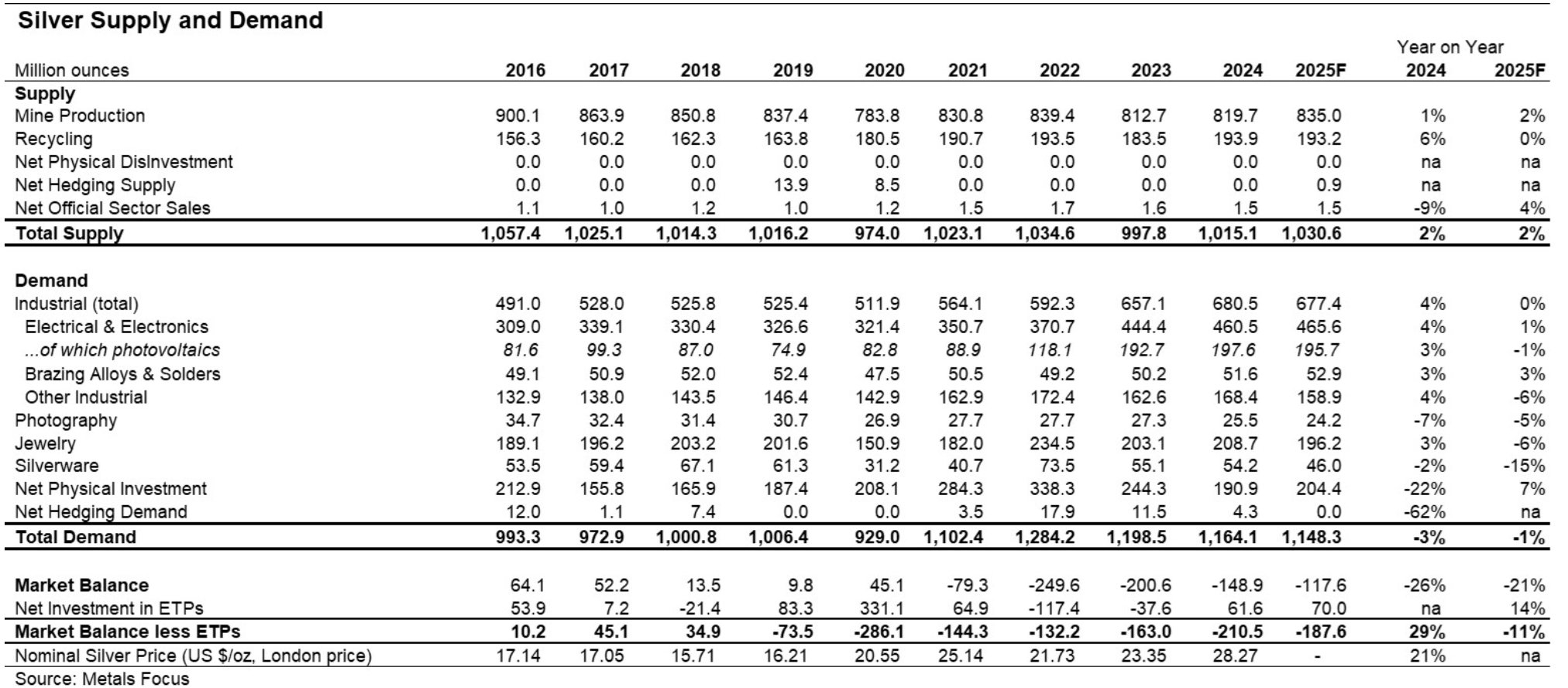

Recent research highlights that a tightening physical supply is underpinning silver’s current rally. Industrial demand continues to grow, led by solar photovoltaics, electronics, and electric vehicles, where silver is critical, so consumption is relatively insensitive to price. The majority of global silver is produced as a by-product of base-metal mining, so production is slow to respond.

This demand–supply mismatch is increasingly visible in physical inventories. Drawdowns in exchange stocks and rising interest in fully allocated products indicate that both industry and investors are consuming available physical silver. The combination of inelastic supply, accelerating demand for green energy, and tightening inventories supports the view that the current price strength is grounded in physical scarcity.

Shift in Institutional Activity

Recently, large government and institutional players that had built positions in silver futures shifted from rolling contracts to demanding physical delivery. This converted paper demand into immediate physical offtake, drawing metal out of exchange inventories.

Given the limited inventory, this surge in delivery requirements exposed the leverage in the paper market, contributing to the sharp rally as prices adjusted to reflect physical scarcity rather than purely financial positioning.

Silver in Battery Technology

Silver’s exceptional electrical and thermal conductivity is driving research into its use in advanced battery systems, including silver-zinc and other designs. These alloys offer high power density, fast charging, and improved safety, making them attractive for specialised applications.

While lithium remains dominant, any broader adoption of silver-based batteries would add a new source of industrial demand that is difficult to meet, further tightening the physical market and reinforcing silver’s strategic role in the energy transition.

Relative Valuation

Rolling Standard Deviation(below)

Source: Godel

Over the past year, both gold and silver have moved higher, but silver has outperformed in percentage terms, consistent with its higher beta in precious-metal bull phases. This has led to a compression in the gold-to-silver ratio as silver has risen faster than gold.

Despite this move, the ratio remains above its long-term historical average, indicating that silver is still undervalued relative to gold on a mean-reversion basis. In previous cycles, such conditions have often preceded further periods of silver outperformance as capital rotates from gold into the smaller silver market.

The volatility profiles support this view. Gold’s one-year standard deviation has increased only moderately, while silver’s has expanded more sharply, reflecting stronger participation and a faster repricing process.

Physical Inventories

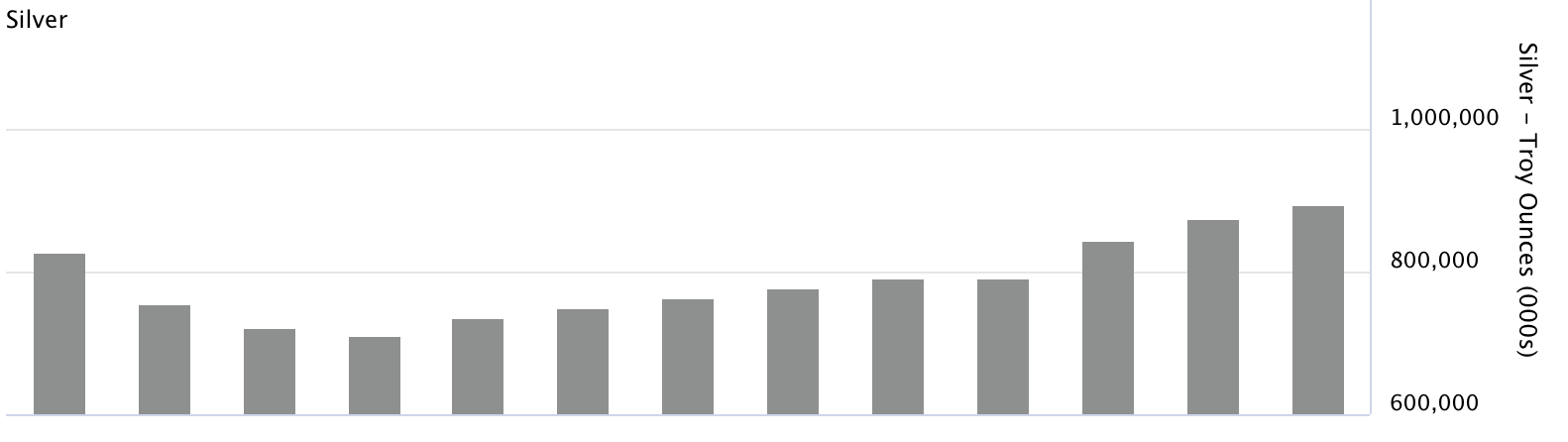

Physical bullion anchors silver prices to real supply and demand rather than paper trading. Rising investor and industrial demand for bars and coins removes metal from available inventories, tightening the balance between stocks and consumption.

COMEX and LBMA stocks offer a window into the availability of deliverable silver. On COMEX, the metal available for delivery against futures has remained tight, with drawdowns during heavy delivery periods. This highlights the small pool of readily accessible supply relative to the large paper open interest.

In London, much of the silver held in LBMA vaults is tied up in ETFs or long-term holdings and is not freely available to the market. The limited amount of unencumbered metal, together with rising delivery demand, points to genuine supply constraints.

PSLV

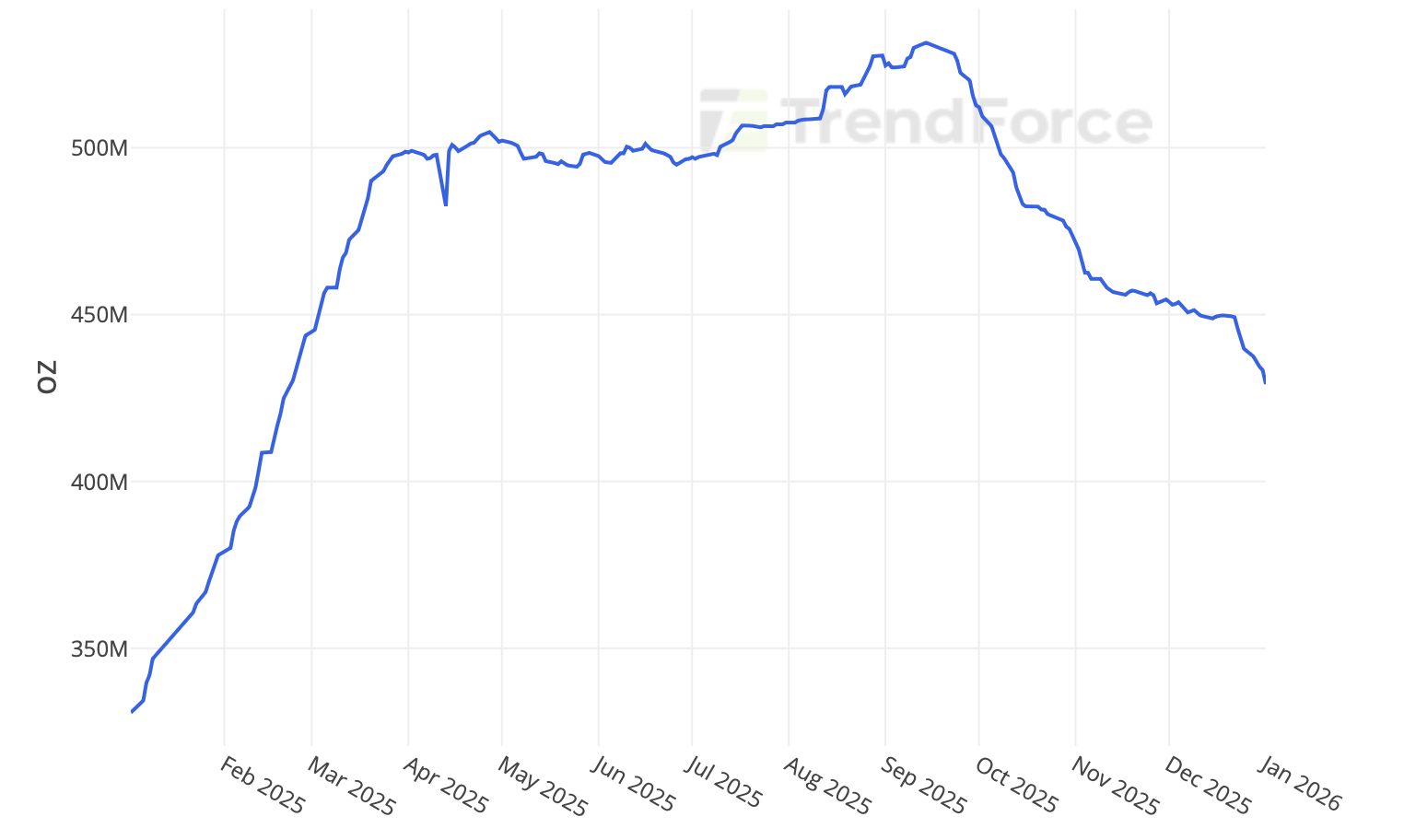

The Sprott Physical Silver Trust (PSLV) is a fully allocated, physically backed vehicle that allows for redemption in wholesale silver bars, making it a direct link between investment flows and the physical market. Unlike most paper-based ETFs, new unit creation requires the trust to acquire and vault actual metal, so changes in its assets and its premium or discount to net asset value provide a real-time signal of physical investment demand and the availability of deliverable bars.

Over the past year, increased interest in PSLV has coincided with tightening exchange inventories and greater emphasis on physical delivery in futures markets. Periods in which PSLV has traded at a premium to NAV indicate that investors are willing to pay above spot-equivalent prices for guaranteed, allocated silver, highlighting stress in sourcing large bars and reinforcing the view that the current rally is supported by genuine physical tightness rather than purely paper speculation.

Conclusion

Silver is uniquely positioned as both a monetary and strategic metal, profiting from macroeconomic, industrial and supply shifts. Despite its sharp price advance and rising volatility, silver remains undervalued relative to gold on a historical basis. The shift by institutional players toward physical delivery, the drawdown of exchange inventories, and the growing role of fully allocated vehicles such as PSLV all point to genuine scarcity rather than a purely speculative rally.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts supporing the idea that rally Silver’s rally will continue in 2026. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for all forecast horizones.

Past Success with SLV Forecast

I Know First has been bullish on the SLV forecast in the past. On December 25th, 2024 the I Know First algorithm issued a forecast for SLV price and recommended SLV as one of the best commodity to buy. The AI-driven SLV stock prediction was successful on a 1-year time horizon, resulting in more than 141.38%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.