Tesla Stock Prediction: Tesla’s Future Tailwind From Electric Motorcycles

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Tesla Stock Prediction

Summary:

- Tesla remains the leader in electric cars. Two or three years from now, I expect Tesla to also lead in high-end electric motorcycles.

- Car vendor Honda is selling more than 19 million units of regular motorcycles per year. Honda has upcoming electric motorcycles.

- More than 130 million units of motorcycles are sold annually. Almost 109 million of them sold in the Asia Pacific Region.

- It is faster to assemble Tesla electric motorcycles than cars and trucks. Tesla can improve its bottom line by the quicker turnaround of selling motorcycles.

- TSLA has a very bullish one-year forecast from I Know First. It might be wise to load up on this stock while it trades below $370.

Tesla (TSLA) remains the undisputed leader in electric car sales in the U.S. My fearless forecast is that Tesla can also be the runaway leader in electric motorcycles. There are much more affordable alternative to the Model 3 but Tesla’s brand power made it sell a lot more units than the Chevrolet Bolt and Nissan Leaf.

The sales chart above is compelling reason to go long on TSLA. General Motors (GM) and other car manufacturers are simply getting outclassed by Tesla when it comes to selling electric vehicles. The Toyota (TM) Prius Prime is a hybrid, not pure electric car. Tesla therefore owns the top three best-selling electric cars in America. The strong sales of the Model 3 is partly why Tesla turned a profit.

Another great revelation from Tesla’s earnings report last month is that it was able to deliver more than 56k units of the Model 3 during the Q3 period. Tesla is now emerging as a potent producer of cars. Tesla was able to deliver more than 83k electric cars worldwide during in Q3 2018, more than double than the number of cars it delivered in Q2.

The chart below is another reason to go long on TSLA. It is now capable of delivering 80k cars per quarter. By 2020, this capacity can double up. As of last month, Tesla’s factories can produce 1,000 units of the Model 3 per day. The upcoming Shanghai Gigafactory 3 facility is designed to manufacture 500k electric cars per year.

1 Million Vehicle Sales By Also Selling Electric Motorcycles

I expect Tesla to become profitable (in annual income basis) by end of 2019. The lower cost from producing its own lithium ion batteries can help make the $35k Model 3 profitable. The lower labor costs of producing electric cars in Shanghai should also lower the price tags of Tesla cars for the Chinese/Asian markets.

The cheaper Tesla cars become, the greater the total addressable market. Right now, Tesla is primarily catering to affluent car buyers. Yes, selling 500k cars annually is possible by 2020 for Tesla. However, hitting the 1 million cars/year sales milestone is going to happen by 2022 or 2023.

It can double annual sales but I don’t think Tesla is willing to sell sub-$20k electric cars. Elon Musk’s emphasis on quality and performance means the $35k Model 3 will remain the cheapest Tesla car for the next 10 years.

The other option is for Tesla to eventually produce its own electric motorcycles/scooters. High-end motorbike builder Harley-Davidson (HOG) is launching its LiveWire electric bike next year. Harley-Davidson has not mentioned any price tag for LiveWire. However, I won’t be surprised if it retails for more than $10k. Honda (HMC) sells an electric scooter in India. BMW (BMWYY) is selling a $5,900 electric bike.

Car makers are making electric scooters and motorcycles because there’s big money to be made from it. More motorcycles are sold than cars annually. The expected total car sales for this year is only 81.5 million units. This is notably lower than the more than 132 million motorcycles that is going to be sold this 2018.

Tesla’s massive brand power can help it sell 300k electric motorcycles/annually with average selling prices of $10k. The potential annual revenue from selling electric motorcycles could add $3 billion in new sales. Tesla needs all the revenue streams it can generate. Tesla’s has a massive $11.3 billion long-term debt. Retiring this debt and meeting the interest payments requires Tesla to keep improving its sales and profitability.

Disrupting The Motorcycle Industry

Tesla is doing fine disrupting the car industry. It will eventually have to disrupt the motorcycle industry by coming up with cutting-edge electric motorbikes/scooters. If Harley-Davidson, Honda, and Yamaha can get away selling $8k traditional motorcycles, Tesla can also sell $8k to $15k electric scooters.

Without Tesla getting involved, industry leader Honda will probably sell 5 million units of electric scooters/motorcycles annually by 2021. Honda will end 2018 with more than 19.5 million regular/electric motorcycles sold.

Yamaha Motor (YAMCY), which sold 5.4 million motorbikes last year, is working on its TY-E electric motocross bike. Zero electric motorcycles can retail for more than $19k each in the U.S. If little known Zero Motors can challenge Honda and Yamaha, Tesla can easily do it too.

I repeat, getting involved in electric motorbikes can add around $3 billion in additional annual revenue for Tesla. Honda and BMW sells motorcycles because there’s a huge market for them in China, India, and the rest of Asia Pacific countries.

The much lower initial cost of buying a motorcycle is why more than 20 million units of them are sold in India. If Tesla wants more of its vehicles running around in Asia, Africa, and China, it will have to sell motorcycles & scooters. Manufacturing these electric motorcycles could be done inside the upcoming Gigafactory 3 in Shanghai, China.

Selling electric motorcycles can also indirectly increase sales of Tesla’s PowerWall batteries and solar roof installations. Majority of people who can afford to buy $8k to $10k electric motorcycles are also potential customers for $15k to $30k PowerWall solar roof systems.

The almost zero-cost and convenience of charging electric vehicles at your own home’s solar power system is pretty compelling.

Conclusion

I understand very well that Tesla is focused on cars and trucks right now. I will still rate TSLA as a buy even if it remains forever as a car manufacturers. However, the big opportunity in selling pricey electric motorcycles should eventually catch the attention of Elon Musk. In my calculation, there’s better margins in selling $10k electric motorbikes than in $35k Model 3 cars.

Proof of this is the high 38.4% gross margins of Harley-Davidson. Consumer-centric Yamaha’s 27% gross margins is also still notably higher than Tesla’s 17.50% gross margins. Tesla is not maximizing its brand power and electric vehicle IP by ignoring the vibrant, growing motorcycle industry.

The other possibility is Tesla could become lead supplier of lithium ion batteries for electric motorbikes and tricycles. The better cost efficiency and lighter weight of lithium ion batteries will make them more attractive than lead acid batteries. Almost 90% of electric motorcycles/scooters/bikes sold on the market today still use lead acid batteries.

The Gigafactory assets made Tesla the no.3 battery cell producer in the world. Tesla’s projected battery production capacity this year is 35 Gigawatt Hour. It is pretty capable of becoming the no.1 supplier of lithium ion batteries for solar power-equipped homes, electric cars, and motorcycles.

My buy rating for TSLA is complemented by its bullish one-year algorithmic forecast from I Know First.

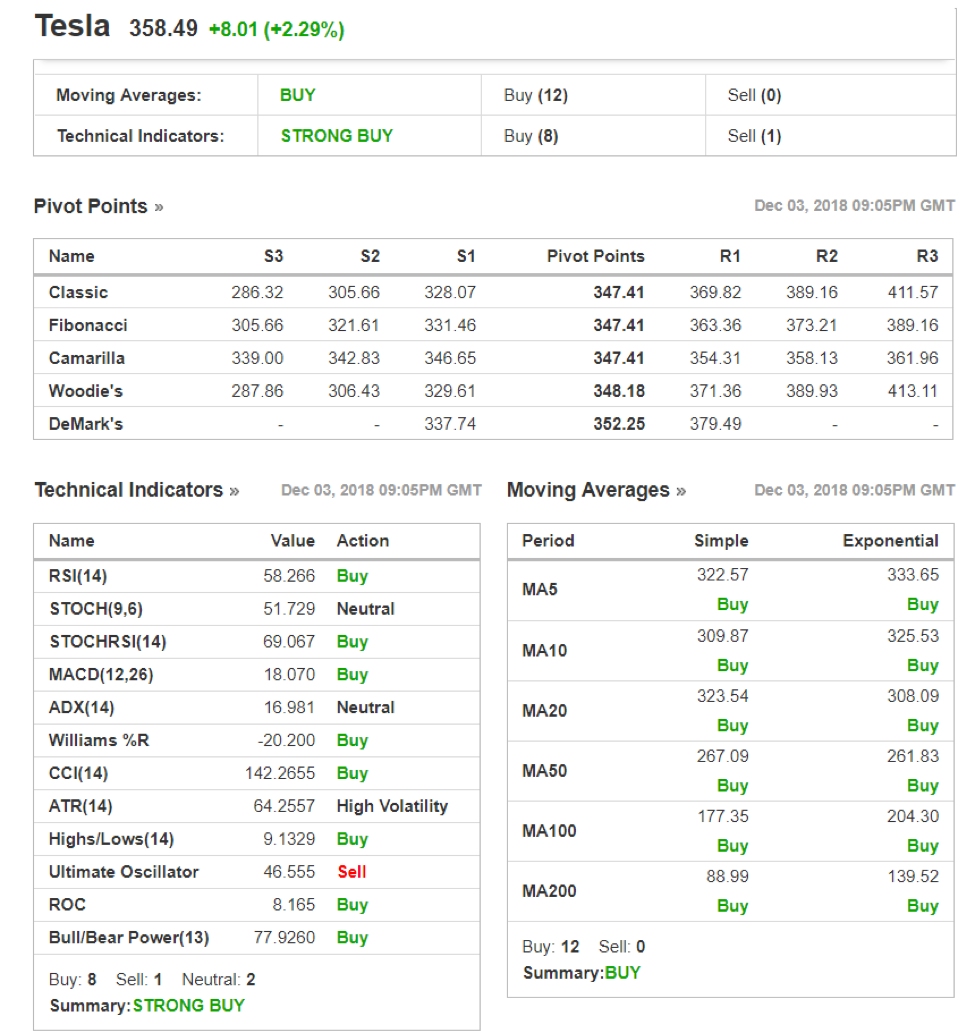

Analysis of monthly technical indicators and moving averages trends also rate TSLA as a buy.

Past I Know First Successful Forecast Performance for TSLA

On July 3rd 2018 I Know First AI Algorithm issued a strong bullish signal of 95.65 and a good predictability of 0.62 . After six month the stock rose by 16.35%.

Current I Know First subscribers received this bullish TSLA forecast on July 3, 2018.

Please note-for trading decisions use the most recent forecast.

To subscribe for today’s forecast and Top stock picks click here.