SPG Stock Forecast: Real Estate Giants Recovering now

![]() This SPG Stock Forecast article was written by Yuxiao Yang – Financial Analyst at I Know First.

This SPG Stock Forecast article was written by Yuxiao Yang – Financial Analyst at I Know First.

Summary:

- Simon Property Group’s 2021 Q2 net sales have been returned back to pre-pandemic levels, it increased 18.9% compared with 2020 Q2.

- We can expect that net sales of Simon Property Group will continue to rise with the golden period of the holiday season this year.

- Simon redeem $1.65 billion of senior notes this year to reduce debt.

- Simon has been actively expanding its overseas business territory and building renovation and expansion projects this year.

- SPG stock has grown by 87.99% since September 18th, 2020.

Overview of Simon Property Group, Inc

Simon Property Group, Inc. is a US self-administered and self-managed real estate investment trust(REIT) that invests in shopping centers, outlet centers, and community/lifestyle centers. The company is the only real estate S&P 100 company (Simon Property Group, NYSE: SPG) and largest retail REIT in the world by equity market capitalization. Other than the North American market, Simon also manages premier shopping, dining, entertainment, and mixed-use destinations in Asia, Europe, and Canada.

The Global Leader in REIT is getting back on Track

After the collapse of the consumer market in the early of the COVID-19 pandemic, the sales of Simon’s shopping centers and outlet stores have been recovered. Simon Property Group‘s most recent quarterly report indicates that Simon Property Group’s 2021 Q2 net sales have been returned back to pre-pandemic levels, it increased 18.9% compared with 2020 Q2.

Compared to its competitors, Simon Property Group’s total revenue’s increased by 18.09% year-over-year in the second quarter of 2021, while most of its competitors’ revenue contracted by -0.09% in the same quarter.

As Simon’s rental sales depend on the sales of retail tenants somehow, with the improvement of vaccination rate, the government encourages people to go back to normal social life, which is helpful for increasing the sales of retail tenants. With the arrival of the holiday season, we can expect that the sales of Simon’s shopping center and outlet stores will continue to increase.

At the same time, Simon is also actively looking for new development models to meet a better turnaround for the enterprise. In recent years, Simon has been actively expanding its overseas business territory, while devoting itself to building more premium outlets. According to Yahoo Finance, in the European market, Simon opened a premium outlet in the West Midlands, England, on April 12, 2021, which will include 197,000 square feet of high-quality branded stores. Simon owns 23 % of the interest of it; The new 222,000-square-foot premium outlet center in Normandy, France, is expected to open in the first quarter of 2023. Simon owns 74% of the project.

Simon is also actively involved in renovation and expansion projects. According to Forbes, by the third quarter of 2019, Simon had remodeled and expanded projects totaling approximately $1.8 billion across more than 30 properties in the United States, Europe, and Asia. For 2021, Simon’s reconstruction work continues at the Burlington Mall in Boston and the Tacoma Mall in Seattle. These redevelopments are scheduled for completion in 2021.

However, Simon also faces the same challenges as most other shopping malls and retail real estate. How to improve the occupancy rate, how to compete with E-commerce, and how to achieve digital transformation will be the bottlenecks for Simon’s future development.

SPG Increase Equity-to-Asset Ratio: Pull back from the edge of danger

Simon Property Group‘s most recent quarterly report indicates that Simon Property Group’s 2021 Q2 Equity-to-Assets ratio is 0.09, this low equity to asset ratio means Simon may encounter greater financial risk now, resulting from the company primarily used debt to acquire assets. According to gurufocus, through the plot of competitive comparison by Equity-to-Assets ratio, Simon ranked at the end of the ranking. Simon didn’t have the competitive advantage on the Equity-to-Assets ratio compared to other competitors.

Simon is aware of the potential financial risks of relying too much on debt. According to Yahoo Finance, Simon redeemed $1.65 billion of senior notes this year to reduce debt. In order to fund this huge redemption, Simon also sold $1.25 billion of senior notes to raise money from investors.

SPG’S Major Financial Metrics: Compare with Industry

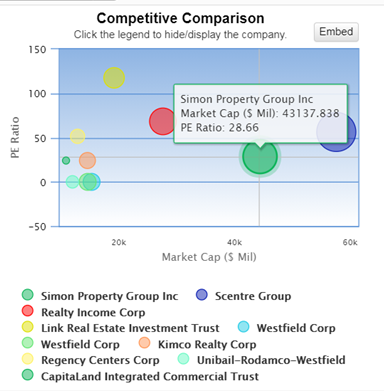

Simon’s ROE is 56.43%, according to gurufocus, Simon is ranked higher than 99% of the 745 Companies in the REITs industry. Simon’s P/E ratio is 28.66, which is relatively lower compared with other competitors. Simon’s P/S ratio is 8.97, which is ranked lower than 53% of the 835 Companies in the REITs industry. These lower P/E and P/S ratios indicate that SPG is undervalued.

Conclusion

SPG is a strong buy stock, after the continued downturn of the consumer market during the Covid-19 pandemic, it is reasonable to expect that Simon’s sales will rebound as people return to normal social life. With this strong momentum, Simon’s profits will have a greater space to rise, while Simon also actively expanding the business map to grab a larger market share.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the SPG stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with SPG Stock Forecast by I Know First

I Know First has been bullish on the SPG stock forecast in the past. On February 10th, 2021 the I Know First algorithm issued a forecast for SPG stock price and recommended SPG as one of the best real estate stocks to buy. The AI-driven SPG stock prediction was successful on a 3-months time horizon resulting in more than 23.60%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.