SIVB Stock Forecast: Time for Banks and Breakthrough Investments in Biotechnology

This SIVB Stock Forecast article was written by Dima Shirikov – Financial Analyst at I Know First.

Highlights:

- Rising US inflation likely to boost bank profits.

- SVB’s ROE of 20.76 is higher than 85% of companies in the Banks industry.

- S&P 500 FINANCIAL INDEX – a new record high.

Overview

SVB Financial Group is a high-tech financial corporation founded in 1983 and provides various financial and banking services. The company is represented by offices in the USA, Canada, UK, Israel, Germany, Denmark, India and China. It includes Silicon Valley Bank, SVB Private Bank, SVB Capital and SVB Leerink as divisions.

SVB is one of the largest banks in the United States and is the largest bank in Silicon Valley in terms of local deposits. The bank’s portfolio includes financing of more than 30,000 startups. SVB Private Bank is the bank’s private banking arm that provides financial solutions for consumers. SVB Capital Segment – deals with venture capital investments of SVB Financial Group, and SVB Leerink segment participates in equity capital markets.

Favorable Market Conditions

Since the beginning of October 2020, the company’s shares are up 187%, which is an impressive figure for a banking-related company. This is primarily due to the business of the clients that the bank is targeting, which are mainly start-ups and venture capital companies in the fields of technology, life sciences, and healthcare. In the reality of the modern world, when the fight against the covid pandemic is going on, companies related to medicine receive a lot of interest from investors.

In the first half of 2021, investments in biopharmaceutical and healthcare venture capital firms in the US and Europe set new records. Growth is colossal in the first and second quarters of 2021, about 50% compared to the record third quarter of 2020. Large investments in biopharmaceuticals, which this year have attracted about half of the investments in healthcare, have become the main driver.

The medical technology sector is also attracting investors: in the first half of 2021 alone, more money was raised than in all of 2020. There are no prerequisites for a change in this trend, so this is a supporting factor for SVB shares.

(Figure 1 – Venture deals across the US and European healthcare sectors)

Also, the rising inflation in the US serves as a positive market factor both for the stocks of the entire financial sector and for the SIVB stock. Inflation posted faster-than-expected growth across a wide range of commodities, according to the key report. In the Labor Department’s CPI, core prices excluding food and energy rose 4.0% in September from a year ago, only marginally declining from a June high of 4.5%. And the broader consumer price index, including all categories, rose 5.4% in September from last year, the fastest pace since 2008.

Since the American economy is developed, a controlled inflation rate will certainly lead to an increase in banks’ profits, and, accordingly, to an increase in their stocks. The market already includes this factor in the value of banks’ shares, in confirmation of this – a new record high for S&P 500 FINANCIAL INDEX on October 15th (closing price is 656.88).

(Figure 2 – S&P 500 FINANCIAL INDEX – new record high)

What Are the Company’s Results and Indicators in the 2nd Quarter?

Now let’s look at the financial results of SVB Financial Group in the second quarter of 2021. As in the first quarter, they came out quite strong and at some points exceeded analysts’ expectations. In particular, the following data looks the most interesting.

Average total client funds (on-balance sheet deposits and off-balance sheet client investment funds) increased by 17.5% to $308.1 billion, compared to the first quarter of 2021. It includes an increase in average on-balance sheet deposits of 20.9%. The growth year over year + 74% was driven by accelerated venture capital investment and continued strong public fundraising and exits fueled client liquidity.

(Figure 3 – SVB Average client funds $ Billions)

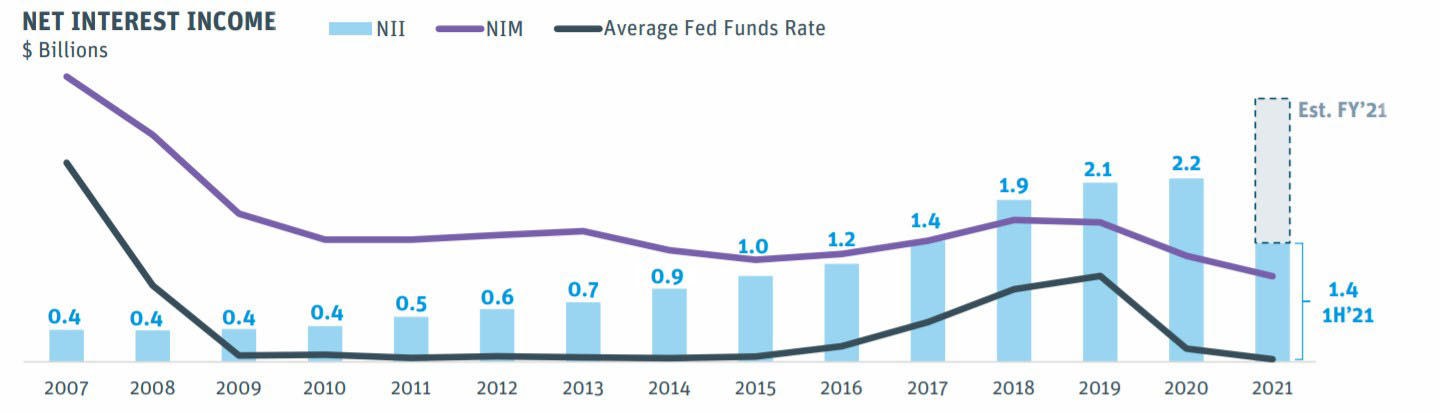

Net interest income (fully taxable equivalent basis) of $735 million, an increase of 10.5% compared to the first quarter of 2021. The growth to the end of fiscal 2021 is expected to be at least 30% more than fiscal 2020.

(Figure 4 – SVB’s Net interest income, net interest margin, Net interest income FY’21 outlook)

Average loans of $49.8 billion increased by 7.6% QoQ. This sustained growth was driven by strong investment activity in private equity and borrowing from technology, biotechnology, and healthcare clients.

(Figure 5 – SVB’s Average loans $ Billions.)

SVB is consistently improving its credit risk profile by expanding the portfolio segments with the lowest risk. So at the end of the 2nd quarter of 2021, 71% of loans were issued to Global Fund Banking and Private Bank, segments with the lowest historical credit losses.

Loans attributable to early-stage investors (ID) are the segment with the highest risk, now accounting for only 3% of total loans. For comparison, in 2009 their share was 11%, and in 2000 it was 30%.

(Figure 6 – SVB’s period-end total loans $ billions)

Now let’s take a look at some of the fundamental indicators of the company that will help us understand its current financial health and position in the market and industry. The key profitability indicators of the SVB financial group look much better than competitors in the Banking industry and this is a serious positive factor for the company’s stocks.

According to GuruFocus, SVB’s ROE of 20.76 is higher than 85% of the 1477 comparable companies in the Banking industry. This can exhibit the company’s excellent profit generation ability from its equity. Net Margin of 37.05% is higher than 81.65% of the 1477 comparable companies in the Banking industry. This indicates that a business is pricing its products correctly and is exercising good cost control.

During the past 3 years, the average earnings per share (NRI) Growth Rate was 35.5% per year that better than 81.65% of the 1477 comparable companies in the Banking industry. This is a great result because investors are willing to pay more for a company’s stock if they think the company has a higher profit compared to its stock price.

(Figure 7 – SVB’s key profitability indicators)

Silicon Valley Bank is also continuing its expansion into Canada and has announced its expansion in Montreal. SVB has been working with Canadian companies from its US offices for twenty years and received a Canadian lending license in early 2019. SVB already has offices in Toronto and Vancouver.

An event worth paying attention to now is that SVB will release its third-quarter report on October 21. Considering that for the last 4 quarters the report came out much better than analysts’ expectations, it can be assumed that the results of this quarter will be quite strong.

SIVB Stock Forecast: Technical Analysis

The daily chart shows the company’s shares moving in the wide sideways channel (542-606$ per share) from late April to September 22nd. However, since the end of August, a rather narrow upward channel can also be observed in stocks, which indicates a bullish trend in the stocks. Also, a sideways movement in stocks looks like a rectangle shape and if the price goes beyond the range of the rectangle in the direction of growth, it confirms that it has an uptrend. In addition, all 3 moving averages have accelerated their growth, which is also a good indicator of the strength of these stocks. There is also no divergence in the RSI index, despite impressive growth over the past two months. The indicator is under the overbought zone and does not go beyond it, which indirectly indicates the potential for acceleration of growth and upward breakthrough in stocks.

(Figure 8 – SIVB 1D: September 2020 – October 2021)

SIVB Stock Forecast: Conclusion

In a nutshell, SVB Financial Group is a strong player in the banking services market, and at the same time has a rich target audience. The business performance is impressive, the growth over the past year speaks of the colossal demand for the company’s shares. I believe that if the 3Q results exceed analysts’ expectations even slightly, the stock has good potential to gain in value in the 5-10% range. Moreover, inflation will boost income in the banking industry.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the SIVB stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success With SIVB Stock Forecast

I Know First has been bullish on the SIVB stock forecast in the past. I Know First analyst published a premium article on July 23th, 2021 about the great SIVB’s stock potential in the coming year. Despite that the prediction one year horizon is not over yet, we can notice a significant current return of some 21.94% that an investor could have If he bought SIVB’s stock according to the analyst’s advice.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.