SIVB Stock Forecast: an Expanding Niche Bank in the Banking Industry

This SIVB stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This SIVB stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlight:

- SIVB stock has grown by 51.32% since January 2021

- Based on the company’s robust balance sheet in 2021Q2, SVB’s average assets have reached $151 billion and average client funds have reached $308 billion

- SVB Financial Group has competitive financial advantages with an ROE of 19.76% and a net margin of 35.81%, outperforming 93% and 84% of companies in the industry

- The company is well-positioned for massive growth as a premier lender for startups and innovation companies, and the target price for SIVB will hit $620 for the upcoming year

Overview of SVB Financial Group

SVB Financial Group is a financial services company, providing various banking and financial products and services. The company’s segments include Global Commercial Bank, SVB Private Bank, SVB Capital, and SVB Leerink. The Global Commercial Bank segment consists of operations from the commercial bank, private equity division, SVB wine, SVB analytics, and debt fund investments. SVB Private Bank is the private banking division of the bank and offers a range of personal financial solutions for consumers. The SVB Capital segment is the venture capital investment division of SVB Financial Group. And the SVB Leerink segment is engaging in equity and convertible capital markets. SVB Financial Group was founded in 1983, and it is now operating through 20 offices in the United States; and offices in Canada, the United Kingdom, Israel, Germany, Denmark, India, and China.

SVB Financial Group: The Bank for Startups and Innovators

The SVB Financial Group (NASDAQ: SIVB) has long been considered as one of the best niche bank stocks to buy as it has soared 153.15% over this 1-year time horizon since last July. Now, let’s see SVB Financial Group’s unique position in the banking industry and find out what are the opportunities ahead for its further burgeoning growth.

Above all, the company occupies a special part in the banking world as it loans primarily to start-ups and ventures capital-backed technology, life science, and healthcare companies. For more than 35 years, SVB has helped innovators and investors move bold ideas forward fast, and now it offers a wide range of banking services to companies in innovation centers around the world. And according to SVB, its clients make up about 50% of all venture capital-backed tech and life science companies in the United States. Startups and innovation companies tend to evolve and thrive fast nowadays, and they have the potential to yield more profits as they got bigger. Being a bank of the innovation economy, SVB can take advantage of this trend and make tremendous returns.

Plus, SVB Financial Group can also take benefit when companies go public. In 2017, SVB made a convertible loan to BigCommerce. According to this article, as BigCommerce completed its IPO in August 2020, its stock has rocketed up 217% since hitting the public markets, and SVB’s investment has led to a gain of more than $149 million from common shares SVB obtained in the company and the exercise of certain warrants. Therefore, investing in IPOs is also a potential source that SVB can keep growing into in order to generate more profits, and this will also help expand its wealth in the long run.

More importantly, SVB Financial Group is expanding its scale and accelerating its growth by acquisitions. In 2020, it acquired WestRiver Group’s debt investment business to establish a credit platform at SVB Capital that provides investors with additional investment opportunities in the innovation economy and provides new debt options for its commercial banking clients. In July 2021, SVB Financial Group announced that it had completed the acquisition of Boston Private Financial Holding Inc. “With the close of our acquisition of Boston Private, we are well-positioned to deliver the understanding, guidance, and solutions to help our clients achieve their wealth goals,” said Greg Becker, President, and CEO of SVB Financial Group. By acquisition, the company can increase its power by creating a stronger customer offering and extending its opportunities today and in the future.

In addition, SVB is also expanding globally to provide banking and investment services in different countries and their currencies. Its global expansion solutions include Global Gateway, Multi-Currency Accounts, Global Trade Finance, In-Country Accounts, Asia Link, and Foreign Currency Accounts. With its efforts in expanding its business worldwide, SVB’s international core fee income has obtained a five-year (2016-2020) CAGR of 27% according to Nasdaq.

Remarkable Financial Performance & Balance Sheet Growth

Now, let’s evaluate SVB Financial Group’s financial performance and see why it has become an ideal bank stock today. One thing to highlight is SVB Financial Group’s excellent balance sheet performance in the second quarter of 2021, and the CEO called it the “another quarter of exceptional growth and profitability”. According to SVB Financial Group’s Financial Highlights Report, SVB Financial Group’s average assets have reached $151 billion with a 21% remarkable rise for the quarter; its net interest income is $735 million, increased by 11% quarterly; and its average client funds have achieved $308 billion with an up by 18% compared to Q1 2021. In addition, 88% of its assets are in high-quality investments and low credit loss experience lending. All the facts here can suggest that SVB is having a strong financial structure.

Next, we can select several comparable companies of SVB Financial Group and the industry benchmark to exhibit its outstanding financial position in the banking industry. These companies are Regions Financial Corp (USD, RF), Citizens Financial Group Inc (USD, CFG), Credicorp Ltd (USD, BAP), Fifth Third Bancorp (USD, FITB), Signature Bank (USD, SBNY).

According to GuruFocus (a reader should notice that at the moment of the publication, SIVB has not presented the form Q-10 for the second quarter yet. For this reason, the information below is based on the quarter that ended in Mar. 2021), SVB Financial Group has an ROE of 19.76%, being the highest one among all its peers we chose and the industry benchmark. This ratio is also ranked higher than 93% of companies in the banking industry, demonstrating the company’s great profit generation ability from its equity. Besides, SIVB has a notable net margin of 35.81%, outperforming 84% of companies in the industry. This high net margin means that the company is efficient at converting revenue into actual profit.

(Figure 1: ROE)

(Figure 2: Net Margin)

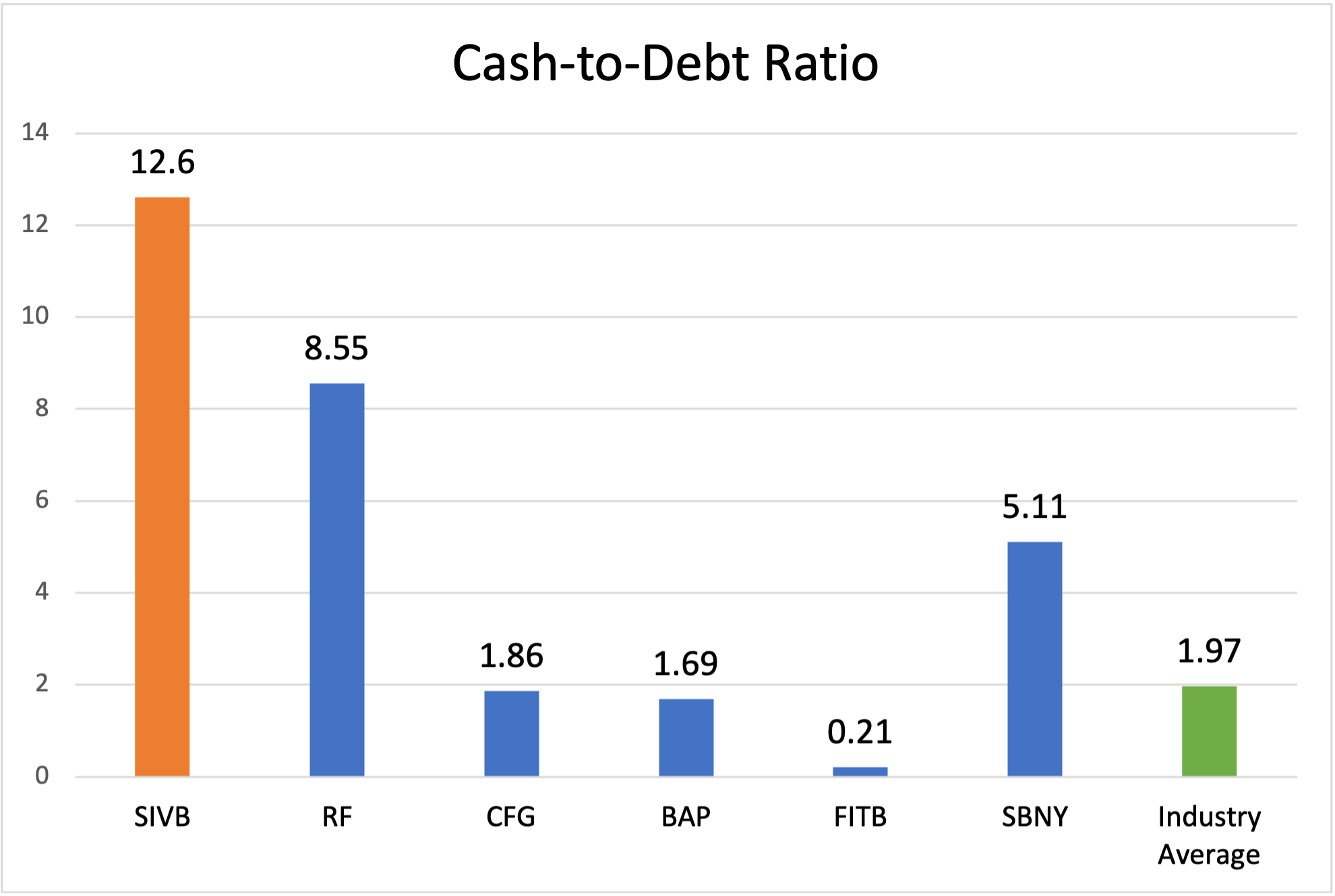

From Figure 4, we can also recognize that SIVB is having the largest cash-to-debt ratio among its rivals we picked and the industry benchmark. This value is also outstripping 83% of companies in the banking industry, which again indicates that SIVB is in a strong financial position.

(Figure 3: Cash-to-Debt Ratio)

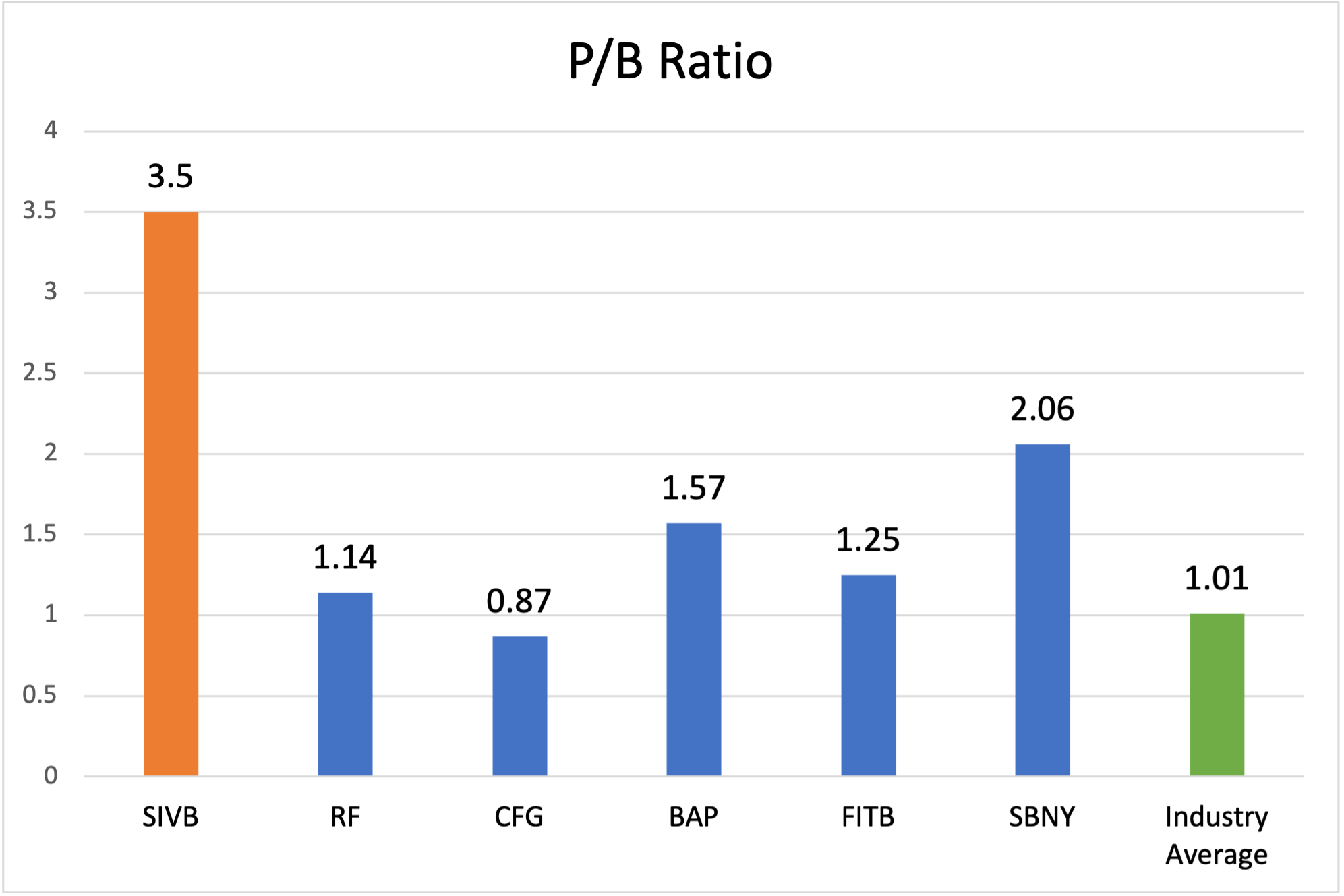

Furthermore, SIVB’s current P/B ratio of 3.50, P/S ratio of 6.65, and P/E ratio of 18.79 suggest that the stock is overvalued when compared to the company’s peers and the industry average.

(Figure 4: Price Ratios of Comparable Companies)

Although SIVB seems to be overvalued based on Figure 4, this can indicate that the company is able to efficiently use its own shares as additional funding in M&A deals to accelerate its business growth. According to Figure 5, the positive price ratios trends can also be seen as a sign of the company’s potential growth. All factors considered, SIVB is a worthy investment.

(Figure 5: The Historical Dynamic of SIVB’s Price Ratios)

SIVB’s Targeted Stock Price Hit $620 in 2022

From the graph, SIVB’s current stock price is above all three moving averages (the purple line is MA-50, the orange line is MA-100 and the blue line is MA-200). We can also notice that the Bollinger Bands have tightened in the recent few months, which indicates a period of low volatility and can be viewed as a potential sign of future increased volatility and possible trading opportunities.

From a long-term perspective, SIVB’s stock price has been steadily increasing, and it is constantly above its MA-200 average line ever since July 2020. This is another mark for its speedy growth and its strong-buy position as a long-term investment. Therefore, my target price for SIVB in 2022 will hit $620 with a return of 8.9%, and the stock price will very likely go higher beyond this target depending on its further expansion and growth as we mentioned earlier.

Conclusion

In a nutshell, SVB Financial Group is well-positioned for massive growth. The company has also been featured in Forbes’ America’s Best Banks 2021 list and ranked in the top 10 of the 100 largest publicly traded banks. Therefore, we can be optimistic to expect SVB to continue to be successful in future years, backed by its unique role as a bank for innovators, its global expansion, and its profitable opportunities through IPOs and acquisitions, etc. Together with the company’s robust balance sheet and its competitive financial performance, SIVB stock is highly recommended for a strong-buy position as a long-term investment.

From I Know First’s forecast above, SIVB stock has positive signals for all the long-term forecasted horizons from 1 month to 1 year, which serves as an indicator for its potential growth. More notably, we can notice a very strong signal of 305.65 and high predictability of 0.67 for the 1-year forecast, suggesting again a strong-buy position of SIVB as a long-term investment.

Past Success with SIVB Forecast by I Know First

On June 29th, 2021, I Know First’s Top S&P 500 Stocks package had successfully predicted 10 out of 10 movements on a 1-year time horizon and achieved great returns. SIVB stock forecast was one among the recommended long-position stocks that received the highest return of 173.17%, which outperformed the S&P 500 benchmark (42.63%) with a market premium of 130.54%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.