Netflix Stock Forecast: The Expansion To Video Games Can Boost NFLX to $600

The Netflix stock forecast was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- My July 2020 take-your-profits recommendation for Netflix was correct. Netflix’s stock is now trading below $515.

- Going forward, the recent announcement that Netflix is expanding to video games convinced me this stock is worth buying again.

- In-app purchases from Netflix-developed mobile games can offset the big slowdown in subscriber growth.

- Bundling free-to-play mobile games with subscription plans help Netflix retains the loyalty of its 208 million subscribers.

- Netflix will likely maintain its $17 billion/year on producing original TV shows and movies. However, it will also allocate a few billion to game development.

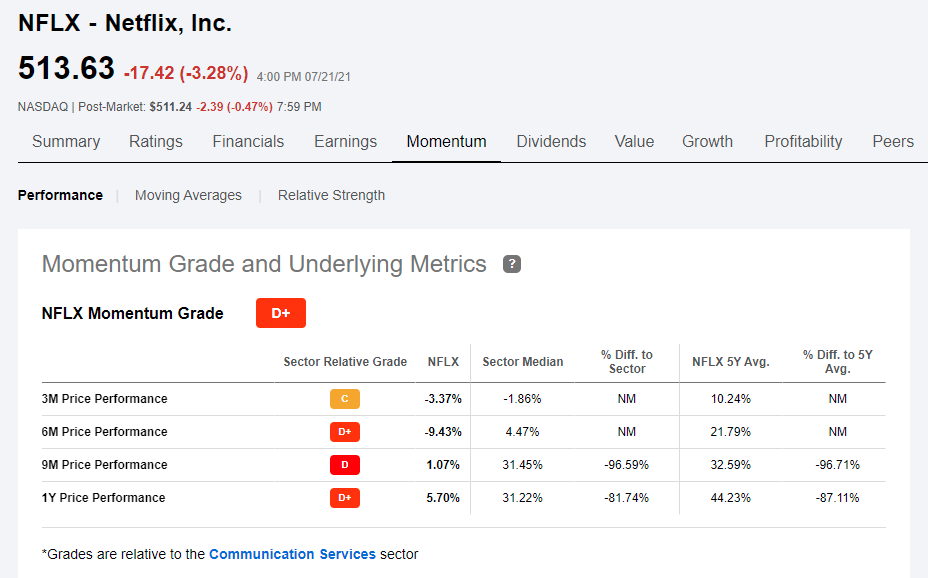

My July 19, 2020, Netflix (NFLX) article called for profit-taking. My view now is that NFLX’s 6-month price performance of -9.43% gave us a cheaper buy-in opportunity. There’s emerging negativity over NFLX. Investors got scared by Q2’s big miss on net subscriber additions. Analysts were expecting Netflix to add 5.9 million new paying customers but the company only managed to get 3.5 million. The Q2 EPS of $2.97 was also missed by $0.19.

NFLX’s price dropped by as much as -6% after its Q2 earnings report. Let us go contrarian and exploit the negative momentum of NFLX. The market’s emotion might reverse after Netflix succeeds as a video games company.

Statista’s chart below clearly illustrates the hyper-growth in Netflix subscribers has evaporated. Netflix’s management expects to add only 9 million new subscribers this year. This is far below last year’s 36 million net additions. The popular view now is that Netflix’s growth spurt is fizzling out after reaching 208 million paying customers.

For the near term, I expect NFLX to go below $500. The perception now is that Netflix is losing its growth-stock privilege due to market saturation and increased competition. Streaming video entertainment is not a wide-moat business model. Disney+ now has 100 million paying customers. HBO Max has 44.2 million, and Hulu 39.2 million. It is not going to be easy for Netflix to reach 300 million subscribers within three years.

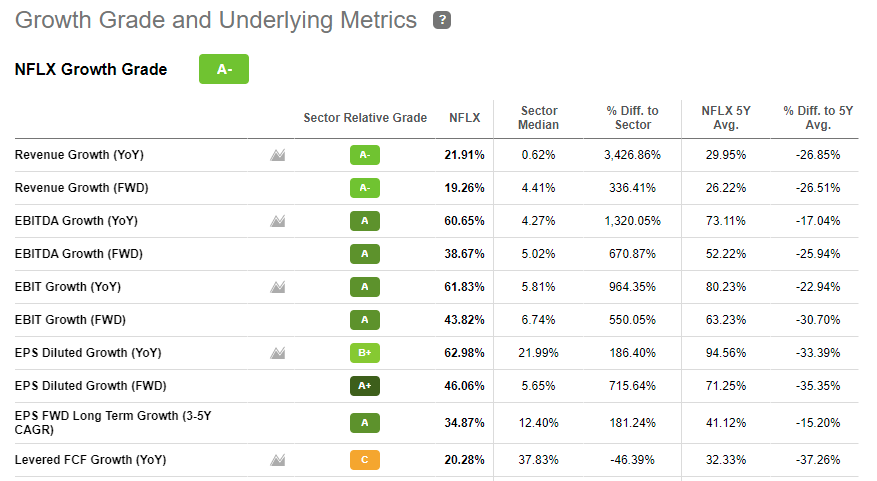

Many investors fear that without 20 million in net new annual addition to its subscribers, Netflix won’t be able to sustain its 20% or higher annual revenue growth rate. NFLX’s currently high valuation ratios are because of the chart numbers below. Netflix’s 5-year average revenue growth rate was 29.95% but last year’s 21.91% was already a big warning that Netflix is losing steam. A slower subscription growth means Netflix might not deliver $30 billion in FY 2021 revenue.

Netflix Stock Forecast: Video Games Can Help Netflix Maintain Its Growth-Stock Status

Netflix’s expansion to mobile games can offset slower subscriptions growth. The $180 billion/year video games industry is large enough to accommodate new players like Netflix. The decades-long experience of Netflix in streaming videos to more than 200 million people gives it a big edge. Netflix already owns a global network of data centers to operate online mobile and PC games.

There are now 2.69 billion active gamers in the world. This will rise to 3.07 billion by 2023. Netflix can get new subscribers by attracting this huge pool of video games aficionados.

Offering free-to-play mobile games can compel more people to sign-up for Netflix’s $8.99 or $13.99 monthly plans. This video games bundling is something that HBO Max or Disney+ is not yet doing. Netflix is pushing free video games as a unique selling point to its current and future customers. Netflix can market its streaming video service to gamers in the Asia Pacific. Some of those 1.447 billion Asia Pacific gamers will sign up for an $8.99 Netflix plan if it comes with free video games.

Going forward, I also expect Netflix to eventually monetize the free-to-play video games via in-app purchases. This is the ultimate aim of giving away free-to-play games. The competitive nature of online games will inspire many players to demand in-app purchases. This will give them an advantage over non-spending players. Getting Netflix subscribers addicted to free video games initially is a good tactic. When they are hooked on Netflix games, they become eager customers of in-app purchases.

Selling virtual currency and goods to players could add $1 billion to $3 billion in additional annual revenue for Netflix. The business of virtual goods in-app purchases is also a high-margin endeavor.

Video games can help Netflix improve its already-excellent margins.

Conclusion

NFLX might breach $600 soon if it establishes itself as a new leader of the $180 billion global video games industry. This is in line with Wall Street analysts’ average one-year price target of $594.47. The majority of experts are still bullish on Netflix. They are not yet worried about the slowdown in Netflix’s subscriber growth rate. We should share their optimism for Netflix. Go long on NFLX now and profit later.

Netflix has the financial resources to quickly develop dozens of mobile and video games. Netflix can afford to spend $17 billion/year on creating original TV shows and movies. Netflix can certainly afford to allocate $2 to $3 billion/year toward making mobile games.

The recent hiring of Mike Verdu is a good move for Netflix. Verdu is a veteran game development head at Electronic Arts (EA) and Oculus VR. Verdu was also once the Chief Creative Officer of Zynga (ZNGA). Verdu commands respect in the video games business. No doubt Verdu will be hiring the best game developers to help him at Netflix.

My buy rating for NFLX is backed by its bullish one-year forecast from I Know First. The AI prediction algorithm of I Know First is confident Netflix’s stock will trade higher than its current price of $513.63 within the next 12 months.

Past Success With Netflix Stock Forecast

I Know First has been bullish on Netflix shares in past forecasts. On June 28, 2020, the I Know First algorithm issued a Netflix stock forecast and recommended NFLX as one of the best consumer stocks to buy. The algorithm successfully forecasted the movement of Netflix’s shares on the 1 year time horizon. NFLX’s shares rose by 20.21% in line with the I Know First algorithm’s forecast.

Here at I Know First, our AI-based stock forecast algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. The database used is 100% historical data free from human-derived assumptions and is constantly evolving with newly added data and adapting to changing market situations. Today, we are producing daily forecasts for over 10,500 assets such as forex forecasts, as well as gold predictions, while also providing the latest Apple stock news. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast.