MHK Stock Prediction: A Low Valuation Stock with Great Potential

The stock prediction article was written by Tianyue Yu, Analyst at I Know First, Master’s candidate at Brandeis University.

The stock prediction article was written by Tianyue Yu, Analyst at I Know First, Master’s candidate at Brandeis University.

Summary

- Q3 encouraging results indicate the margin level rebounded

- Favorable housing market trend will be the revenue driver

- EPS estimation show potential upside from the current price

Q3 Performance is Back on Track for Margin Repair Boosting MHK Stock Forecast

As the US real estate market is booming recently, housing and other relevant sectors have been back to investors’ attention. Mohawk Industries (MHK) is one of the leading companies in the US floor covering industry. MHK delivered surprisingly strong financial results in Q3, driving the MHK stock forecast to grow 12%. Operating margin increases 130 bps on a YoY basis. The EPS also surpassed the Street’s estimation of $2.10 reaching $3.26. MHK stock price topped up $100 right after the quarter results were released.

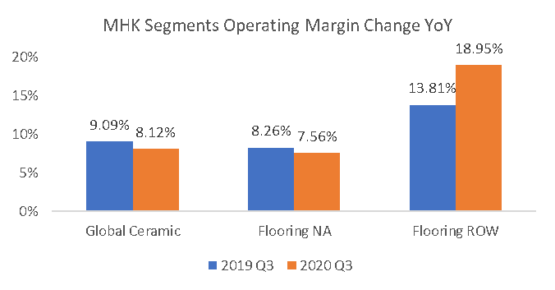

This margin improvement largely attributes to the high productivity and low-cost input of the Flooring Rest of the World (ROW) segment. Margin recovery is regarded as the first leg of MHK’s return to favor by investors. I expect that the margin will keep at a healthy level in the next twelve months because of the company’s price increasing plan in the Global Ceramic sector and the completion of the restructuring program in the next year. The savings from the product and assets restructuring program are estimated to be $110 to $120 million, which will pay back in the coming years. However, the Q4 margin is likely to decline due to the seasonal contraction of the business.

US Housing Market Booming will Bring Tailwind to the Residential Sector Revenue

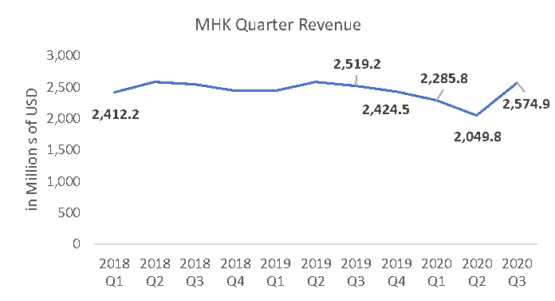

In the Q3 report, we also saw the revenue bounce back to the level equal to the pre-pandemic number. This outcome primarily results from the heating up US housing market. The near-term economic and financial impact of the COVID-19 pandemic is improving the remodeling demand in the residential markets. Meanwhile, a combination of low mortgage interest rates and strong demand for housing will remain important tailwinds to the new housing market. The evidence of this trend is the homebuilders’ record level of optimism.

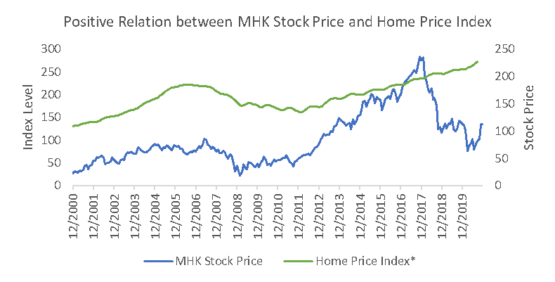

Looking forward, I expect this high demand in the residential housing market will continue this year. Experts estimate that residential investment will make another strong contribution to GDP growth in Q4. Since there is a positive relation between MHK stock price and the Home Price Index, MHK price will keep the momentum throughout next year.

Another worth mentioning point is that there is a lag between housing demand and revenue growth of floor covering industry companies since the floor is always the last step of decorating a new house. In this case, the impact of the residential housing market is likely to be longer. Noticing the revenue number already recovered to the pre-CPVID level while the commercial market demand is still absent, I predict that the revenue level will have more upside after the bounce-back in the commercial sector sales.

Future EPS Consensus Indicates 13% Stock Price Upside

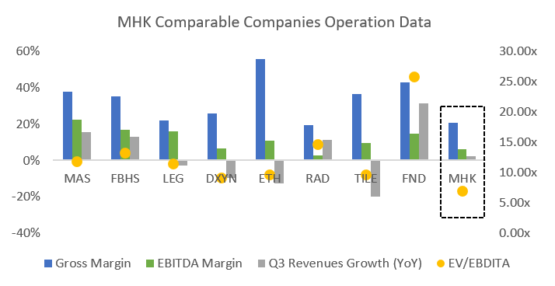

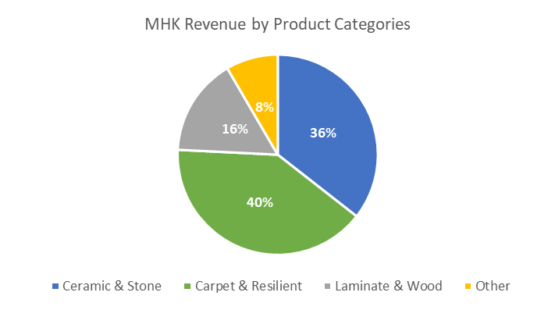

Despite the impressive Q3 result and potential upside in the US residential market, MHK still underperformed its peer group, leading to a relatively lower trading multiple at 6.9x EV/EBITDA and a lower stock forecast.

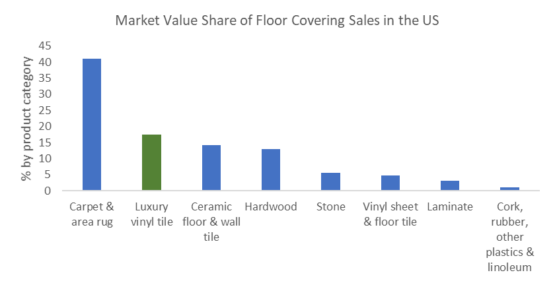

I believe that the 6.9x multiple fairly reflected the existing company level disadvantage and investment risk. For example, MHK has a heavy position in Carpet and ceramic sectors products which naturally require high fixed cost investment and low margin, and falls behind in the emerging luxury vinyl tile (LVT), vinyl, and Laminate market with high value-added products. This unfavorable product mix brought up approximately $19 million downside of the revenue.

However, I expect that we can see some turnarounds in MHK’s disadvantaged aspects in the next twelve months. First of all, sales of MHK’s residential LVT collections continued to expand at a rapid pace. The rigid products grow faster in Europe, and the company is deploying similar product development in the US market. Adding to this point, MHK could also benefit from the new tariffs on Chinese LVT/ vinyl flooring, and additional Ceramic tile tariffs in late 2019.

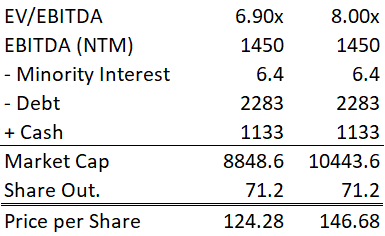

In the past, the MHK multiple levels basically follow the change of EPS. If we adjust the multiple to the Street’s analysts’ EPS consensus, we should get an EV/EBITDA multiple at around 8x. After applying the number to the estimated EBITDA number for the next twelve months, we will get the share price at $147, representing a 13% premium from the current price at $130.

Final Thoughts on MHK Stock Forecast

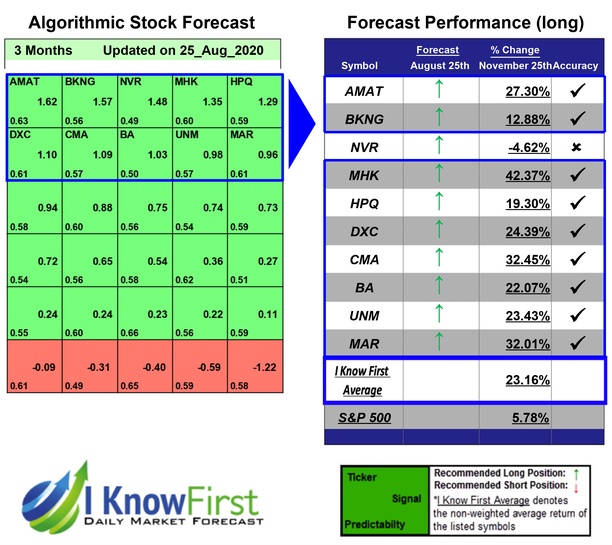

As a leading company in the floor covering industry, MHK company stock is trading at a relatively low multiple because of the pandemic uncertainties and MHK’s weak profitability in the past years. I believe that there are several positive aspects that will boost the stock valuation in the next twelve months. My forecast is in line with positive prediction results from I Know First. In the next quarter, the revenue is likely to decrease because of the seasonal demand cut, leading to the stock price fluctuation. The price adjustment will provide a good buy-in point for investors to lock in future stock price upside.

Past Success With Mohawk Stock Forecast

I Know First has been bullish with its MHK in the past. On December 6, 2020, the I Know First algorithm issued a bullish forecast for MHK stock price and recommended MHK as one of the top S&P 500 stocks to buy. The AI-driven MHK stock forecast was successful on a three-month horizon resulting in a more than 40% gain since the forecast date. See the chart below.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.