Summary

- Why the true automobile innovation of our decade is the plug-in electric vehicle (PEV) vs. the technologically outdated Hybrid Electric Vehicle (HEV).

- Elon Musk is another layer of risk mitigation when investing in Tesla, often not taken into account.

- What is the importance of Tesla’s oversized production factory and Panasonic partnership for battery production?

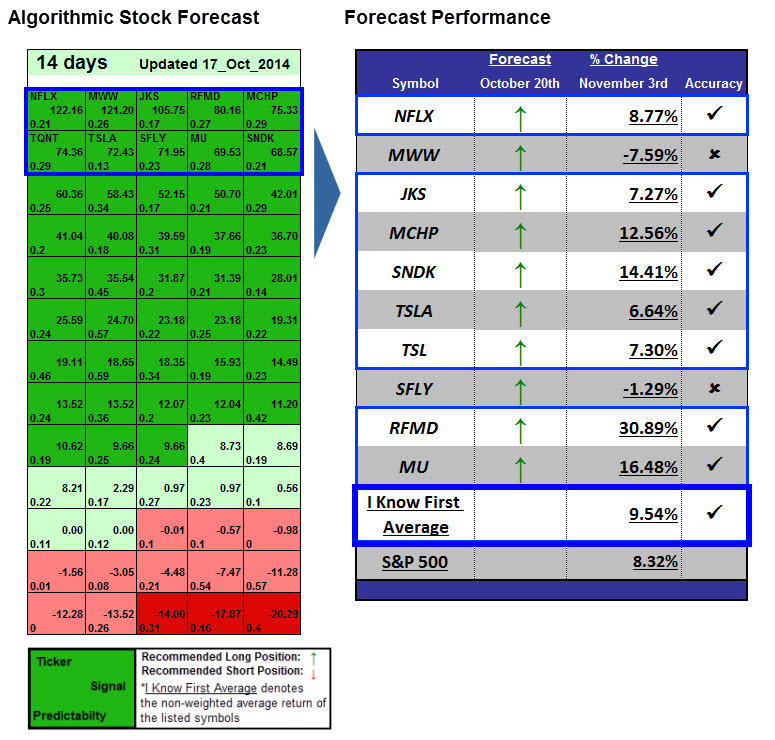

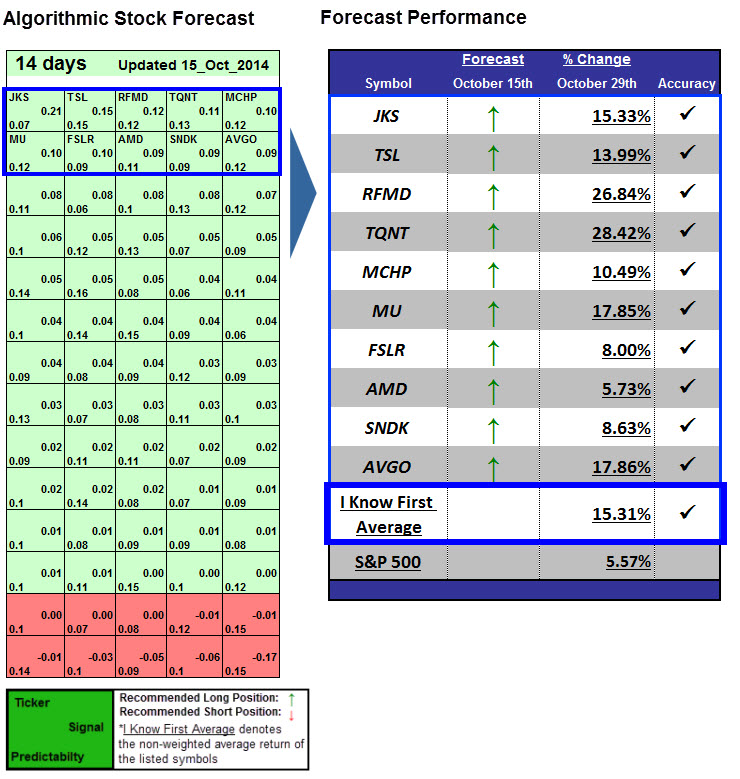

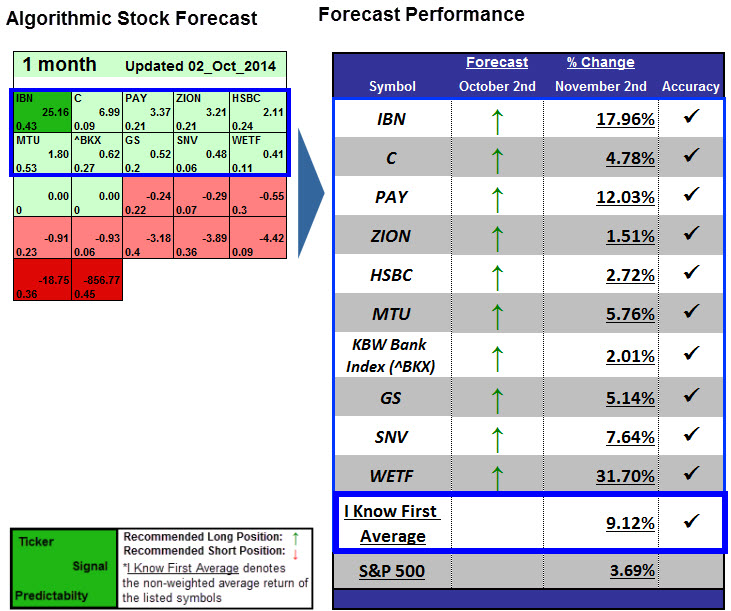

- I Know First state of the art market algorithm predictions for the 3 months and 1 year time horizons.

Introduction

Tesla Motors, Inc. (NASDAQ:

TSLA) is not just a stock with a symbol; it is the stock of what could possibly become the most

disruptive company of this decade. The company gave up profits and rejected producing

hybrid electric vehicles (HEV) to produce an all-electric vehicle fleet (EV). The company currently stands at the top of the electric car industry with its flagship the

Tesla Roadster, the

Model S Sedan, the upcoming

Model X Crossover SUV, and the announced mass market model III. For these reasons, it is not surprising that Tesla is one of the most watched stocks on the market. From a microeconomic perspective many analysts have projected both bullish and bearish forecasts; however, none of these perspectives took the time to look at the reduced risk through the big picture. Just take a step back and look at Tesla for what it is: the future of mobility. For the last two decades, we knew we must find an alternative to our reliability on gasoline, and this company finally did it. This article analyzes why Tesla can't fail from three unusual perspectives. The first is the astonishing progress Tesla made in such a short time as a start up in one of the most competitive,

entry barrier infected industries. Second is the guardian angel Elon Musk, who as a CEO does not only see Tesla as his business, but his life's work. And finally, the incredible growth strategy Tesla had, and why the real revenues are just around the corner.