Trading NYMEX (Crude Oil) Like a Quant: 55% Annual Return

Strategy for maximizing profits trading a single commodity.

Strategy for maximizing profits trading a single commodity.

Author: Daniel Hai

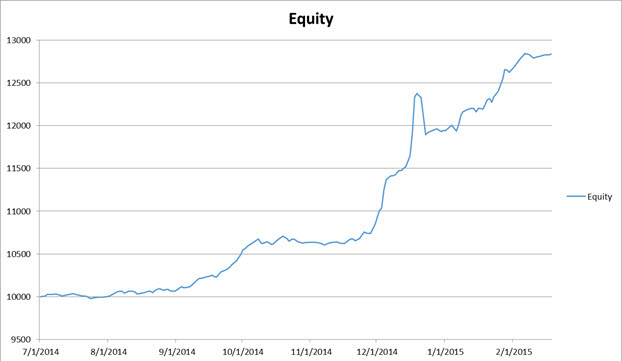

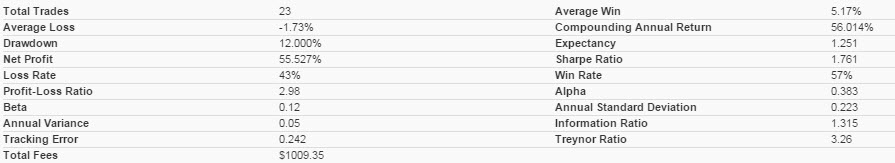

While I strongly believe in good portfolio diversification I want to discuss trading a single commodity in this post, NYMEX Crude Oil futures which I Know First tracks as CL1 in the commodities forecast. The strategy is unique in that is uses the long term signal to trigger a decision; however the shortest term signal (3 Days) us used to actually execute it. First of all the results are listed below. For testing I use the QuantConnect Lean Engine which is free and open (highly recommended). As they currently dont support futures I use the United States Oil ETF (USO). The results are an annual return of 55.5% with a sharpe ratio of 1.76 and an annual standard deviation of 22.3%.

The results are an annual return of 55.5% with a sharpe ratio of 1.76 and an annual standard deviation of 22.3%.Read More

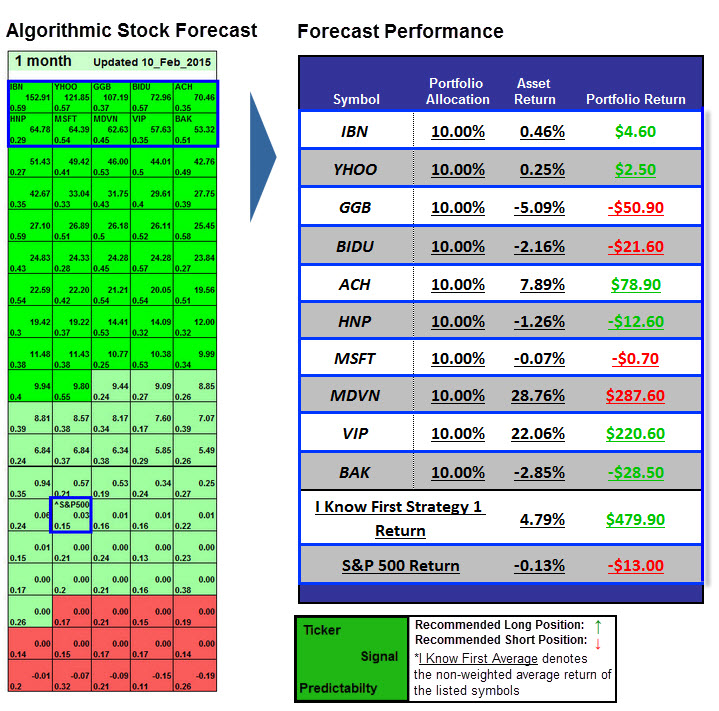

Global Market Forecast Based On Algorithms

What Happened in 2014 Globally?

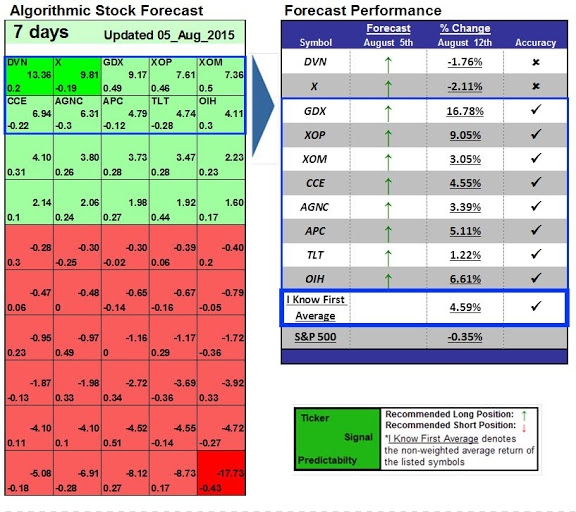

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm predicts the flow of money in almost 2000 markets across a range of time frames (e.g., 3-day, 1-month, 1-year). The algorithm’s predictability becomes stronger in the 1-month, 3-month, and 1-year horizons, so it is particularly useful as a long investment tool, albeit that it can also be used for intraday trading.

In the article “Stock

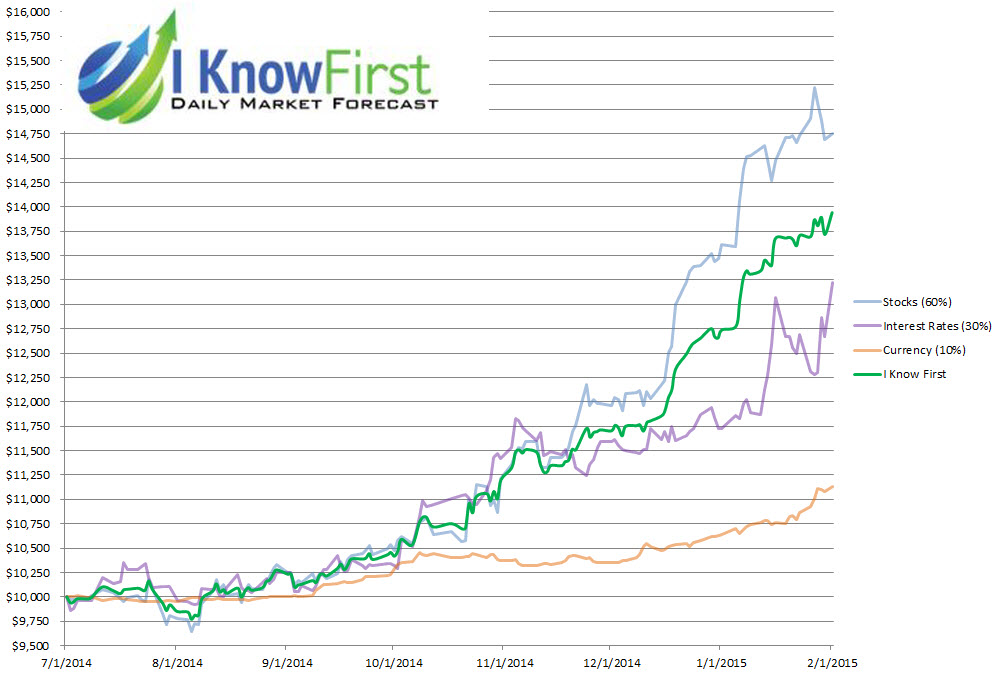

I Know First Hedge Fund Simulation: 39.5% Return in 7 Months

- I Know First hedge fund simulation -> 39.42%

- I Know First stock simulation ->47.54%

- I Know First interest rates simulation -> 32.27%

- I Know First G10 currencies simulation -> 11.00%

Trade Simulator – March, 2015 (Algorithmic Hedge Fund Simulation)

OVERVIEW

I Know First systematic hedge funds specialize in algorithmic trading according to the best market opportunities available on a daily basis. The market scanning is done on a nightly for over 6 markets and 2000 financial assets, through which we determine the best opportunities before the market opens the next morning. Good investments are often replaced by even better ones in order to ensure the portfolio performs at a constant optimum. The funds can trade according to any parameters and filters; moreover, they are generally market neutral.

SWING TRADING FUND - PERFORMANCE HIGHLIGHTS

- The swing trading nature of the fund involves a higher annual volatility of 11.1%, which is more than compensated by the expected annual return of 69.3%.

- I Know First’s performance to risk ratio (Alpha) is 6.08, and represents one of the highest figures in the algorithmic trading industry.

- While most algorithmic trading focuses on seconds to milliseconds (high frequency trading), I Know First scans the markets for longer horizons and is able to invest from the 1 day – 1 year investment horizons profitably.

- In December 2014 and January 2015, when the S&P500 dropped by -0.42% and -3.10%, I Know First had a monthly return of 7.18% and 7.71% respectively. In March 2015 as the S&P500 dropped -1.74%, the I Know First fund had its highest return to date of 8.76%.

Read The Full Article

Backtesting Trading Strategies – Forex & Currencies 28% in 7 Months