Volatility Trading Strategies: Up To 22.57% In 1 Month

Volatility Trading Strategy

This Volatility Index forecast is designed for investors and analysts who need predictions of the implied volatility for a basket of put and call options related to a specific index. It includes 8 volatility indices with bullish and bearish signals and indicates the best tech stocks to buy:- Volatility indices for the long position

- Volatility indices for the short position

Recommended Positions: Long

Forecast Length: 1 Month (02/15/15 – 03/15/15)

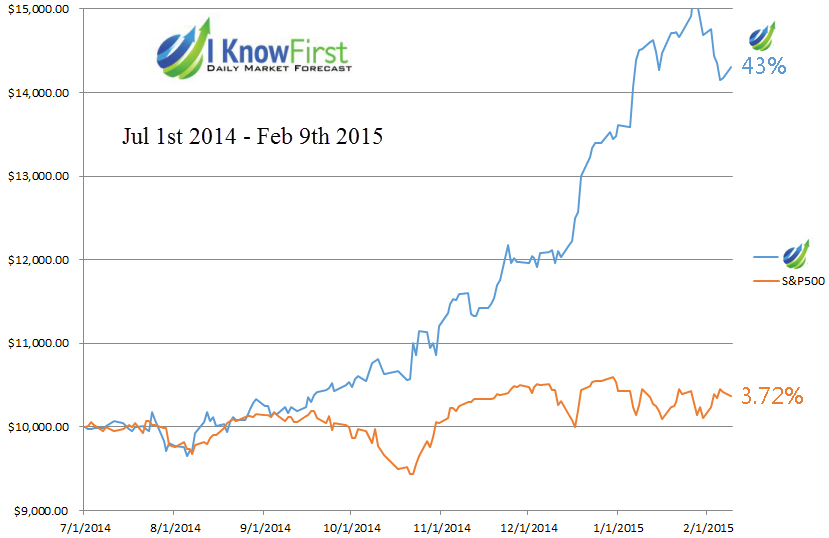

Forecast Length: 1 Month (02/15/15 – 03/15/15)I Know First Average: 3.31%

Get the “Volatility” Package.