Amazon Stock Forecast: 2020, A “Prime” Investment year

This Amazon stock forecast article is written by Hao Liu, Financial Analyst at I Know First.

This Amazon stock forecast article is written by Hao Liu, Financial Analyst at I Know First.

“2020 is setting up to be an e-commerce inflection year as the combination of shelter-in-place, lower spend on experiences (dining out, bars, travel, etc) and [government] stimulus have driven dollars online.”

— Brian Nowak, analyst at Morgan Stanley

Summary

- Various growth verticals together with new market penetrations will allow Amazon emerge from the pandemic stronger.

- The company will face challenges but they are estimated to be manageable.

- Despite a potential bearish scenario in the short term, we recommend to BUY AMZN in the long term.

Strong Financial Performance Over the Pandemic

There is no doubt that Amazon (AMZN) has delivered an impressive performance for the past quarter (Q1FY20). The company reported revenues of $75.5b in the quarter, compared with $59.7b in Q1FY19. Excluding the $387m unfavorable impact from Y/Y changes in foreign exchange rates throughout the quarter, net sales increased 27% compared with Q1FY19. Product revenues in the quarter was $41.8b, an increase of 13% Y/Y. Services revenues in the quarter grew 32.2% Y/Y to $33.6b.

For Q2FY20, Amazon expects net sales to grow in the range of 18% to 28% Y/Y to a range of $75b to $81b. Operating income is expected to range from a loss of $1.5b to an income of $1.5b, assuming around $4b of COVID-19-related costs.

According to CrispIdea Research Analysis Report, AMZN’s 5-year growth is expected to be 43.3% against S&P 500 average growth of 8.7%, which also looks promising.

Various Growth Verticals Build a Strong Wide Moat

In almost every significant growth market you can think of in the future, Amazon plays a role. Already been the leader in e-commerce industry, over the years Amazon has also expanded its business into digital payments (Amazon Pay), AI technology (Alexa), streaming TV (Prime Video), gaming (Twitch), and of course, cloud computing (AWS).

Particularly during this pandemic, AWS (Amazon Web Services) has proven to be a huge beneficiary with an over 30% leap in quarterly revenue (over $10b). Using cloud computing, AWS provides all kinds of products and services from commerce to business and entertainment. What people are most familiar with is that AWS offers messaging platform (Slack and Facebook) and streaming TV (Netflix and Disney) to support the working and relaxing activities in lockdown life. Actually it is also capable of accomplishing more complex analysis work and machine learning. AWS has penetrated into every aspect of people’s life in the period of social distancing and working from home.

Penetration Into New Markets Will Be Future Growth Driver

Not satisfied with current businesses, Amazon is also making its move to the new markets including healthcare and self-driving car market, which I believe is likely to become the big driver for its future growth.

With the introductions of “PillPack” and “Amazon Pharmacy” over the past 2 years, Amazon has showed great ambitions in the healthcare and pharmacy market. And the current pandemic situation is likely to accelerate Amazon’s push into this market. With Alexa’s effective skills and particularly now with telehealth demand surging, Amazon shows massive healthcare potential, especially with the pandemic.

Apart from healthcare, Amazon is also expanding into the automotive realm, which is very likely to be the future of automation. According to WSJ, the company is said to be in advanced talks to acquire Zoox , a robo-taxi developer. This is actually not Amazon’s first foray in autonomous vehicle technology. Last year the company has made an investment in Aurora, a self-driving developer.

Not All Are Merits in Amazon’s Future

Despite all the prosperity discussed above, Amazon also faces some challenges in the future. Firstly, the company’s response to the criticism on its labor and safety practices is not going to be cheap, which can hurt Amazon’s profitability. Following its share of missteps in April, Bezos (founder and CEO of Amazon) has warned investors that Amazon will spend $4b (estimated to be the entire Q2FY20 operating profit or even more) to ensure its employees’ safety, as well as to improve its logistics and operations to keep up with the surging demand. To accomplish this goal, last week Amazon also raised $10b in US corporate bond market. This is a pretty smart move. One the one hand, the borrowing cost is extremely low (carrying only 0.4% interest rate) by taking advantage of the current beneficial market conditions created by the Fed. On the other hand, the short-term liquidity risk and long-term solvency risk are relatively low compared to other corporations.

Secondly, as Elon Musk called for a break-up of Amazon because “monopolies are wrong”, there is potential that regulators take antitrust action to breakdown Amazon into several constituent parts. However, it remains a question when the de-merger level will be reached. According to calculations by Financial Times, it requires enormous growth assumptions to reach that figure. Also, although Amazon is a big company, the sectors it operates in are all highly competitive. In retail sector, Amazon faces competition from eBay, JD and Walmart; in streaming videos it competes with Netflix and Warner; the company also needs to contend for market share with big competitors in cloud computing sector such as Alphabet and IBM. Many of the competitors have larger market shares, longer operating histories as well as more resources than Amazon, and are also making efforts to seize a larger market over the years. This could constrain Amazon’s expansion. Therefore, it’s probably still early to consider the possible antitrust legislative impact on Amazon.

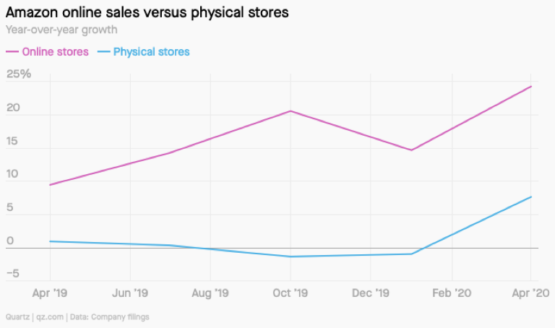

However, even if the de-merger happens down the road, I think the individual businesses are likely to be successful on their own based on their robust historical financial performances. As we can see that not only Amazon’s online business rose up following the boosting of e-commerce, but its physical stores (mainly Whole Foods grocery chain) also achieved increasing sales. Although this growth in sales may gradually subside following the COVID-19, Amazon is destined to keep its momentum because as I discussed in my last article about the post-pandemic market, the shift in customers’ shopping behaviors will be permanent.

Thirdly, there is foreign exchange risk. As Amazon makes constant efforts expanding its business to different parts of the world, the company is exposed to the volatility of US dollar against other currencies. Just in FY2019, Amazon suffered a loss of US$30 million from foreign currency translation adjustments. However, the company could enter into foreign exchange forward contracts to hedge this risk.

Technical Analysis Still Indicates a BUY

The recommendation for AMZN may not be a STRONG BUY (especially in short term) as our previous prediction, but still remains a BUY recommendation (especially in the long term). As we can see below, AMZN outperformed the market strongly over the past, increasing $400 even during the four recessions in April.

As we can see the MACD is slowly decreasing but still above the zero line, meaning the extreme momentum has passed but with a positive trend ahead in the short term. At closing time RSI is 61.92 , indicating AMZN is no longer as overbought as it once was. Actually, the past 6-months RSI shows that there was no fully oversold before the stock bottoms over the past 6 months, further indicating the trend is healthy. According to William %R, the price starts to fall into the -80 to -20 range and stays closer to the overbought level, meaning there’s no trading signal in the short run but the price is near the highs of its recent range.

However, as we can see in the green lines, a rising triangle is forming, which is likely to be a short-term bearish scenario here. However, considering the massive growth and the prospects for fundamentals discussed above, Amazon stock forecast is still bullish in the long run. For traders or investors who want to take advantage from this short-term bearish scenario, you can either enter the market (a more aggressive approach) or wait until the rising triangle bearish to the downside is confirmed (a relatively conservative approach), depending on your risk preference and investing strategy.

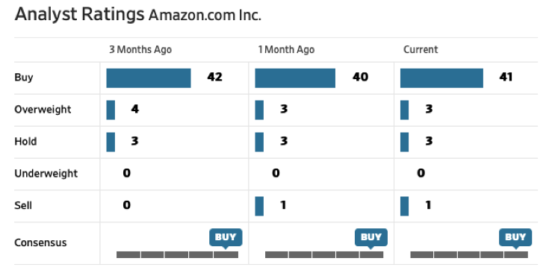

To summarize, the general recommendation will be BUY AMZN. There may be a bearish scenario ahead in the short term, but the long-term outlook is definitely bullish. The momentum indicator under oscillators may indicate a sell signal (just below buy level), most of the oscillators are neutral. While almost all of the moving average indicate strong buy, the BUY recommendation looks pretty solid. This conclusion is also in line with WSJ analyst ratings (see graph below).

Conclusion

It seems that 2020 is a big investment year for Amazon. Both fundamental and technical analyses of AMZN lead to a BUY recommendation.

On the fundamental side, with its wide penetration in e-commerce, AWS cloud hosting business and smart devices portfolio, Amazon is benefiting greatly form the pandemic. Furthermore, it is also taking full advantage of the situation by expanding into new market such as healthcare and self-driving car market, which is considered to be a stimulus to maintain its momentum in the future. In terms of the potential challenges the company is facing, how much impact the Coronavirus related expenses and antitrust regulations remains to be seen. But based on the robust result of financial analysis, the company will be able to keep up the momentum in the foreseeable future.

On the technical side, the strongest momentum has passed. Despite few oscillators indicate sell signal in the short term, the long term outlook for AMZN remains bullish.

Current I Know First Algorithmic Amazon Stock Forecast

I Know First Algorithm forecast dated on June 7th, 2020 leads to a similar conclusion as above analysis. As we can see form the chart below, there’s no significant bullish Amazon stock forecast in the coming 1 month or 3 months, but the yearly outlook is a strong bullish. The predictability also increases for the longer term prediction.

Go here to read how to interpret this diagram.

Past I Know First Success with Amazon Stock Forecast

On April 4th 2020, I Know First has made a bullish Amazon stock forecast, which proves to be successful as we see AMZN’s price rose by $400 in April and kept up the momentum ever since. Comparing the current and past predictions also further supports my conclusion above. In the short term AMZN is not a STRONG BUY as 2 months ago (the signal figures for 1-month dropped from 2.18 to 0.81, 3-months dropped from 3.48 to 2.19), but the long-term BUY recommendation gets stronger (the signal figure rise from 351.03 to 370.64).

Here at I Know First, one of the top fintech companies in the industry, our algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily S&P 500 forecast, including daily stock market forecast, currency exchange forecast, gold price forecast as well as AAPL stock price. In particular, I Know First has been closely watching and predicting the Coronavirus stock market to assist investors during this uncertain time.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.