Walmart Stock Forecast: Why Walmart Made A Pricey Gamble On Flipkart

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Watch out Amazon, Walmart is now a bigger threat after it acquired control of Flipkart.

- After SoftBank agreed to sell its 20% stake in Flipkart to Walmart, Walmart now owns 77% of Flipkart.

- Flipkart is India’s biggest e-commerce operator. The Flipkart Group ended 2017 with around 39.5% market share in India’s e-commerce sales.

- Morgan Stanley expects India’s e-commerce industry to grow at 30% CAGR. India will have gross merchandise value of $200 billion by 2026.

- Buying Flipkart gave Walmart a tailwind in Asia.

Sorry Amazon (AMZN), Walmart (WMT) just bought control of Flipkart. Walmart paid $16 billion to take a 77% stake in Flipkart – India’s top dog in e-commerce sales. Amazon made an offer earlier this month to buy a majority stake in Flipkart but it was all in vain. The large early investors of Flipkart like SoftBank (SFTBY) chose Walmart’s offer.

This development is a good reason to go long WMT. Walmart clearly expanded its global footprint by taking over India’s biggest e-commerce company. Flipkart could push Walmart’s international revenue to $200 billion within the next three years.

(Source: Walmart/Flipkart)

Why This Victory Matters

India’s huge population of 1.29 billion makes it a great expansion market for Walmart. India’s rising average per capita income makes many people there potential repeat customers for Flipkart. Walmart’s global net sales is in a slow-growth trend because it has failed to compete better against online retailers like Amazon (AMZN).

As you can see from the Premium chart of Statista, Walmart’s global revenue was largely stagnant since 2014. Walmart needs Flipkart to shore up its topline growth.

Taking a leadership role in India’s e-commerce business helps ease the embarrassment of Walmart’s failure in China. JD.com (JD) and Alibaba (BABA) already dominate China’s retail industry. Walmart and Amazon now only have India as a sizeable expansion opportunity. Lazada – a subsidiary of Alibaba, already owns Southeast Asia’s e-commerce industry.

Walmart will pump in another $2 billion to shore up Flipkart’s operations. This will keep it ahead of Amazon in India’s rapidly growing e-commerce industry. India’s online retail business generated revenue of $20.3 billion last year. It is expected to grow to $27 billion this year. The Flipkart Group (which includes Jabong and Myntra) had a 39.5% share in last year’s e-commerce sales.

Yes, The Purchase Price For Flipkart Is Expensive – But It’s Worth It

I will agree with anyone who thinks the $16 billion payment for the 77% stake in Flipkart was on the pricey side. Back in April 2017, Flipkart’s total valuation was only $11.6 billion. However, the investment in Flipkart Group is a shortcut bet on the rapidly-growing online retail business of India. Without the investment in Flipkart, Walmart will spend many years before it can make any notable share in India’s online and traditional retail industry.

Walmart’s recent quarterly free cash flow was $8.13 billion. It can easily afford taking on new debt to finance its 77% stake acquisition in Flipkart. The $18 billion total investment in Flipkart can be perceived as a buying a giant online mall which can accommodate 1.3 billion Indian customers. Walmart can push thousands of its American products via Flipkart. Alibaba is now using Lazada as a gateway to sell China-made Taobao products to South East Asians.

Morgan Stanley believes the gross merchandise value (GMV) of India’s e-commerce industry will growth at 30% CAGR. By 2026, Morgan Stanley expects India’s online retail business will have a GMV of 200 billion. Statista’s 2025 prediction expects India’s e-commerce trade to hit $188 billion in revenue. Morgan Stanley and Statista agree that India indeed is a coveted expansion market for retailers like Walmart and Amazon.

Conclusion

Going long on WMT is a safer move than investing on AMZN. Walmart is a low-beta or low risk long-term investment that has wide moat in the retail industry. Compared to the stratospheric valuation of AMZN, WMT only has a forward Price/Earnings ratio of 15.79. Walmart’s Price/Sales ratio is only 0.49. Amazon’s forward P/E is 81.09 and its P/S ratio is 4.39x.

Flipkart will help grow Walmart’s e-commerce muscle. Five years from now, Walmart might displace Amazon as the world’s no.1 Business-to-Consumer online marketplace. We have to take into account that the 11,718 of Walmart brick & mortar stores around the world can actually become distribution/delivery centers for online purchases.

A Walmart store can become a hub for future smart delivery drones. The Trump administration approved Walmart’s drone project. Amazon was not one of the companies that got approval to test delivery drones. Walmart will probably be the first retailer to start operating delivery drones for products bought online.

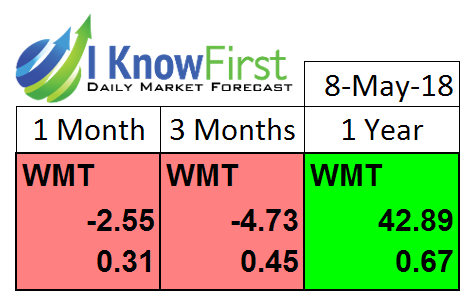

Its bullish one-year algorithmic market trend forecast score backs my buy rating for WMT. The 0.67 predictability score of WMT’s one-year forecast is saying I Know First has a great history of correctly predicting the 12-month trend of Walmart’s stock.

Analysis of the monthly technical indicators and moving averages trend also rates Walmart’s stock as a buy.

(Source: Investing.com)

Past I Know First Forecast Success With Walmart

On August 30, 2017, I Know First Research published a bullish article about Walmart. In the article, the author discussed effects of the Amazon’s takeover of Whole Foods and Google’s help in voice-assisted smart online shopping that could help Wal-Mart minimizing the threat from Amazon/Whole Foods. Since the forecast date WMT has returned 23.33% in 3 months in accordance with the I Know First algorithmic forecast.

This bullish forecast for WMT was sent to I Know First subscribers on August 30, 2017.

To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.