TSM Stock Forecast: The World’s Leading Semiconductor Producer with Promising Growth

This TSM Stock Forecast article was written by Yuwei Zhou – Financial Analyst at I Know First.

Highlights:

- TSM’s revenue has risen by 43.53% since Q2 2021

- TSM will construct and operate a fab that utilizes 12/16- and 22/28-nanometer technology to address strong global market demand

- The company is constructing a $12 billion plant in the U.S. state of Arizona to save the worldwide chip shortage

- Outperforming profitability and liquidity with an undervalued price

Overview

Established in 1987 and headquartered in Hsinchu Science Park, Taiwan, Taiwan Semiconductor Manufacturing Company TSMC (NYSE: TSM) pioneered the pure-play foundry business model with an exclusive focus on manufacturing customers’ products. TSMC’s foundry business model has enabled the rise of the global fabless industry, and since its inception, TSMC has been the world’s leading semiconductor foundry.

TSMC is the world’s largest contract chipmaker and serves a global customer base that is large and diverse and includes a wide range of applications. These products are used in a variety of end markets including mobile devices, high-performance computing, automotive electronics, and the Internet of Things (IoT). Such strong diversification helps to smooth fluctuations in demand, which in turn allows TSMC to maintain higher capacity utilization and profitability levels, and generate healthy returns for future investment.

The largest Contract Chipmaker with Good Prospects

In the past 3 years, TSMC strengthened its leading position in the foundry segment of the global semiconductor industry, maintaining one-fourth market share, while TSMC’s revenue has increased by 53.9%. This 3-year revenue growth rate is better than 68.94% of 834 companies in the Semiconductors industry. Its revenue in Q2 2022 was $534.14 million, with a rise of 43.53% compared to the last year. The growth was mainly driven by the continued expansion of 5G and high-performance computing-related (HPC) applications.

In recent years, TSMC’s solid growth in the foundry segment was fueled by strong, broad-based market demand. Industry megatrends, such as 5G, and artificial intelligence (AI) proliferation drove increased demand across all major markets: smartphones, high-performance computing (HPC), Internet of Things (IoT), and automotive. It seems to healthily increase in the overall demand for electronic devices in general.

For the five major markets above, the focus of customer demand is shifting from process-technology-centric to product-application-centric. In the short term, TSMC substantially ramps up the business and sustains advanced technology market share by continually increasing capacity and R&D investments (Research and Development Expenses raised to US$2.64 million for the six months ended June 30, 2022). In the long term, TSMC will provide more integrated services, covering system-level integration design, design technology definition, design tool preparation, wafer processing, 3DFabricTM advanced packaging, and silicon stacking technologies.

In December 2021, TSMC established a subsidiary, Japan Advanced Semiconductor Manufacturing, Inc. (JASM), with Sony Semiconductor Solutions Corporation and DENSO Corporation participating as minority shareholders. JASM will construct and operate a fab that utilizes 12/16- and 22/28-nanometer technology to address strong global market demand for specialty technologies. Production is targeted to begin by the end of 2024.

Taiwan President Tsai Ing-wen showed the willingness to cooperate with the U.S. to produce “democracy chips” recently. Under the background of the chip shortage tide sweeping the world, the ability of TSMC to produce customer electronics is definitely sought-after. TSMC, the major Apple Inc supplier, is constructing a $12 billion plant in the U.S. state of Arizona. This will have a positive influence on the supply chain and future opportunities.

TSMC’s Outperforming Financial Position and Valuation

TSM’s leading position and high level of technology in smartphone and high-performance computing-related (HPC) applications have brought the company substantial revenue and rapid growth. EPS is an important indicator reflecting a company’s profitability. The high level of ability to make a profit has led to unexpected EPS numbers for TSM, which earnings performance has exceeded expectations several times in a row.

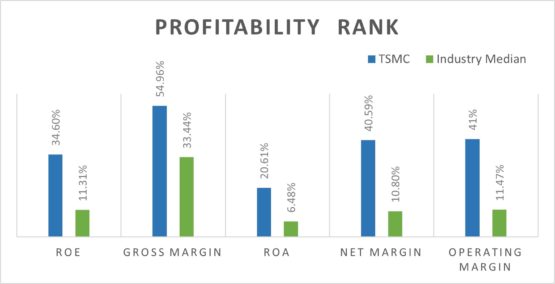

According to TSMC’s quarterly report for Q2 2022, the company has $ 117.9 mln free cash flow forming. According to GuruFocus, the ROE of TSMC is 34.6% which is better than 91.32% of companies in the Semiconductors industry. The high level of profitability results from a high net profit margin, 40.59%, which is higher than 96.9% of companies in the same industry, and the medium number is 10.08%. All the data above illustrates the ability of TSMC to generate cash flow. The operating margin of TSMC is 41%, which is ranked better than 97.45% of 903 companies in the Semiconductors industry. Such data performance is very excellent in the industry, according to the median is 11.47%. Furthermore, the cash ratio of TSMC is 172% surpassing 68.62% of companies in the Semiconductors industry. Plenty of cash flow ensures liquidity and seizes opportunities when they arise.

In the past 10 years, the dividend growth rate of TSMC is 17.5%, with EPS and dividend per share continuously raising. These ratios represent overall raising trends, which means a strong ability to create wealth for shareholders.

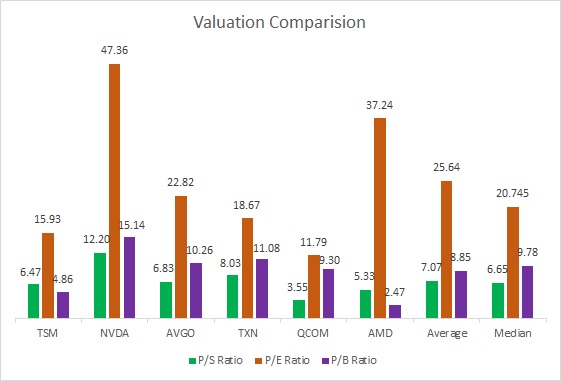

Furthermore, let’s take NVIDIA Corp. (NVDA), Broadcom Inc. (AVGO), Texas Instruments Inc. (TXN), QUALCOMM Inc. (QCOM), and Advanced Micro Devices Inc. (AMD) as comparable companies to evaluate TSM’s financial competitiveness.

TSM’s current P/E, P/S, and P/B ratios of 15.93, 6.47, and 4.86 are lower than average and median numbers, respectively. Taking the profitability rank and liquidity mentioned above into consideration, the stock price of TSMC is undervalued.

Conclusion

I stand for the buy-side on TSM stock. TSM has highly advanced technology to address strong global market demand, which will sustain TSM’s legacy of above-forecast revenue growth. I believe that TSM will seize the world’s chip shortage and make full use of the new factory in Arizona to write a brilliant future. In a nutshell, according to the profitability and liquidity rank and under-valued stock price, it is reasonable to estimate further growth in the future.

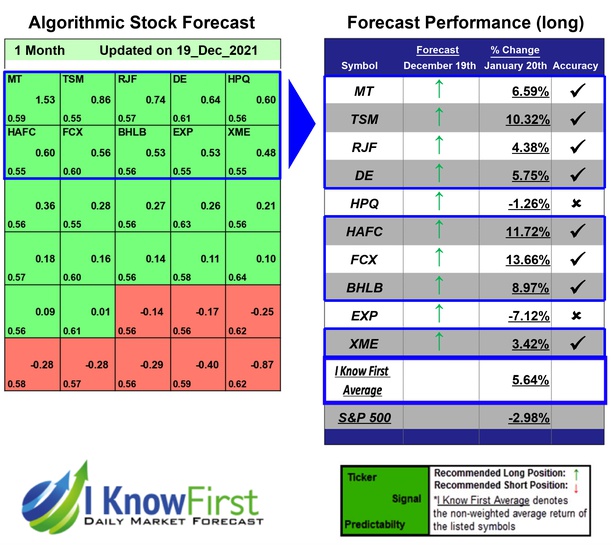

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the TSM stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with TSM Stock Forecast

I Know First has been bullish on the TSM stock forecast in the past. On December 19, 2021, the I Know First algorithm issued a forecast for TSM stock price and recommended TSM as one of the best stocks to buy. The AI-driven TSM stock prediction was successful on a 1-month time horizon resulting in more than 10.32%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.