The AI Investment Revolution: How Algorithmic Strategies Crushed Hedge Funds Giants in January 2026

Article Written by Samy Nakach – Investment Analyst at I Know First

Highlights

- IKF Combined Long/Short Strategy delivered +3.54%, outperforming Point72 (+2.9%), Millennium (+1.4%), and Citadel Wellington (+1.0%)

- IKF MAGIC Strategy returned +2.04%, beating the S&P 500 by +0.56% and outperforming Citadel Wellington by +1.04%

- Both IKF AI strategies exceeded the S&P 500 (+1.47%) during a month marked by geopolitical volatility and commodity dislocations

- AI-powered algorithms demonstrated superior adaptability compared to traditional multi-strategy hedge funds managing $70B+ in assets

- Multi-horizon confirmation and Signal × Predictability scoring enabled IKF strategies to navigate January’s market turbulence while maintaining positive returns

- Institutional investors increasingly recognize that AI-driven systematic approaches offer scalability, transparency, and performance that traditional hedge funds struggle to match

January 2026 Performance: IKF AI Strategies Lead the Pack

| Strategy/Fund | January 2026 Return |

|---|---|

| IKF Combined Long/Short | +3.54% |

| Point72 | +2.9% |

| IKF MAGIC Strategy | +2.04% |

| Balyasny | +2.0% |

| S&P 500 (SPY) | +1.47% |

| Millennium | +1.4% |

| Citadel Wellington | +1.0% |

About Hedge Funds

- Point72 is a leading global alternative investment firm led by Steven A. Cohen that deploys fundamental equities, systematic, macro, private credit, and venture capital strategies.

- Balyasny is a global multi-strategy hedge fund with over $31 billion in AUM utilizing strategies like equity long/short, macro, and commodities to generate uncorrelated returns.

- Milennium is a global, diversified alternative investment firm managing +$85B in AUM

- Citadel is a global multi-strategy hedge fund managing over $65B in AUM

January 2026 Performance Ranking

What This Chart Shows:

- IKF Combined Long/Short leads all strategies with +3.54%

- Point72, one of the world’s most sophisticated multi-strategy platforms, delivered +2.9%

- IKF MAGIC outperformed both the S&P 500 and Citadel Wellington

- Millennium and Citadel Wellington, managing $70B+ each, delivered +1.4% and +1.0% respectively

- Both IKF AI strategies significantly exceeded the S&P 500 benchmark

What Happened in Markets During January 2026

January 2026 delivered a challenging environment that tested the resilience and adaptability of every investment approach:

Geopolitical Volatility

According to Reuters and Bloomberg reporting, U.S. military action in Venezuela created significant market uncertainty along with possible action from President Trump on Greenland. Equity markets initially sold off on the news before recovering as investors assessed the scope and duration of the conflict.

Federal Reserve Uncertainty

Questions surrounding Federal Reserve independence emerged mid-month, creating uncertainty around monetary policy direction. Traditional correlations between interest rate expectations and equity valuations became less predictable.

Commodity Market Dislocations

The most dramatic development was in natural gas futures, which surged +140% between January 20-28 due to extreme cold weather across the United States. This violent move in commodities rippled through energy sector equities and broader market volatility measures. Other commodities such as Gold and Silver plunged due to Trump appointed a new chairman of the Federal Reserve

Liquidity Challenges

The combination of geopolitical news flow, commodity volatility, and policy uncertainty created periodic liquidity thinning in equity markets, widening bid-ask spreads and increasing execution costs.

This environment favored adaptive, systematic approaches over rigid models or human-only discretionary strategies.

Strategy Structures: How IKF AI Strategies Are Beating the Market and Major Hedge Funds

IKF Combined Long/Short Strategy: +3.54% in January

Portfolio Structure:

How This Strategy Beat Point72 (+2.9%), Millennium (+1.4%), and Citadel (+1.0%):

1. Multi-Layer Diversification with Concentration

While maintaining exposure to broad sectors (60% in GICS L1 ETFs), the strategy concentrates capital in high-conviction individual stocks (20%) identified through AI signals. This balance captures both sector trends and individual stock alpha.

2. Dynamic Sector Rotation

The 10% GICS Level 2 allocation enables tactical positioning in industry sub-sectors showing strongest AI signals. During January, this captured rotations within sectors that broad equity exposure missed.

3. Liquidity Management Through SPY/OEF

The 10% SPY/OEF allocation acts as a portfolio stabilizer during volatility spikes and provides liquidity for rebalancing. During January’s mid-month selloff, this allocation limited drawdowns while maintaining exposure to the subsequent recovery.

4. Multi-Horizon Signal Confirmation

Every position required alignment across 4+ of 6 time horizons (3-day through 1-year). This filtering prevented the algorithm from chasing false breakouts during January’s choppy price action—a mistake that likely hurt discretionary traders at traditional hedge funds.

5. Signal × Predictability Scoring

Each asset is ranked by Internal Score = Signal × Predictability, ensuring capital flows to opportunities with both directional conviction (Signal) and confidence (Predictability). This two-dimensional filter prevented allocation to noisy or low-conviction positions.

Why This Beat Traditional Hedge Funds:

Multi-strategy platforms like Point72, Millennium, and Citadel rely on human portfolio managers making discretionary decisions within risk constraints. Even the most talented PMs can only analyze 20-50 positions deeply. IKF’s algorithm analyzes 13,500+ assets simultaneously across 50+ global markets, identifying cross-asset opportunities that human-only approaches miss.

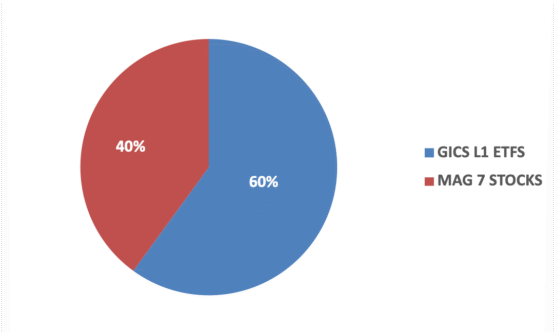

IKF MAGIC Strategy: +2.04% in January

Portfolio Structure:

- 60% GICS Level 1 Sector ETFs (3 positions) – Sector-level diversification

- 40% Magnificent Seven Stocks (3 positions) – High-conviction mega-cap technology/AI leaders

How This Strategy Beat the S&P 500 (+1.47%), Millennium (+1.4%), and Citadel (+1.0%):

1. Concentrated Mega-Cap Exposure

The 40% allocation to Magnificent Seven stocks provides high-conviction exposure to companies driving AI, cloud computing, and digital transformation. These mega-cap leaders have structural advantages (pricing power, cash flow, R&D budgets) that smaller companies lack.

2. Sector ETF Foundation

The 60% sector ETF allocation provides broad market exposure while avoiding single-stock concentration risk. This structure captures sector trends identified by AI signals while limiting idiosyncratic risk.

3. Growth-Focused Selection

The algorithm prioritizes assets with strong positive signals across multiple time horizons, creating a growth-tilted portfolio that outperforms during risk-on environments while sector ETFs provide stability during corrections.

4. Rebalancing Discipline

Monthly rebalancing ensures the portfolio continuously aligns with current AI signals. If a Magnificent Seven position weakens (declining Signal or Predictability), the algorithm rotates to the next-highest-ranked alternative.

Why This Beat Traditional Approaches:

Many hedge funds maintain broad diversification across 50-200+ positions to manage risk. While diversification limits downside, it also dilutes alpha. The MAGIC Strategy’s concentrated approach—just 6 total positions—maximizes exposure to highest-conviction opportunities while sector ETFs manage tail risk.

The Technical Edge: Why IKF’s AI Algorithms Succeeded Where Others Struggled

1. Deep Self-Learning Neural Networks

IKF’s proprietary DSL (Deep Self-Learning) algorithm doesn’t just analyze historical patterns—it learns from market evolution in real-time. The neural network architecture identifies non-linear relationships between:

- Price patterns across multiple timeframes

- Cross-asset correlations (equities, sectors, commodities, currencies)

- Volatility regimes and regime transitions

- Market microstructure and order flow dynamics

Why This Matters:

When January’s geopolitical shocks and commodity dislocations created correlation shifts, the algorithm adapted its internal weights rather than rigidly following historical patterns. This adaptability is what separates modern AI from traditional quantitative models.

Continuous Learning and Adaptation

Unlike static quantitative models calibrated to historical periods, IKF’s neural networks continuously update as new market data arrives. The genetic algorithm optimization layer refines model parameters in real-time.

Why This Matters:

January’s natural gas spike (+140%), geopolitical news flow, and Fed uncertainty created conditions unlike recent history. Static models broke. Adaptive AI adjusted.

Global Opportunity Set: 13,500+ Assets Across 50+ Markets

The algorithm monitors:

- U.S. equities (S&P 500, Russell 2000, Nasdaq components)

- International equities (Europe, Asia-Pacific, emerging markets)

- Sector ETFs (GICS Level 1 and Level 2)

- Commodities, currencies, indices, interest rate instruments

- Cryptocurrencies and alternative assets

Why This Matters:

Even the best human portfolio manager can deeply analyze 20-50 positions. IKF’s algorithm evaluates 13,500+ opportunities simultaneously, identifying cross-asset relationships and rotational opportunities that single-market specialists miss.

For example: during January, the algorithm identified that certain sector ETFs would benefit from natural gas volatility while specific mega-cap tech stocks would outperform despite broader market choppiness. A traditional equity-focused PM might miss the commodity-equity linkage.

Why AI Adoption Is Accelerating Among Institutional Investors

January 2026’s performance is not an isolated success—it reflects a multi-year trend driving institutional capital toward AI-powered strategies:

The Scalability Problem Facing Traditional Hedge Funds

Point72 ($35B AUM), Millennium ($70B AUM), and Citadel ($72B AUM) are hitting capacity constraints.

As these multi-strategy platforms grow, finding enough uncorrelated alpha sources becomes exponentially harder. Adding more portfolio manager “pods” dilutes average talent quality. The largest funds are effectively indexing their talent pool.

Key Issue:

Performance degrades as AUM grows beyond $50-70B. Point72, Millennium, and Citadel have all limited new capitalat various times because deploying additional billions without diluting returns is nearly impossible.

AI’s Advantage:

Algorithmic strategies analyze the same 13,500+ asset opportunity set whether managing $100M or $10B. Performance doesn’t degrade with scale—capacity constraints are driven by liquidity and market impact, not talent scarcity.

Key-Person Risk: What Happens When Star PMs Leave?

Multi-strategy platforms depend on retaining top portfolio manager talent. When a star PM generating $50-100M+ in annual profits departs:

- That pod’s performance often craters

- Capital allocated to that strategy must be reallocated

- Institutional investors question continuity

Recent Industry Examples:

Multiple high-profile PM departures from major multi-strats in 2024-2025 led to pod closures and capital redemptions.

24/7 Global Market Monitoring: Human Limitations vs. Algorithmic Vigilance

Human Portfolio Managers:

- Work 60-80 hour weeks

- Focus on specific sectors or geographies (tech specialist, financials specialist, etc.)

- Monitor 20-50 positions deeply

- Limited ability to track Asian market opens, European closes, after-hours U.S. trading simultaneously

IKF’s AI Algorithms:

- Monitor 13,500+ assets continuously

- Cover 50+ global markets without geographic limitations

- Identify opportunities in Asian equities at 2 AM EST, European industrials at 8 AM EST, U.S. tech at 4 PM EST

- Never sleep, never take vacations, never have “off days”

Human Decision-Making Challenges:

- Loss aversion: Holding losing positions too long, selling winners too early

- Recency bias: Over-weighting recent events, under-weighting base rates

- Confirmation bias: Seeking information that supports existing views

- Panic during volatility: Emotional reactions during market stress

AI’s Advantage:

Executes systematic rules without emotion. The algorithm doesn’t:

- Panic during drawdowns

- Chase performance during rallies

- Second-guess signals during uncertainty

- Deviate from process during stress

During January’s mid-month volatility, IKF’s algorithms maintained exposure to high-Signal, high-Predictability positions even as prices temporarily declined. Human PMs often cut positions during volatility spikes—locking in losses before the recovery.

The Track Record: Consistent Outperformance Across Market Regimes

January 2026 is not an outlier—it’s part of a multi-year pattern:

IKF MAGIC Strategy (2020-2026 YTD):

IKF Combined Long/Short Strategy (2020-2026 YTD):

IKF Combined Strategy (2020-2026 YTD):

Performance Across Different Market Environments:

- Bull markets: Outperformed (2020-2021, 2024-2025)

- Corrections: Outperformed (early 2022, Q2 2025)

- Volatility spikes: Outperformed (March 2020, January 2026)

- Regime transitions: Outperformed (Fed policy pivots, geopolitical shocks)

This consistency across regimes is what institutional investors value most. Any strategy can outperform in a specific environment. Outperforming across environments demonstrates robust, adaptable systematic processes.

Closing Remark: The Future of Institutional Investing Is Already Here

January 2026 delivered a clear message: AI-powered systematic strategies are no longer experimental—they’re superior.

The evidence is undeniable:

- IKF Combined Long/Short (+3.54%) outperformed Point72 (+2.9%), Millennium (+1.4%), and Citadel Wellington (+1.0%)

- IKF MAGIC (+2.04%) beat the S&P 500 (+1.47%) and major multi-strategy funds

- Both strategies demonstrated superior adaptability during a volatile, unpredictable month

For decades, institutional investors believed the best risk-adjusted returns required discretionary human judgment, massive research teams, and complex organizational structures. January 2026 proved otherwise.

The future of asset management isn’t coming—it’s already here. AI-powered strategies are outperforming Wall Street’s most sophisticated hedge funds. The institutions that recognize this shift early will capture the alpha. Those that cling to outdated models will face increasing pressure to justify their fees, their processes, and their results.

The choice is clear. The data is conclusive. The future is algorithmic.

Ready to Harness AI-Powered Alpha?

Discover how I Know First’s algorithmic forecasting can transform your portfolio management:

REQUEST A CUSTOM AI STRATEGY →

About I Know First:

I Know First is a leading AI-powered WealthTech company providing daily algorithmic stock market forecasts for institutional investors, hedge funds, family offices, and retail investors. Our proprietary Deep Self-Learning algorithm analyzes over 13,500 assets across 50+ global markets using advanced neural networks and genetic algorithms to identify the best investment opportunities. Winner of multiple industry awards including the Geneva WealthTech Award, Fintech Investment Competition, and recognized as a WealthTech100 company.

Contact: iknowfirst@iknowfirst.com

Learn More: www.iknowfirst.com

Disclaimer:

I Know First-Daily Market Forecast does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts, and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor. Past performance does not guarantee future results.