Stock Market Forecast: 38.92% Return in 3 Months

Recommended Positions: Long

Forecast Length: 3 Months (6/15/2014 – 9/15/2014)

Forecast Length: 3 Months (6/15/2014 – 9/15/2014)I Know First Average: 6.63% Get the "Risk-Conscious" Package.

Read More

Read More Forecast Length: 3 Months (6/15/2014 – 9/15/2014)

Forecast Length: 3 Months (6/15/2014 – 9/15/2014) Read More

Read More Forecast Length: 90 days (6/15/14 – 9/15/14)

Forecast Length: 90 days (6/15/14 – 9/15/14)Get the "Best small caps Stocks" Package.

Read More

Read More Forecast Length: 1 month (8/15/2014 – 9/15/2014)

Forecast Length: 1 month (8/15/2014 – 9/15/2014)

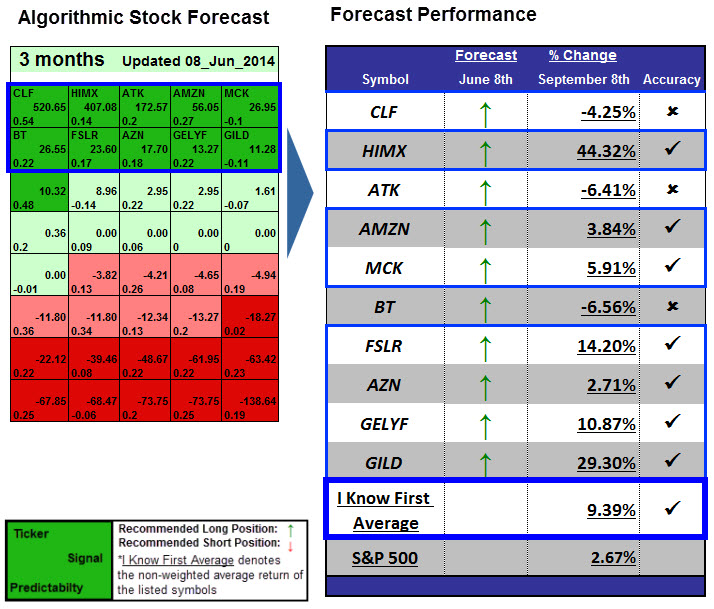

Package Name: Risk-Conscious

Recommended Positions: Long

Forecast Length: 3 Months (6/8/13 – 9/8/14)

I Know First Average: 9.39%

Quantitative Analysis: This forecast is part of the "Risk-Conscious" package, as one of I Know First's quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

Package Name: Risk-Conscious

Recommended Positions: Long

Forecast Length: 1 Year (9/6/13 – 9/6/14)

I Know First Average: 49.51%

Read More

Read MoreDisclaimer:

I Know First-Daily Market Forecast, does not provide personal investment or financial advice to individuals, or act as personal financial, legal, or institutional investment advisors, or individually advocate the purchase or sale of any security or investment or the use of any particular financial strategy. All investing, stock forecasts and investment strategies include the risk of loss for some or even all of your capital. Before pursuing any financial strategies discussed on this website, you should always consult with a licensed financial advisor.