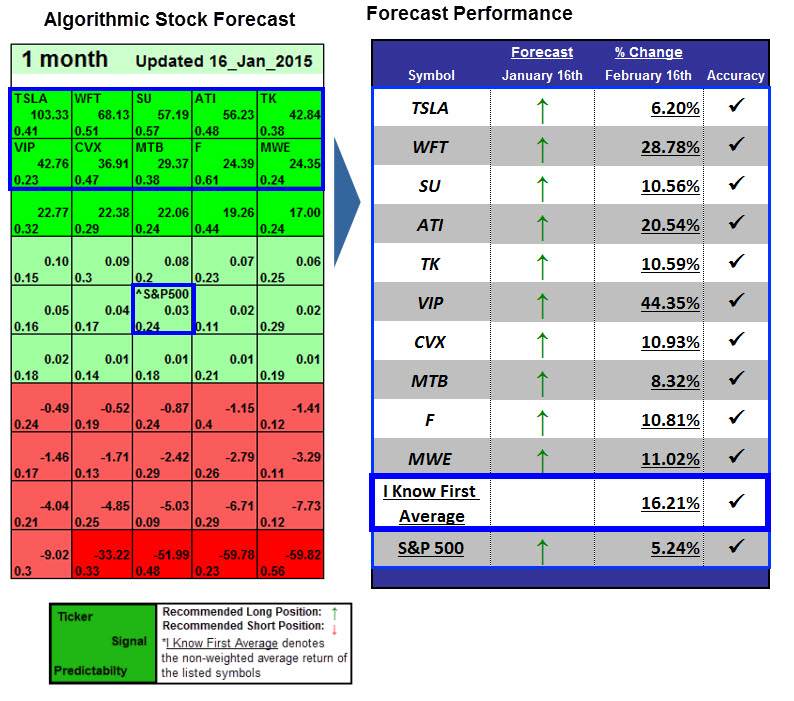

Stock Forecast Based on Machine Learning: Up To 44.35% Return In One Month

Stock Forecast Based on Machine Learning

This forecast is part of the “Top 10 stock picks ” package, as one of I Know First’s algorithmic trading tools. The full Top 10 stock picks forecast includes a daily predictions for a total of 20 stocks with bullish signals:

- top 10 stock picks to long

- top 10 stock picks to short

- S&P 500 forecast

Recommended Positions: Long

Forecast Length: 1 Month (01/16/15 – 02/16/15)

Forecast Length: 1 Month (01/16/15 – 02/16/15)I Know First Average: 16.21%

Get the "Top 10 Stock Picks" Package.

one of the most famous tech companys, mostly due to the Windows Operational System. Currently the company develops, licenses, markets, and supports software, services, and devices worldwide. The companys Devices and Consumer (D&C) Licensing segment licenses Windows operating system and related software; Microsoft Office for consumers; and Windows Phone operating system. Its Computing and Gaming Hardware segment provides Xbox gaming and entertainment consoles and accessories, second-party and third-party video games, and Xbox Live subscriptions; surface devices and accessories; and Microsoft PC accessories.

one of the most famous tech companys, mostly due to the Windows Operational System. Currently the company develops, licenses, markets, and supports software, services, and devices worldwide. The companys Devices and Consumer (D&C) Licensing segment licenses Windows operating system and related software; Microsoft Office for consumers; and Windows Phone operating system. Its Computing and Gaming Hardware segment provides Xbox gaming and entertainment consoles and accessories, second-party and third-party video games, and Xbox Live subscriptions; surface devices and accessories; and Microsoft PC accessories.