Successful Stock Forecast: W&T Offshore Inc. (NYSE: WTI) Drilled Down To Profit In 2017 And Already Mined 18.75% In 3 Days

Successful Stock Forecast

“We are extremely pleased to form this multi-year joint exploration and development program that will allow us to continue unlocking the value of our significant drilling opportunities while drastically reducing our capital expenditures.” – Mr. Tracy Krohn, W&T Offshore Chairman and Chief Executive Officer

[Image Source: Flickr]

[Source: Yahoo Finance]

[Source: Yahoo Finance]

The above highlights could not pass unseen by the market, especially in the light of coming Q1 2018 W&T Offshore, Inc. earnings conference call. Although the analyst community took hold position on WTI stock, market observed its growth of 18.75% on the week started on April 16, 2018. The below chart illustrates this:

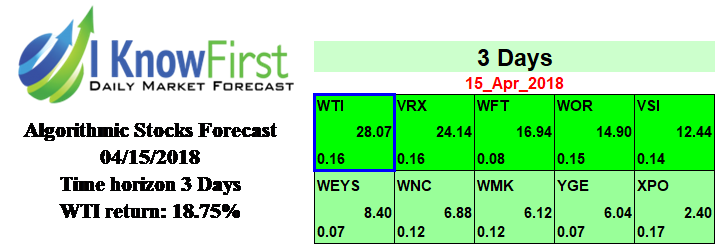

On April 15, 2018, I Know First issued a bullish 3 days forecast for W&T Offshore Inc. (NYSE: WTI). The forecast illustrated a signal of 28.07 and a predictability of 0.16. In accordance with the forecast, WTI’s stock returned 18.75% over this period, highlighting the accuracy of the prediction produced by the I Know First algorithm.

Current I Know First subscribers received this bullish WTI forecast on April 15, 2018.

To subscribe today click here.

W&T Offshore, Inc. (NYSE: WTI), an independent oil and natural gas producer, acquires, explores for, and develops oil and natural gas properties in the Gulf of Mexico. The company sells crude oil, natural gas liquids, and natural gas. It holds working interests in approximately 49 offshore fields in federal and state waters. The company also owns interests in approximately 135 offshore structures. It has interests in offshore leases covering approximately 370,000 net acres spanning across the Outer Continental Shelf off the coasts of Louisiana, Texas, Mississippi, and Alabama. As of December 31, 2017, its total proved reserves were 74.2 million barrels of oil equivalent. W&T Offshore, Inc. was founded in 1983 and is headquartered in Houston, Texas.

Disclaimer

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.