Quick Win by the Algorithm: Vale Is Looking Optimistic

Quick Win by the Algorithm

Vale S.A. (VALE)

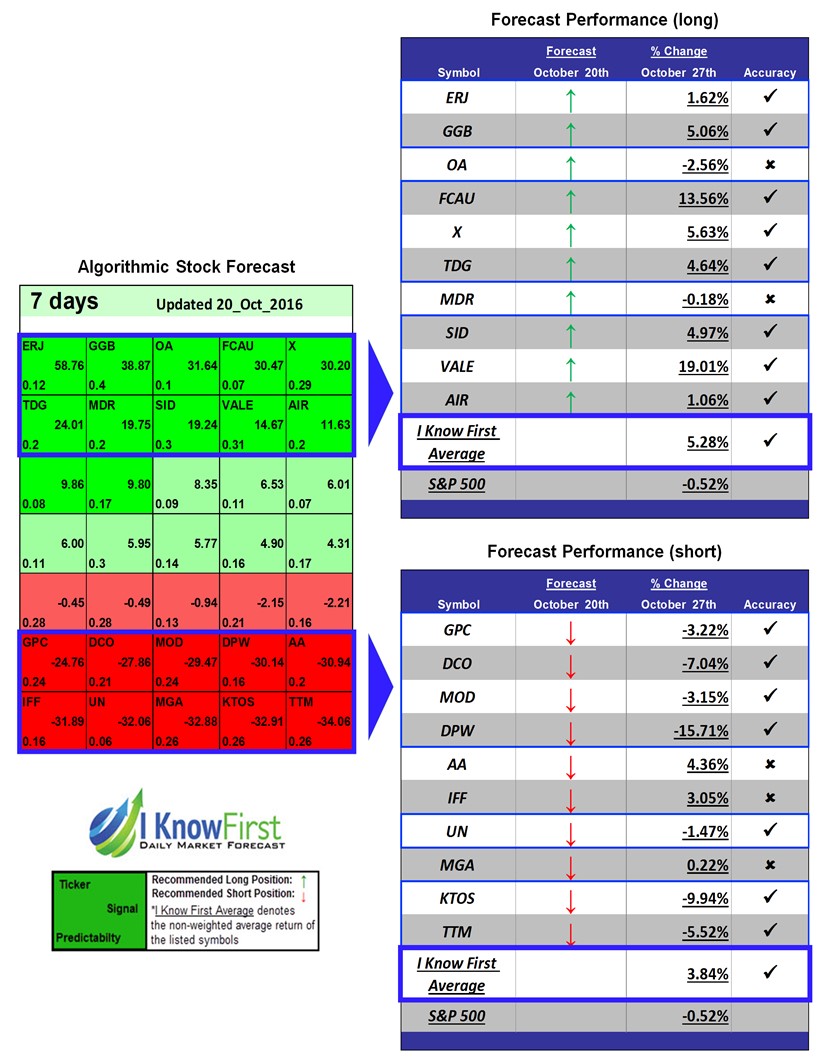

On October 20, 2016, the I Know First algorithm gave a bullish signal of 14.67 for the ticker VALE with a predictability indicator of 0.31. In accordance with the I Know First algorithm, VALE developed into a quick win with a 19.01% return in 7 days.

Vale S.A. (NYSE: VALE) is a Brazil-based metals and mining company. Founded in 1942, the company is headquartered in Rio de Janeiro, Brazil. As the world’s largest producers in iron ore, iron ore pellets, and nickel, the company has operations in over thirty countries, spanning across six continents. The lines of business are: ferious minerals, base metals, coal, fertilizer nutrients, logistics, and energy. Besides iron ore, the company mines other ferious minerals of manganese ore and ferroalloys. In addition to mining for nickel, the company mines other base metals such as copper, gold, and other precious metals. In the line of fertilizer nutrients, the company achieved to be the largest producer of phosphate and nitrogen crop. The company owns stake in hydroelectric power plants and logistic facilities in Brazil and abroad.

Vale has been increasing in stock price since its given 7 days forecast from October 20, 2016. The rise is attributed to three factors: rise in iron ore commodity price, favorable analyst ratings, and improving financial. The price of iron ore has been recovering. The price of the commodity surpassed the $60, settling close to its year to date high back in April 29, 2016. As the the world’s largest producer of iron ore, this translates to higher revenue and profit margin. Vale has been receiving favorable analyst ratings. Seeing the company’s potential and refocusing its business operations, ITAU BBA also upgraded the stock to outperform on October 20, 2016. After receiving favorable analyst ratings, the company reported better than expected third quarter earning on October 27, 2016. The company surpassed earnings estimate from $0.16 to $0.19. The company reported a net profit of $575 million compared to a net loss $2.12 billion in the third quarter of last year. Despite the company having $32 billion in debt, the company is addressing this matter by decreasing its capital expenditure budget from $6.2 billion to $5.5 billion and selling part its assets in coal and copper mining.

This bullish forecast on VALE was sent to current I Know First subscribers on October 20, 2016.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm