Tesla Stock Forecast: Selling Solar Shingles Roof Is A Long-Term Tailwind For Tesla

![]() The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Tesla Stock Forecast

Summary:

- Tesla’s upcoming $5 billion Gigafactory for lithium-ion batteries justifies Elon’s decision to merge with SolarCity.

- Elon is now using SolarCity’s photovoltaic cell expertise to build roofs that are made of solar shingles.

- Tesla is not a car company anymore. It is a clean energy firm with the potential to dominate the market for solar-powered houses in America and Europe.

- Tesla will make money from installing solar shingles roof and the Powerwall batteries to store them. This venture will also likely global.

- Tesla has very strong buy signals from I Know First’s algorithmic forecasts. It’s time to go long on this stock now.

Tesla’s (TSLA) $2.6 billion takeover of SolarCity is a pre-emptive strike of Elon Musk to dominate early the solar-powered homes industry. The tons of lithium batteries that will be produced from the $5 billion Gigafactory will need more products aside from Tesla’s cars. The Gigafactory is obviously big enough to produce more than 500,000 lithium ion batteries that Tesla cars will need annually starting 2020.

Musk bought SolarCity to marry that company’s solar panel technology with Tesla’s lithium ion Powerwall home solar storage battery. The Gigafactory is using solar power too, so it makes sense that this idea is behind Musk’s plan to build and sell residential roofs that are made of solar shingles.

SolarCity and other solar home system installers currently use the old method of putting solar panels on top of traditional asphalt or concrete roofs. Elon Musk wants to make bolt-on solar panel roofing obsolete by building roofing materials that are entirely made of solar cell panels.

Elon Musk wants to sell roofs that serves a purpose other than just to cover people’s homes.

Why Investors Should Care

It was smart/prudent of Musk to take control of SolarCity. He wants to transform Tesla from a money-losing electric car company in to a vertically-integrated clean energy powerhouse. SolarCity’s solar panel business is a way out for Tesla to reduce its exposure to electric vehicles.

Solar shingles roof is a more cost-efficient way for people to switch to solar-powered living. Musk pointed out that bolt-on solar panel is not optimal because of the persistent need of people to repair/replace their traditional asphalt/concrete/brick roofs. It will cost people periodically to remove and re-install their solar panels when they need to replace/repair their roofs.

This disadvantage of traditional bolt-on solar panels is illustrated below. The owner of the house will have to pay people to remove and re-install his solar panels if the roof below them needs repair/replacement.

(Source: Solar Power Authority)

Tesla knows that there are about 5 million roof installations every year being done in America. Tesla has a brighter future ahead of it if could sell 500,000 solar shingles roof jobs and 500,000 Powerwall home batteries every year. The upcoming threat of Ford (F) and General Motors (GM) building cheaper electric vehicles limits the growth potential of Tesla cars.

What Musk is trying to do is to expand Tesla’s total addressable market by putting solar shingles roof on American homes.

Solar Shingles Roofing Could Boost Tesla’s Topline Growth

The future economic benefits of selling solar shingles roofing materials is easy to calculate. The estimated cost of buying and installing solar panels is around $7-$9 per watt. A typical 5 kW home solar panel installation will cost around $25,000-$35,000.

If Tesla can get 100,000 solar shingle roofing contracts every year, the company could generate new annual revenue stream of at least $2.5 billion. Add to this the additional sales from the Powerall batteries. Tesla charges $3,000 for its 6.4 kWh Powerwall. A typical American home will need at least two $3,000 Powerwall batteries. We multiply $6,000 with our projected 100k solar roof customers and we get another possible $600 million/year new revenue stream.

Selling photovoltaic-integrated roofs has the potential to give Tesla an additional annual sales of $3.1 billion. This could go a lot in Tesla’s topline growth. As per Statista’s chart below, car-reliant Tesla’s revenue last year was only around $4 billion.

(Source: Statista.com)

We are just talking about residential solar home systems here. There’s also the other bigger market of providing small and medium companies/factories with solar shingles roofing. If Tesla could install a solar power system on top of the $5 billion Gigafactory, it could easily build one for other companies.

Tesla’s entry in solar shingles roofing is also timely. One of the pioneer companies selling these kind of solar-integrated roofs has called it quits. Dow Chemical’s (DOW) subsidiary, Powerhouse Solar Systems has quit selling its solar shingle roof products.

Tesla is likely going to be the only big-cap company left that will engage in solar shingles roofing.

Conclusion

I strongly endorse a go-long action on TSLA right now. This stock could shoot up beyond $260 again once SolarCity starts building and selling solar shingle roofing. Expanding its business into residential/business solar energy installation is a smart expansion move for Tesla.

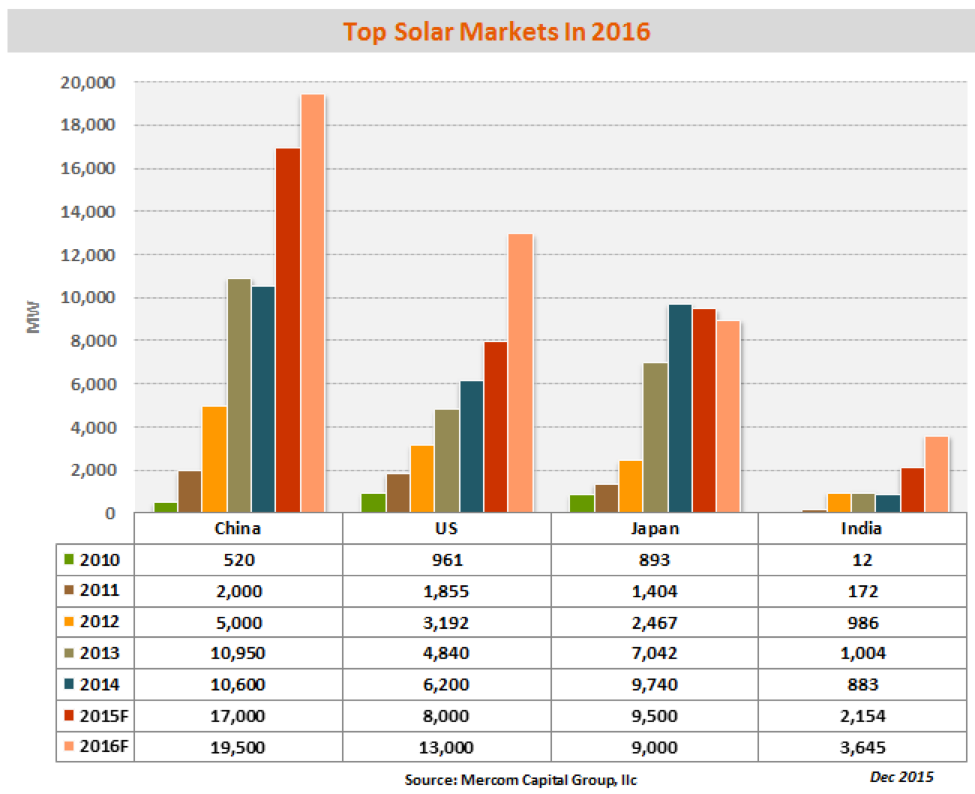

The global solar energy industry continues to post double-digit growth rate. China and America, where Tesla sells most of its cars, are the two biggest markets for solar power systems installation. It makes perfect sense for Tesla to buy SolarCity as a complementary asset for its Gigafactory-made batteries.

The near-term and long-term algorithmic forecasts are also strongly favorable toward buying Tesla shares right now. As per the deep learning neural networks of I Know First, TSLA’s one-year market trend signal is +327.93, with a predictability factor of 0.6.

I Know First has been bullish on TSLA in the past and I Know First analysts have recommended going long on Tesla as exemplified in this article. In past forecasts such as the one dated February 18, 2016, the I Know First algorithm predicted strong growth from TSLA. TSLA ultimately returned 25.19% during the 3-month time frame following the forecast.

As per my TipRanks account, hedge fund managers are also positive over Tesla. It is more often safe for small retail investors to imitate what the big boys of the stock market are doing. They are buying TSLA.

(Source: TipRanks.com)

Trust I Know First and trust me. TipRanks has identified me as one of the very few financial writers who tout 100% 1-year forecast accuracy.

(Source: TipRanks.com)