PLUS Stock Forecast: ePlus Inc Is Very Affordable Right Now, Bet On Its Future In Cloud Computing

The PLUS stock forecast article was written by Motek Moyen ResearchSeeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The PLUS stock forecast article was written by Motek Moyen ResearchSeeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- If you like networking hardware giant Cisco, you should consider taking a position on ePlus Inc.

- ePlus provides networking hardware and software products to big and small corporations.

- ePlus also dabbles in financing the server, data center, and computer requirements of companies and organizations.

- Networking specialists Juniper Networks, NetApp, and Equinix recently awarded ePlus as their Partner of the Year. This should convince you that ePlus is a long-term winner.

- Go long on ePlus because it is relatively undervalued compared to its sector peers.

Seeking Alpha authors have forgotten about ePlus Inc. (PLUS). Nobody has written about this company for more than a year now. This is just sad because ePlus is a smaller but nimbler version of Cisco (CSCO). ePlus Inc. supplies IT hardware products and software solutions to big and small companies. Going forward, the new work-from-home initiative of many companies during this pandemic time ultimately benefits firms like ePlus and Cisco. Going long on PLUS right now is judicious. The screenshot below is clue to the long-term prosperity of ePlus. This small-cap company is involved in high-growth industries.

PLUS is a buy because it is engaged in Cloud computing, data center operations, security and networking, collaboration, and Artificial Intelligence. Yes, ePlus is a dwarf among giants in cloud computing. However, the long-term prosperity of ePlus is secured because of its partners. Data center bigwigs like Equinix, Juniper Networks (JNPR) and NetApp (NTAP) recently awarded ePlus Inc as their Partner of the Year. This recognition is proof that ePlus serves an important role in the world’s big shift to cloud computing.

You go long on a small firm like ePlus because it is standing on the shoulders of giants. This company will eventually prosper faster because of its long list of partner firms. The screenshot below are just a small sampling of partner firms that rely on ePlus to attract enterprise customers for cloud computing, data center operations, and networking.

Cloud computing is a pandemic-boosted industry. Cisco, NetApp, Juniper, and Amazon (AMZN) Web Services requires the help of ePlus to attract customers. ePlus acts like a product middleman and the financier. ePlus enables small and large companies to buy cloud computing hardware and software solutions. This of ePlus as the financing company that allows a budget-constrained firm like Seeking Alpha to go buy pricey server processors and GPU accelerators for its website and mobile apps.

This financier role of ePlus is not a high-margin business because of too many rivals. However, the big shift to cloud computing due to work-from-home can ultimately lead to better growth and profitability for ePlus. Low growth rate and low profitability is why PLUS is now a very affordable investment.

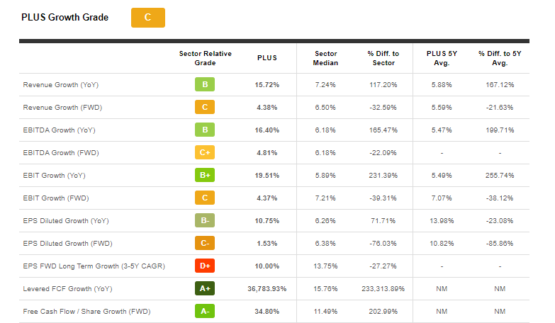

Yes, investors are sitting-on-the-fence on ePlus because of its unimpressive 5.88% revenue growth rate for the past five years. However, this year’s pandemic is forcing more companies to upgrade their computer systems to be more complimentary with work-from-home. This year could be the start where PLUS can do the next five years with 10% or higher in average annual revenue growth.

Stronger revenue growth in the future ultimately leads to better profitability. ePlus is currently operating on a TTM net margin of just 4.35%. This is because of its low TTM gross margin of 23.53%. As more companies upgrade their computer systems to cloud computing compatibility, ePlus can charge financing interests and hardware sales fees.

Buy PLUS While Its Still Cheap

ePlus’ stock is trading at very attractive valuation ratios. Seeking Alpha’s AI Quant Rating System gives PLUS a Value Grade of A-. ePlus Inc’s stock is very affordable right now because its forward GAAP P/E is just 18.44. This is more than 49% lower than the Information Technology Sector’s median forward GAAP P/E of 36.55.

The chart above also reveals that PLUS’ forward Price/Sales valuation is just 0.63. This is 78% lower than the sector average of 2.88. Any company that has a forward P/S that is more than 50% cheaper than its sector peers automatically becomes a deep-value candidate.

The relative undervaluation of ePlus’ stock is not justified. This company is playing an important role in connecting hardware suppliers to cloud computing customers. Without the financing muscle of ePlus, many companies and government agencies simply cannot afford to upgrade their legacy computer network to the new cloud computing framework.

Better revenue performance is urgent because ePlus has a weak balance sheet. Its total cash is only $86.2 million. ePlus has a total debt of $93.4 million. ePlus also ended its fiscal year 2020 last March 31 with a TTM Cash from Operations of -$74.17 million. Its TTM free cash flow is also very low at just $10.33 million. This weak cash generation is likely due to COVID-19’s effect on companies who got shuttered. Companies who are indebted to ePlus could probably not pay their monthly or quarterly amortizations because they stopped operating because of COVID-19.

This is just temporary. Most companies in America are now back to full operations. The first quarter of ePlus’ FY 2021 will likely result in better cash flow statements.

Conclusion

There is risk in investing on small-cap tickers like PLUS. They have a hard time growing against bigger rivals. However, the many giant, mega-cap partners of ePlus ensure it will survive for a very long time. I do not believe that ePlus can do 20% annual sales CAGR. I will be satisfied if it could just do 8 to 12% annual sales improvement for the next 10 years. ePlus only needs to improve its low gross and net income margins.

Becoming more profitable will eventually convince more investors to boost PLUS to above $90. This is my one-year price target for PLUS, $90. This is very ambitious but I have faith that COVID-19 is forcibly many companies to upgrade their computer systems this year and going forward.

My buy rating for PLUS is also strongly influenced by its super bullish one-year forecast from I Know First. A stock only needs to score 100 to get a clear buy signal from the stock prediction AI of I Know First. PLUS boasts a 1-year forecast score of 345.47.

Here at I Know First, our stock forecasting software has modeled and predicted assets price movement worldwide ranging from 3 days to a year. Since 2011, we have been using our stock algorithm to provide daily stock market predictions and top stock picks. We also provide clients with fx forecast, gold price predictions, as well as AAPL stock news. Today, we are producing daily stock algorithm forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.