NFLX Stock Forecast: Exit The Netflix Content Wars or Buy on Dips?

![]() This NFLX Stock Forecast article was written by Opher Joseph – Financial Analyst, I Know First.

This NFLX Stock Forecast article was written by Opher Joseph – Financial Analyst, I Know First.

Highlights

- NFLX is preparing to scale down its business expecting to lose further subscribers in the coming periods.

- The Cash to Debt ratio of the company is 41% and the Debt to Equity ratio is 83% which indicates a heavy debt on the books of the company.

- NFLX has laid-off 150 staffers and also has issued a “culture” memo to its employees.

Overview

Netflix, Inc. operates as a streaming entertainment service company. The firm provides subscription service streaming movies and television episodes over the Internet and sending DVDs by mail. It operates through the following business segments: Domestic Streaming, International Streaming, and Domestic DVD. The Domestic Streaming segment derives revenues from monthly membership fees for services consisting of streaming content to its members in the United States. The International Streaming segment includes fees from members outside the United States. The Domestic DVD segment covers revenues from services consisting of DVD-by-mail. The company was founded by Marc Randolph and Wilmot Reed Hastings Jr. on August 29, 1997, and is headquartered in Los Gatos, CA.

The Treacherous Road Ahead

Netflix has constantly been in the news spotlight and mostly not for the right reasons. Its market price has taken a massive hit, despite growth in revenue. Not only has the platform kept on losing its subscribers to competitors, but also it has generated a lot of negative comments on the content streamed on its platform for its quality and the cast it has hired.

This has attracted a lot of negative sentiment from investors as well. One may even perceive the recent dips as an overcorrection of the market due to a pessimistic outlook and thus would now present an investing opportunity for growth. However, the platform faces stiff competition in its market, with several new competitors claiming market share based on competitive pricing and varied content access.

In the past quarters, NFLX’s earnings have beaten market predictions. As a response strategy to these challenging conditions, the company is preparing to scale down its business expecting to lose further subscribers in the coming periods. Combined with tough macro-economic conditions and negative customer and investor sentiment towards NFLX, the stock would take a considerable amount of time to recover its losses and return investor gains. Hence the drastic decrease in subscribers is not only due to difficult macro-economic conditions but also has been due to rivals taking over market share, specifically Disney Plus.

The Path to Double-Digit Growth Might Be Longer Than Expected

Netflix being a market leader in streaming services for a long period of time has been rigid to explore and change to different sources of income adopted by its competitors. To maintain a healthy revenue stream, NFLX has finally decided to adopt industry competitor practices and has plans to allow an advertisement-based version allowing the company to generate additional revenue streams.

The company also has to deal with password sharing issues to different logins by its customer base. It predicts that there are an additional $100 million households that access the platform through shared passwords. To ensure to monetize from these households as well, NFLX has to come up with measures to prevent password sharing and earn from these uncapped viewers. NFLX has increased its subscription fees in the past and had managed to maintain its strong subscriber base, however with several competitors in the market now, it would not be a feasible option this time around, and the company might end up losing even more subscribers. With the losing subscriber base, NFLX has also laid-off 150 staffers and also has issued a “culture” memo to its employees regarding the content diversification direction it has taken, demanding employees that if they do not agree to work on titles that they don’t fully agree to, Netflix won’t be a right place to work for them.

Also, NFLX has been subject to paying tax compensation due to lawsuits in Italy for a case related to tax evasion. Moreover, it has recently been subjected to class-action lawsuits by its own shareholders over the non-disclosure of material facts relating to the loss of its subscriber base during the period of Oct-2021 to Apr-2022. Also, to encourage local production of movies, several European countries have resorted to levying additional tax on subscription fees charged by streaming companies, further impacting the revenue of NFLX.

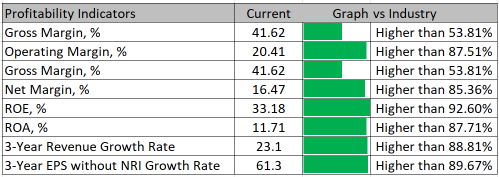

The Cash to Debt ratio of the company is 41% and the Debt to Equity ratio is 83% which indicates a heavy debt on the books of the company. The company is not generating enough operating cash flows to cover its debt and interest outflows. The operating profitability and financials are still favorable against the industry, it has an operating gross margin of 41.62%, only better than 53.81% of the companies in the media industry.

NFLX still scores well in terms of Piotroski F-Score and Altman Z-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 7 may indicate that the company’s stock is undervalued. The Altman Z-score is the result of a credit test that measures the likelihood of a publicly owned manufacturing company going bankrupt, it is also towards a safe level for NFLX as shown in the above image. The Beneish M-Score of -1.92 shows concern over the reliability of the operations and financials of the company.

Conclusion

The overall outlook on Netflix for the current moment looks negative and it would be advised to stay away from the stock. However, for its investors who hold the stock, it would be interesting to see how the company manages to steer through the troubled waters and continue its forward momentum gain, thus potentially can return some gains from the current price levels. Given that the stock is trading at lower price levels than during the pandemic levels, I certainly do not advise investing in the stock now.

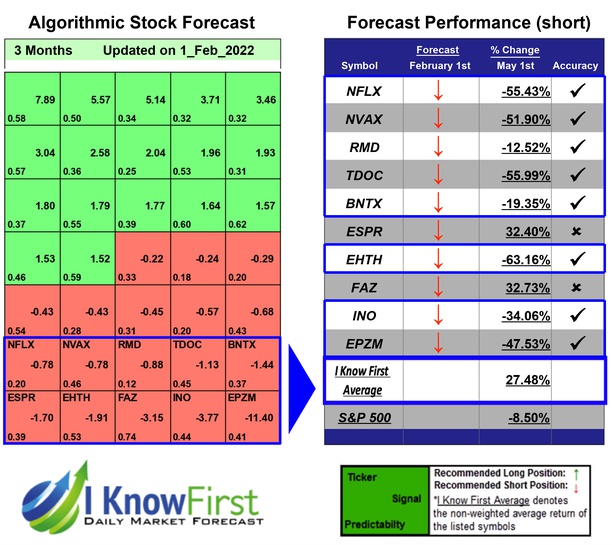

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with NFLX Stock Forecast

I Know First has been bearish on the NFLX stock forecast in the past. On February 1st, 2022 the I Know First algorithm issued a forecast for NFLX stock price and recommended NFLX as one of the best stocks to buy. The AI-driven NFLX stock prediction was successful on a 3-month time horizon resulting in more than 55.43%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.