MU Stock Prediction: New 3D NAND Can Help Micron’s Market Share In Smartphones

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Micron’s new triple level cell (TLC) 3D NAND mobile memory products are timely. They could be used in this year’s flagship phones and tablets.

- Smartphones are already the largest customers of NAND memory chips. Technavio calls smartphones the key driver in global NAND flash sales.

- Technavio expects NAND flash sales to experience a 15% CAGR from 2018 to 2022.

- On-device Artificial Intelligence for smartphones/tablets requires larger and faster NAND memory solutions. Data will be stored and processed on the device itself.

- The advent of 4K video recording and 12-megapixel photography in modern smartphones also require faster and larger memory chips.

Congratulations to those people who heeded my August 22, 2017 buy endorsement for Micron (MU). MU’s stock was trading below $32 back then. MU closed $49.11 last Friday, March 2. I am reiterating a buy rating for MU. I like Micron’s timely release of three new high-speed mobile 3D NAND storage for smartphones/tablets. First unveiled last year, Micron’s 2nd Generation TLC 3D NAND memory products offer 150% faster performance and 6x more storage than planar NAND.

(Source: Micron)

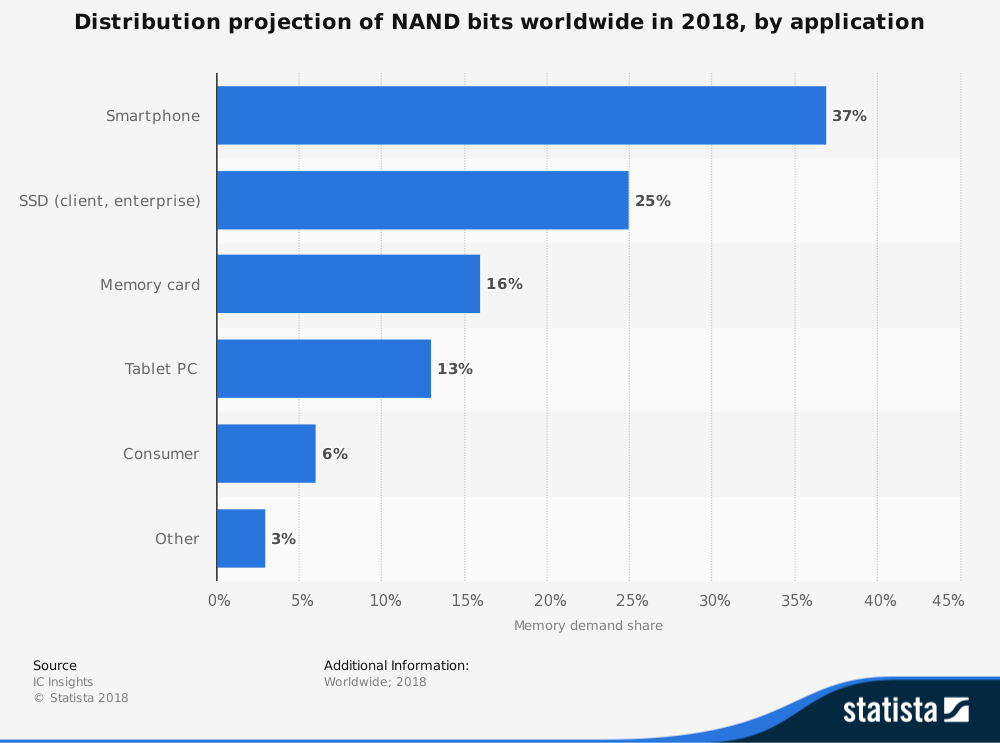

Micron is correctly targeting which markets offer growth opportunities. Smartphones are already the greatest consumer (37%) of NAND memory chips. Technavio identified smartphones are the key driver for global NAND memory sales. Smartphones are largely responsible for the estimated 15% CAGR of global NAND flash in 2018 to 2022.

Micron’s new triple level cell [TLC] 3D NAND is compatible with the high-speed Universal Flash Storage (UFS) 2.1 standard. These new 3D NAND products were designed to accommodate new smartphone technologies like facial recognition, virtual reality, and on-device artificial intelligence. A faster and larger flash storage is needed to install AI/Augmented Reality virtual reality-enabled mobile apps.

Targeting Smartphones Can Lead To Better Overall Market Share

The coming implementation of on-device artificial intelligence for smartphones can lead to more cluttered space on Android and iOS smartphones. The continuous machine-learning data being gathered by on-device AI-equipped phones will have to be stored and processed locally. Meaning most future smartphones with on-device AI will need at least 64GB of flash storage.

A faster and larger 3D NAND flash storage is also required to store larger file sizes from 4K videos and high-resolution photos. Even mid-range Android phones can now do 4K video recording. One minute of a recorded 4K video at 30fps can consume 375 MB. This should explain why Micron is only selling 64GB, 128GB, and 256GB versions of its latest 3D NAND storage for mobile devices.

If priced reasonably, these new products can help boost Micron’s overall market share in global NAND flash storage. As of Q3 2017, Micron is a far fourth in the global ranking for NAND Flash memory market share distribution. Micron only has a 12.9% market share. This is notably smaller than the top-ranked NAND memory supplier Samsung’s (SSNLF) share of 37.2%.

The 15% CAGR of global NAND flash is a strong motivation for Micron to try to increase its global market share. The 2D/3D NAND market is estimated to generate $42.8 billion in revenue this year. This estimate is projected to grow to $80.3 billion by 2025.

Micron’s annual revenue growth if it can it improve its market share in NAND memory to 20% or more. Twenty-percent of $40 billion is $8 billion. Micron’s FY 2017 annual revenue was only $20.32 billion.

Final Thoughts

We should appreciate Micron’s industry-leading mobile 3D NAND memory products. Micron revealed last year that it has the smallest TLC 3D NAND Die. This is important because the processors of new smartphones are getting more powerful and they come in bigger display screen. More powerful CPU/GPUs and bigger LCDs require longer-lasting batteries. The upcoming availability of 5G connectivity will also be a battery-drainer. Faster streaming of 2K or 4K videos will increase the CPU/GPU usage in smartphones.

Micron making its mobile memory chips smaller will free up space for bigger batteries and faster 5G modems.

My new 12-month price target for MU is $55. My PT is conservative. The average 12-month PT for MU at TipRanks is $59.38.

(Source: TipRanks)

I Know First share my bullish sentiment over Micron. MU has outstanding 1-month, 3-month, and one-year algorithmic market trend scores. The lower numbers (0.68, 0.8, and 0.89) on the chart below are the predictability scores. A score above 0.50 is already excellent indication that I Know First has a long history of correctly predicting a stock’s market movements.

Lastly, monthly technical indicators and analysis of moving averages still call for a buy on Micron’s stock.

Past I Know First Success With MU

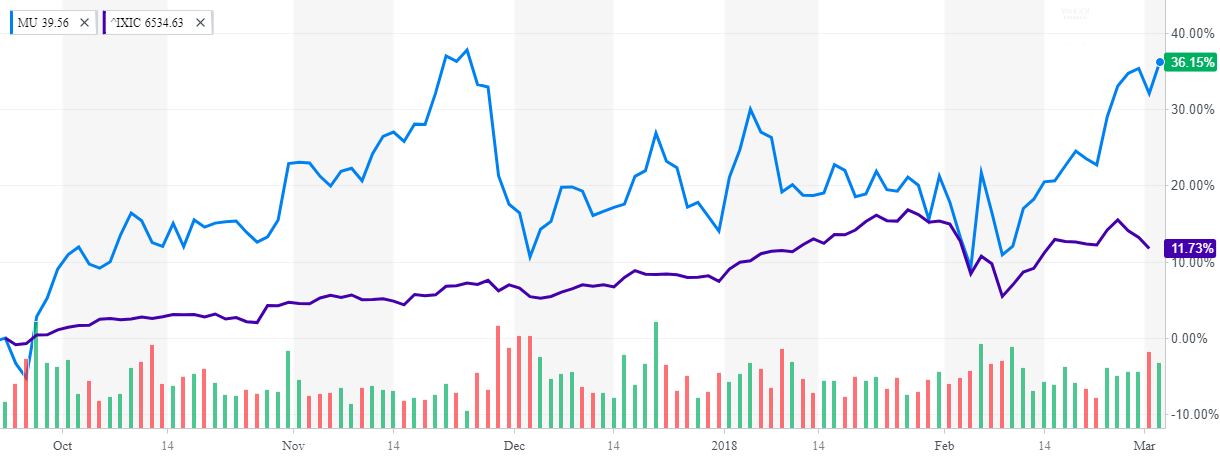

On September 22, 2017, I Know First published a premium article about Micron’s stock still being relatively undervalued at that time. I Know First has been bullish on Micron stock as it was expected to benefit from improving average prices for DRAM and NAND Flash over the coming quarters. The forecast was increasingly bullish going out one month, three months, and even one year. As of today we continue to see growth of the MU stock price gaining 36.15% since the date of forecast. See chart below.

(Source: Yahoo Finance)

This bullish forecast for MU was sent to I Know First subscribers on On September 22, 2017. To subscribe today click here.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.