MSFT Stock Forecast: Microsoft Can Be A Profitable Vendor Of Surface Android Phones

This MSFT stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This MSFT stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- Microsoft investors should applaud Satya Nadella’s decision to release Microsoft Surface-branded Android phones next year.

- The Surface brand now covers smartphones, tablets, laptops, and desktop computers.

- It was Nadella who killed the Windows Phone and Windows 10 Mobile smartphone business. However, he finally realized the smartphone is a key device for productivity.

- After making good on his cloud-first initiative, Nadella now wants to fulfill his mobile-first vision for Microsoft.

- You cannot fully implement a mobile-first approach to marketing your software products without risking it also on selling the computers for them.

My last buy recommendation for Microsoft’s (MSFT) stock was last February 3. MSFT was trading below $107 that time. I am again endorsing MSFT as a buy $136.28. Microsoft’s announcement that it will sell the Android OS-using Surface Duo foldable smartphone is a future tailwind. Nadella finally realized that his “cloud-first, mobile-first” vision for Microsoft is incomplete without Microsoft-branded smartphones.

Going forward, selling high-priced Android smartphones could add $2 to $5 billion in new annual sales to Microsoft. Professionals and business users already trust the Surface brand of computers. We can surmise that millions of them are now eager to buy the Surface Duo.

The foldable Surface Duo is pricey gadget aimed at business users and professionals/wealthy customers. Microsoft is going to make money selling the Surface Duo. Selling high-priced Android phones is better than Microsoft’s previous practice of selling subsidized sub-$150 Windows smartphones four years ago. The Surface Duo features two hinged 5.6-inch displays and it will be available next year.

Why This News Matters

Like it or not, I was correct in my years-ago conclusion that Microsoft needs a robust smartphone hardware business. Selling and controlling their own smartphone hardware ecosystem can improve its advertising and software marketing businesses. It was Nadella who killed Microsoft’s Windows Phone 8 and Windows 10 Mobile phone hardware business. Nadella is now reviving Microsoft as a smarter smartphone hardware vendor.

Accepting and using the dominant Android OS for its comeback smartphone attempt is wise. While Google (GOOGL) controls the official Play app store and Google Mobile Services, there is nothing preventing Microsoft to pre-install its own Android apps on every Surface Duo. By selling its own brand of smartphones, Microsoft can pre-install software that can track the online habits of its phone customers.

Selling high-end Android smartphones like the Surface Duo will help Microsoft build a bigger library of personal data and online habits. This is necessary if it wants to attract more customers to its Bing Search and Bing Ads display advertisement platforms.

A Microsoft-branded Android phone can also be optimized to run Microsoft mobile apps to run at peak performance. The fragmented ecosystem of the Android operating system (most top-selling Android phone vendor uses their own User Interface software on top of Android OS) means third-party apps like Microsoft Skype performs differently on different brands of Android phones.

Four years ago, Microsoft was selling 40 to 50 million units of Lumia-branded Windows 7/8 smartphones. Going forward, Microsoft is capable of selling 5 to 10 million Surface Duo Android smartphones per year. That is not going to be the end-all to Microsoft’s emergence. My fearless forecast is that Microsoft will also sell traditional, non-foldable Android phones under the Surface branding. Microsoft can still make money by selling traditional Android phones that retails for $200 to $400. Let us not forget that Microsoft’s comeback as a phone hardware vendor is because it wants to attract more paying customers of Office 365, and to gather or collect more personal data/online habits of Android device users.

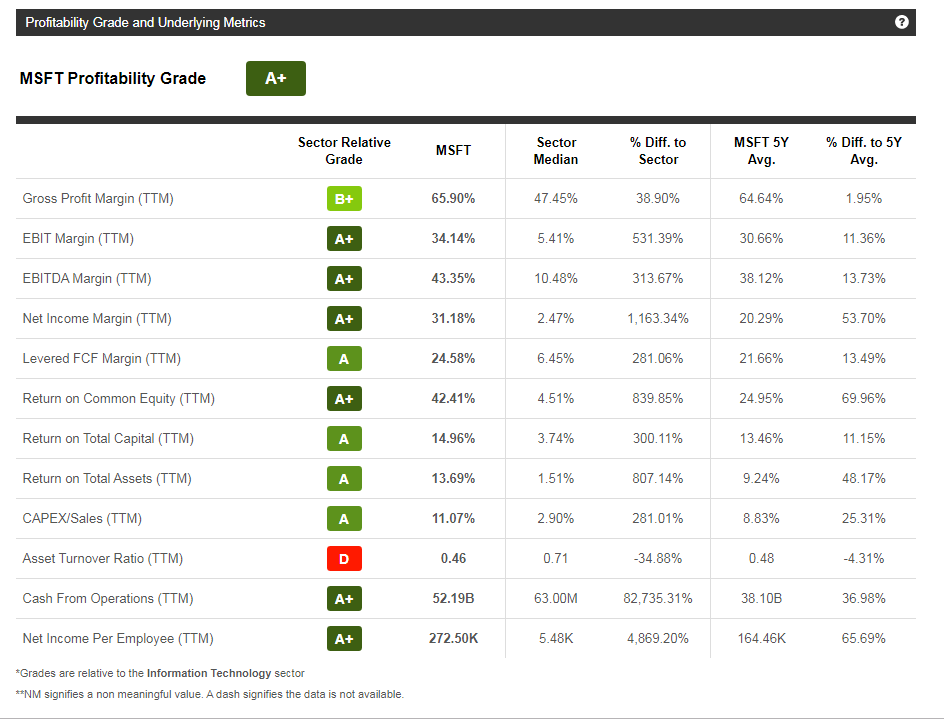

Microsoft selling its own brand of Android smartphones is just akin to Google selling its own Pixel brand of smartphones. Microsoft and Google compete on search engine and web/mobile digital display ads. Microsoft is a highly profitable company that can grow even more profitable as it compete more against Google and Apple.

Conclusion

The top vendors of Android smartphones should be scared of Microsoft’s Surface Duo. The commercial success of the Surface laptop/tablet idea convinced us that Microsoft could quickly become a formidable vendor of foldable Android phones. The Surface brand (not the old Lumia brand) is now also trusted around the world.

The smartphone is the future of work-anywhere computing. The Surface Duo can fit a pocket and yet can be used as a real office-level computer. The dual hinged screen means the other display can be used as a decently sized typing screen to edit/create Office 365 documents.

Three years from, Microsoft becoming a global leader in Android smartphone sales can help boost the stock to $180 to $200. Microsoft becoming a leader in software-as-a-service, smartphones, cloud computing and advertising makes it the better long-term investment than Apple (AAPL) or Google. It is therefore wise to go long on MSFT while it still trades below $140. My reiterated buy recommendation for MSFT is backed by its bullish one-year algorithmic trend from I Know First. A score higher than 100 (MSFT has 142.7) is a buy signal from I Know First’s stock-picking AI.

How to interpret this diagram.

Past Success With MSFT Stock Forecast

I Know First has been bullish on MSFT’s shares in past forecasts. On February 3, 2019, the I Know First algorithm issued a bullish forecast for Microsoft. The algorithm successfully forecasted the movement of the MSFT’s shares. Until today, MSFT’s shares have risen by 34.38% in line with the I Know First algorithm’s forecast. See chart below.

This bullish MSFT stock forecast was sent to the current I Know First subscribers on February 3, 2019.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.